By McKenna Halvorson

Finding your dream property may feel like finding a needle in a haystack. You may be tempted to act fast. But wait! There are illegitimate property listings and fake sellers out there.

Unfortunately, seller impersonation scams, also called “deed fraud”, are on the rise. Deed fraud is when criminals attempt to sell property they do not own. The listings may steal information from properties already on the market or create a new advertisement based on real property, such as real estate listed in a city/town’s grand list. Scammers often target property of absentee owners like vacation homes, vacant lots, or residential rentals. Criminals succeed by forging deed documents. There are few barriers, especially when the property has no lienholder and debts have been paid.

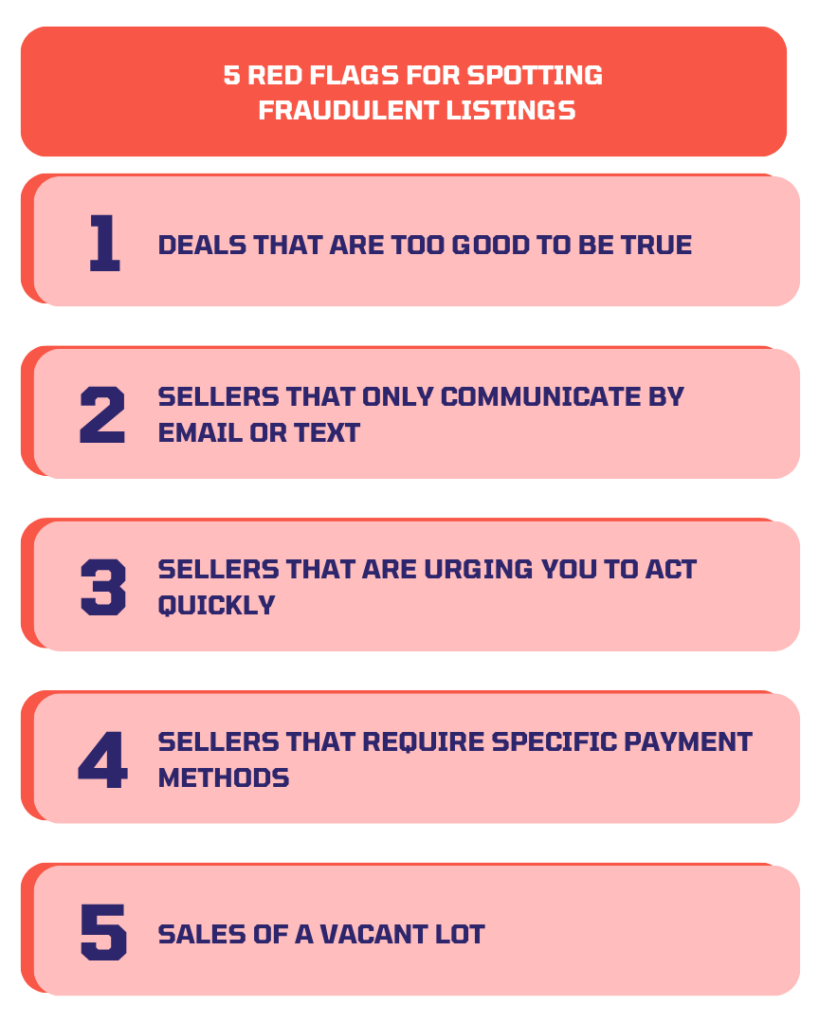

Red Flags for Spotting Fraudulent Listings:

- Deals that are too good to be true

-Criminals may list property significantly below normal asking price to entice potential buyers. Trust your instincts. - Sellers that only communicate through email or text

-Criminals may claim their phone can’t call or they are unavailable to meet in person to sign documents.

ex: It’s a for-sale-by-owner listing, but you never talk to the owner. - Sellers that urge you to act quickly

-Criminals may claim the deal is only available for a limited time or that you have to “act now,” hoping that you won’t pause to check it out. - Specific payment methods

-Criminals may claim buyers can only pay in cash or wire money to an out-of-state bank account. Never send money for unseen property. - Sales of a vacant lot

-Criminals may focus on vacant lots hoping that the owners live out of state or don’t manage the property.

Options that May Help Protect your Property from Criminals:

- Consider “not-for-sale” documents

-Filing not-for-sale documents with the Town Clerk may serve as a caution flag to realtors when engaging in transactions that involve your property. - Keep a close eye on property bills

-Check your address on bills to ensure a criminal hasn’t changed the mailing address without your knowledge. - Check your Property’s Deed Status

-Research your county’s land records/deed information online to ensure criminals have not altered the status of your home to “for sale.” - Monitor the property

-Ask neighbors to notify you if there is unusual activity on the property.

-For uninhabited properties, install motion sensors, such as a smart home security camera or device that alerts you about activity. - Set up a Google Alert for your property address

-This alert will notify you when someone posts about your property online. - Check for online activity

-Search popular real estate sites like Zillow, Redfin, and Realtor.com and review your property location to see if it is being listed.

-Search for your address on social media platforms to see if there have been any posts about your property. - Learn about title insurance policies.

-Homeowner’s insurance policies may offer enhanced title insurance, which can alert you of deed fraud. - Monitor your Credit Report

-An unknown account can be a sign of identity theft, which could include deed fraud.

-You can check your credit reports weekly for free at annualcreditreport.com.

For realtors being contacted by potential real estate sellers, reference this notice about seller impersonation fraud by the Vermont Association of Realtors.

If you believe you are experiencing a seller impersonation scam, reach out to local law enforcement, and file a report at ic3.gov. Report the scam to the Vermont Attorney General’s Consumer Assistance Program at 1-800-649-2424 and ago.vermont.gov/cap

Sources:

American Land Title Association: https://www.alta.org/file/Combating-Seller-Impersonation-Fraud.pdf

NH Department of Justice: Consumer Alert – Attorney General Warns Public to be Diligent Amidst Reports of Quit Claim Deed Fraud | New Hampshire Department of Justice

Vermont Realtors: https://www.vermontrealtors.com/new-scam- and https://www.vermontrealtors.com/consumer-guides/targets-land/