By Katharine Clark, SHECP Intern

With increased vacationing, sightseeing, and attending events, summer is a fun-filled time in Vermont. Have a safe and happy summer by avoiding scams that may seek to intercept your vacation rental search, sell you fake tickets, or purport to be extended family stranded while on vacation.

When searching for a vacation rental or event tickets online, be sure to do extensive research before agreeing to complete a purchase. If a family member calls in need, always take steps to verify.

Vacation Rentals

When looking for a vacation rental—some listings may seem too good to be true. Scammers can create fake listings to rope interested renters into dangerous schemes. Learn how to catch and avoid rental scams so you can rent safely and protect your money.

Spot the Signs:

- Too Good to Be True: If the price is significantly lower than other similar properties in the area, the listing likely isn’t real.

- Unprofessional Listing: If a listing has many typos or poor grammar, it was likely made by a scammer. Serious listings are seriously made, and they will be carefully constructed and proofread.

- Double Listings: If rentals appear multiple times across platforms, and especially on a single platform, it is likely that the duplicates are scams. Scammers will frequently copy a legitimate rental and add their own information.

- Unverified Address: Scammers can list properties that either don’t exist or are unavailable (E.g. foreclosed properties). Scammers can also take advantage of vacant properties, sometimes even agreeing to show the listing in person even when it is not actually available.

- Payment First: If you must pay and/or provide personal information before meeting the seller, seeing the property, or signing the rental agreement, it is likely that the seller is either withholding information or attempting to scam you.

- Untraceable Payment: Though there can be exceptions, be wary of listings that require untraceable/non-refundable payment such as cash, wire transfers, money transfer services (like Western Union or MoneyGram), or more suspiciously, gift cards or cryptocurrency, including crypto kiosks. Scammers can also go through legitimate services like Airbnb but request payment through another service or an escrow account.

- Faulty or Missing Agreement: Scammers can manipulate incomplete leases (filled with blank spaces or vague writing) without your knowledge or consent. Or they can simply take your money with no legal documentation if there is no lease at all.

What to Do:

- Protect Your Information: Before viewing the rental, never give out your social security number, bank account, or debit or credit card information.

- Verify the Address and Price: Look up the property and verify that other results (either duplicate listings on different sites or more information about the property) show the same listing with the same seller information. You could also do a public records search with the town clerk to verify the property owner. If the results differ between listings, or if the property is not actually available for rent, it is a sign of a scam.

- Verify the Price: Check the prices for similar rentals near the listing to verify that the seller’s price is in line with expected costs. If it seems too good to be true, it is safe to assume that it is.

- Seller Reputation: Look at reviews of the seller online to find complaints from former tenants. If words like “scam” frequently appear, avoid the listing.

- See the Property and Meet the Seller: Try the view the property and meet the listing agent/landlord either on a video call or, ideally, in person. If the seller refuses, avoid the listing.

- Check the Rental Agreement: Try to have someone review your lease for completion and quality before signing, and if there is no written rental agreement, avoid the listing.

- Send Your Money Wisely: Whenever possible, insist on paying all fees, deposits, or rent through traceable and recorded forms of payment like a credit or debit card. Only pay after verifying where you’re sending your money.

- Websites to Look Out For: Be extra cautious when looking at listings on websites like Craigslist, Zillow, or Facebook Marketplace. These are sites that interested renters frequent and scammers know to target. When using designated vacation rental website like AirBnB and VRBO, look out for sellers requiring payment through external services.

- Go With Your Gut: If you don’t trust the listing or if something feels off, avoid it.

Online Ticket Sales

This summer, Vermont will be filled with fun, ticketed events that you and your loved ones will be eager to attend. Before buying your tickets, learn these steps to avoid being scammed by fraudulent ticket sellers and keep your summer plans safe from scams.

Spot the Signs

- Prices are Too Good: If most other sellers are listing similar tickets for much higher prices, the ticket you’re considering buying is likely a scam.

- Untraceable Payment: Ticket scams will often require untraceable/non-refundable payment methods such as gift cards or wire transfers. Scammers can also pose as legitimate sellers on trusted sites like Ticketmaster but require off-site payment.

- Phishing: Emails, texts, and social media messages can be used to phish for personal information through ticket scams. If the email address has a strange or unfamiliar domain name, or hovering over an included URL looks suspicious, it is likely a phishing scam. Scammers might also use lookalike websites (E.g. slightly misspelling as “Ticketsmarter.com” to appear as the known ticketmaster.com).

- Sold-Out Tickets: Though there can be exceptions, sold-out tickets are often used as scams, especially if the seller has very little information available and refuses to meet in person.

- Printed or Replicated Tickets: Scammers can print the same ticket multiple times or replicate a bar or QR code on a ticket being resold. If there is no secure digital form of the ticket, or if the seller included photos of the ticket with a visible barcode or QR code (even if crossed out), it is likely a scam.

- Fake Support Numbers: Scammers can create a website or ad with a fake customer support number for real ticketing services. These numbers may appear as the top results when searching for support from specific companies. Once called, these scammers will pretend to be agents with the company and ask for your personal information.

What to Do

- Purchase your tickets directly from official sources like the box office (ex. Flynn Center) or a primary ticketer like Ticketmaster or StubHub (E.g. Vermont Lake Monsters Tickets)

- Whenever possible, use traceable forms of payment and pay directly to the ticketer. Avoid third-party payment or unconventional payment methods like peer-to-peer payment (PayPal, Venmo) gift cards or cryptocurrency/kiosks.

- Be cautious of ticket customer support numbers you find online. Fake numbers for well-known companies like Ticketmaster, are often used to scam customers seeking support online.

Family Emergency While Vacationing

With increased travel of family members during summer months, family imposters may strike. Scammers can pretend to be a relative in an emergency – in need of money immediately because they’ve been stranded, or in an accident while traveling. Know the signs so you and your real loved ones can stay safe from family emergency scams this season.

Spot the Signs:

- Scammers call about a family member in an unlikely but dire situation such as a medical emergency or arrest and need money immediately. They often share specific details that could make the scam more convincing like names and school information. The Federal Trade Commission (FTC) has even warned about scammers using advanced technology such as voice cloning.

- They will often ask for money to be sent through untraceable/non-refundable methods such as gift cards.

- Common forms of this scam include the grandchild imposter, or “grandparent scam,” in which scammers claim to be one’s grandchild.

What To Do:

- Stay up to date with the information your loved ones are sharing online. Personal information and pictures, especially when shared on public accounts on social media platforms, can be stolen and used by imposter scammers.

- Create a secret code to use among family members in cases of emergency.

- Keep trusted contacts of loved ones in an easy to locate place.

- Never send money parties you can’t verify

- If the scammer threatens to come to your house or you are told that someone will come to pick up the money, do not answer your door and call the police.

- Establish a family plan now, before contacted. Plan to go S-L-O-W:

Slow down and calm down. Scammers will try to spike your emotional response with emergency situations requiring immediate reactions. Take your time to verify the legitimacy of the situation.

Log the contact. Write down the information of whoever contacted you and disengage.

One call. Call either the number you know to be the person the scammer is impersonating or call a trusted contact. A trusted contact should be someone you can meet/have met in person.

Warn others: Help others to identify scams by reporting them.

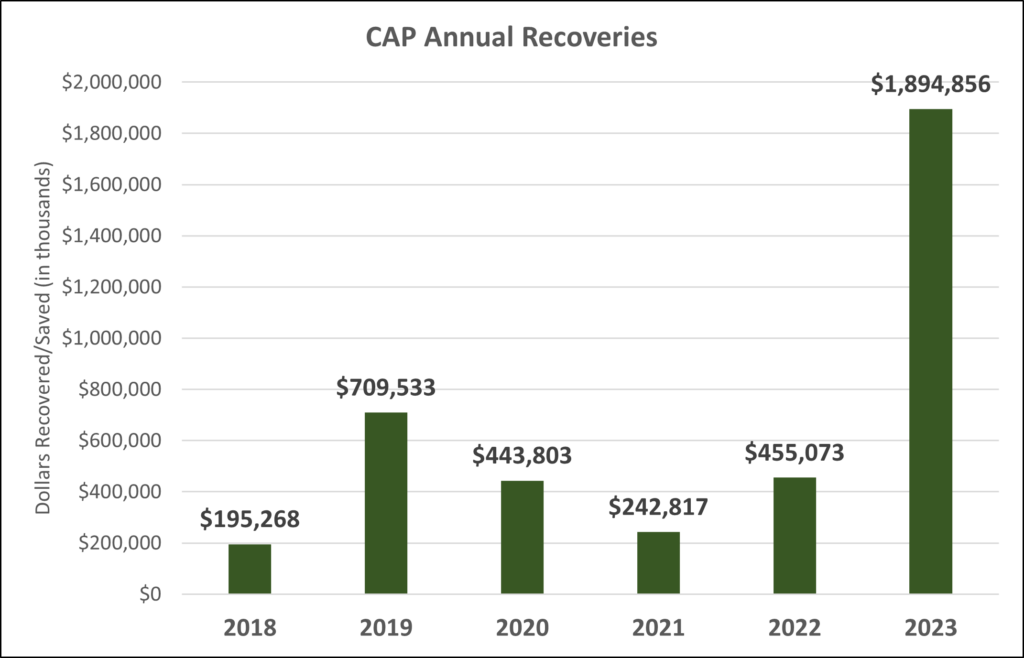

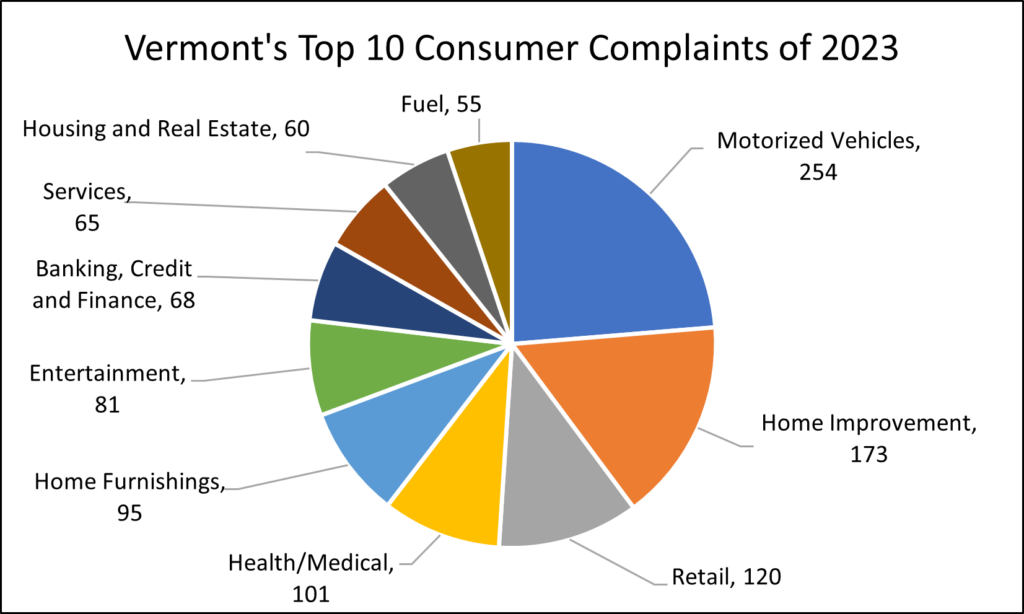

If you notice a scam, disengage and report. Report scam encounters to FBI Internet Crime Complaint Center at ic3.gov. If you sent money, contact the financial institution right away. The Consumer Assistance Program at the Vermont Attorney General’s Office is your Vermont resource for scam prevention and information.