For Immediate Release

Contact: Maribeth Spellman

Director of Policy, Outreach and Legislative Affairs

Vermont Department of Taxes

(802) 828-0141 or Maribeth.Spellman@state.vt.us

Important Income Tax Changes for H-2A Status Workers

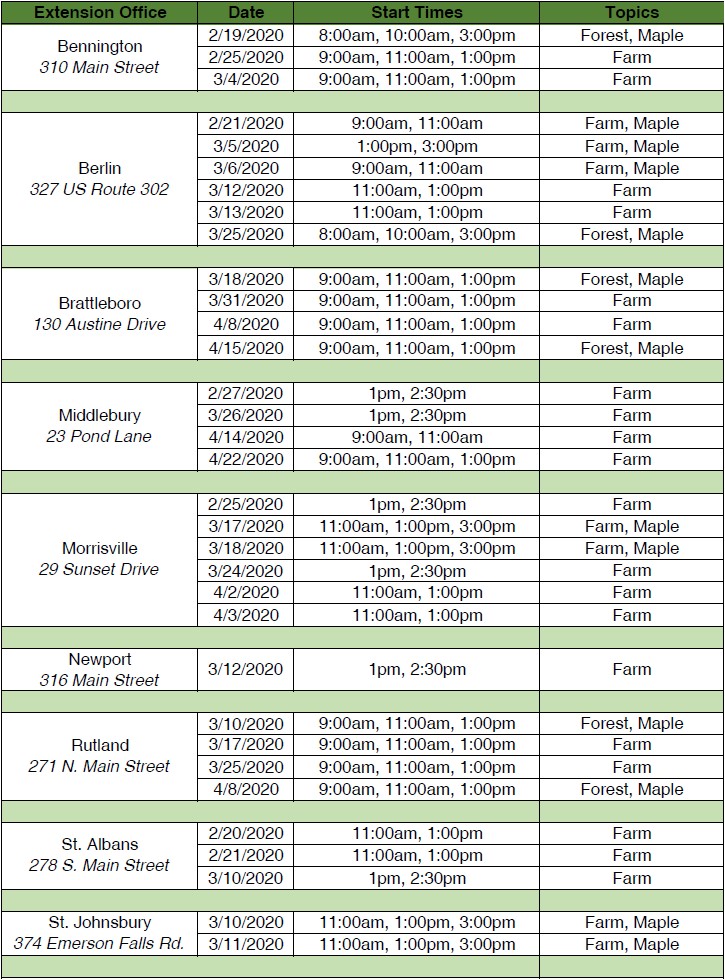

Montpelier, Vt., July 30, 2013 – The Vermont legislature recently passed a law that clarifies the tax status of individuals enrolled in the H-2A visa program. Many Vermont farms employ foreign national workers who come to the U.S. for temporary or seasonal work through the H-2A program.

Beginning with tax year 2012, H-2A status workers must file individual income tax returns in the state of Vermont, as well as at the federal level. For individuals who have not submitted an individual income tax return for 2012, they should do so as soon as possible.

For tax years prior to 2012, any liability, interest or penalty paid by an H-2A status worker will be refunded upon request. In order to be eligible, an individual must provide proof of H-2A status by submitting Form I-94 where their class of admission is H-2A. This is marked on their visa. H-2A workers seeking refunds should contact the department.

Employers who already have a withholding account may use that for H-2A status workers. If an employer wants to open a withholding account, they may do so by completing Form S-1, Application for Business Tax Account.

The Vermont Department of Taxes is assisting H-2A status workers and their employers with this change. For further information, please contact the department at (802) 828-2865 or (866) 828-2865 (toll free in Vermont).