By Sabine Love, CAP Service-Learning Intern

Feature on credit, blog 2 of 2, follows up with additional information on the What is Credit blog.

What are the different types of credit?

- Revolving Credit holds a given credit limit that you cannot exceed. The balances are paid off, either through portion payments or in full every month, with the remaining balance carried over. The most common forms of revolving credit are credit cards.

- Installment Credit is where your payments increase and you gradually pay back the creditor overtime, like student or car loans and mortgages.

- Service Credit is a binding contract you enter where a business provides a service that you pay them for after—most commonly, cell phone plans, utilities, and membership services.

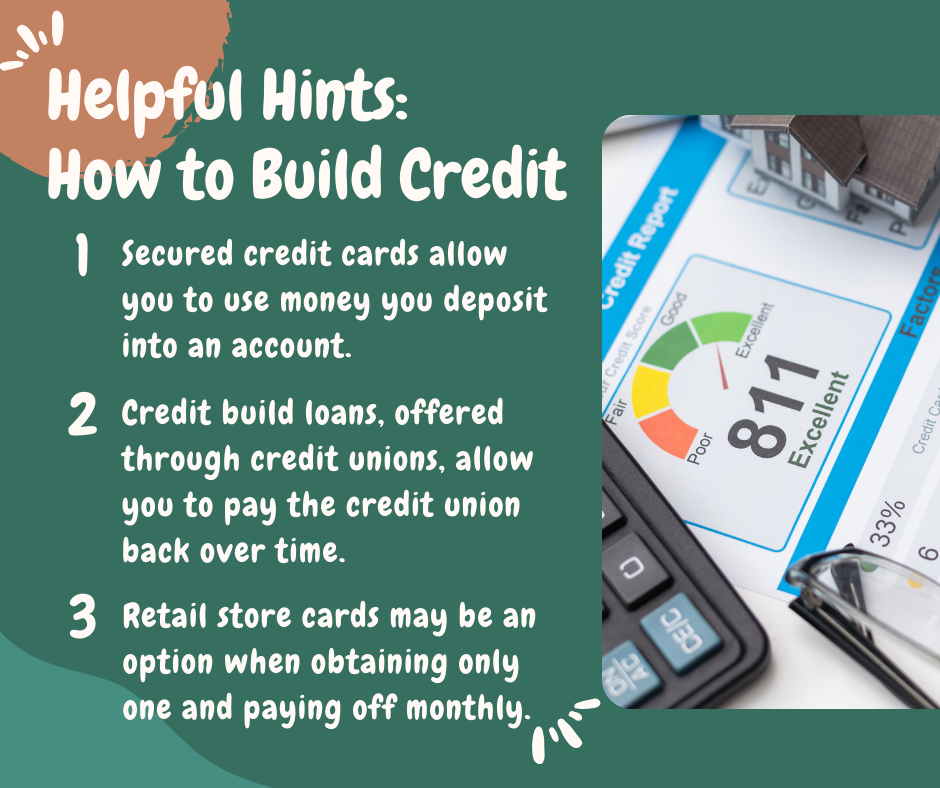

How to build your credit

There are many ways to build your credit, such as through the different types of credit previously mentioned. But, what do you do if you cannot obtain revolving credit, or a car loan, because you have not been focusing on building your credit? You can build credit in other ways, even without a cosigner.

Secured Credit Cards. These forms of credit cards have the same application process as a traditional credit card, but once you are approved, you deposit money into a separate account. With this card, the bank holds the deposit and you have a small monthly range of money to use. It is recommended to use only 30% of this total credit limit, making sure you can pay it in full and don’t “max out” your card.

Credit Build Loans are the second tip, these are usually offered by credit unions (CU), and you pay the CU back over time through small monthly payments, once you finish the payments, you receive the total amount of funds back.

Finally, there are Retail Store Cards, these you should be more careful with because they are typically quite easier to obtain than traditional credit cards. These cards usually can only be used at a particular store/chain of stores, and they offer lower credit lines and high interest rates. For those building credit, one card at a favorite store can help build credit, provided it can be paid off every month.

Building credit can feel overwhelming, but it doesn’t have to be! There are credit education and counseling services available, such as through the Community Action Agencies, and some nonprofits. They are working to empower people to lead financially healthy lives.

And don’t forget, the Consumer Assistance Program is always here to help with any consumer questions you have.

This piece is one in a series of Helpful Hints brought to you by the Consumer Assistance Program’s (CAP) service-learning interns. UVM undergraduate students make significant contributions to our program and Vermont through their participation in our service-learning lab, where they learn about consumer protection while honing their professional skills.

Please note, the information herein is provided for educational purposes and does not constitute legal advice. Consumers with general consumer questions should contact CAP for more information, or seek private counsel from an attorney for legal advice.

References: