US-Canada

Update: On October 1st 2018 the new United States-Mexico-Canada Agreement (USMCA) was announced…details are still emerging (10/4/18) Original post written on 9/30/18. Canada placed a 10% tariff on US maple syrup exported into Canada in 2018. While some US syrup or US finished maple syrup goods do get sent to Canada the volume is small. This trade dispute retaliation from Canada is not expected to have huge impact on US maple syrup distribution. Canada exports far more syrup into the United States. The overall US-Canada trade situation that include steel, aluminum and other products will have a more pronounced impact on maple equipment and manufactured goods crossing the US-Canada border.

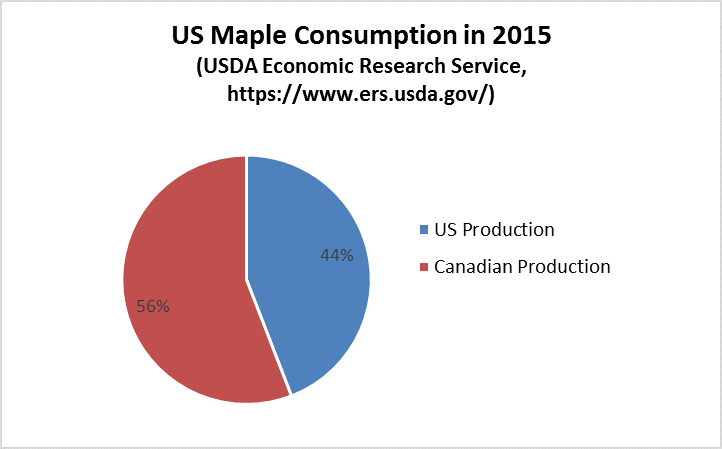

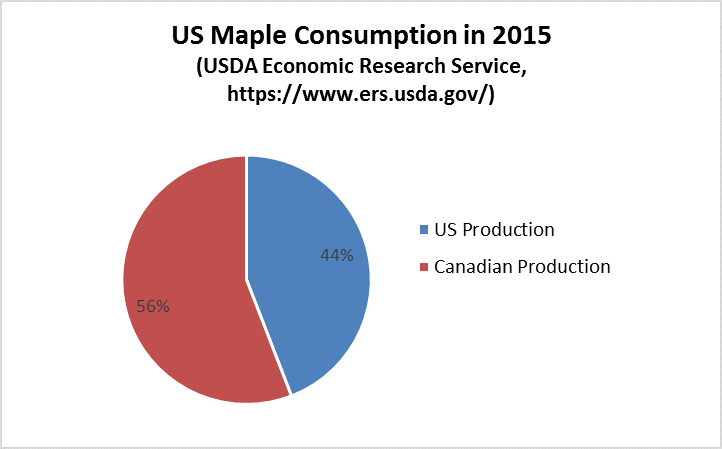

Rou ghly 62% of Canadian export syrup reaches the United States. The result is that over half of maple syrup consumption in the United States is Canadian syrup. The UVM Extension Maple Business team ran a rough calculation on the 2017 value of Canadian syrup imported into the United States. The Canadian imports represent roughly 18 million maple taps at the prevailing US maple yield per tap.

ghly 62% of Canadian export syrup reaches the United States. The result is that over half of maple syrup consumption in the United States is Canadian syrup. The UVM Extension Maple Business team ran a rough calculation on the 2017 value of Canadian syrup imported into the United States. The Canadian imports represent roughly 18 million maple taps at the prevailing US maple yield per tap.

A look at recent and defunct trade agreements…..

European Union

Comprehensive Economic and Trade Agreement (CETA) was approved in 2017. CETA includes Canada and the European Union. The agreement removes tariffs on Canadian syrup imported into the European Union. The US is not part of this agreement and US syrup is subject to an ~8% tariff when imported into the EU.

Trans Pacific Partnership (TPP) Trade Agreement

This agreement between many nations was set to eliminate the 17.5% tariff on US (and Canadian) maple syrup entering Japan. Japan represents a significant existing export market for Canadian maple syrup and a possible growth area for US exports in the future. The United States pulled out of this trade agreement in 2017 and the tariffs on US maple remain in place.

The New Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) This agreement was made by the remaining TPP nations without the United States. Under that deal the tariffs on Canadian syrup imported into Pacific nations will be phased out in the next few years.