As businesses rebuild what was lost and purchase new items after the floods, we urge businesses to engage trusted contacts to help consider the next steps and to help make informed decisions. Businesses with concerns can reach out to the Attorney General’s Consumer Assistance Program (CAP) for help. Vermont businesses are covered by our state’s consumer protection law and CAP is a helpful resource available to businesses. CAP’s Small Business Advocate can assist businesses with any questions relating to consumer purchases and consumer complaint mediation.

First and foremost, businesses must document everything. Take pictures and write down all actions you are taking. This step will be integral in applying for relief and insurance claims down the road.

Making Repairs to your Business:

Below are a few tips to follow before making changes to your business as you repair and rebuild what was damaged in the flood.

- Contact your insurance company as soon as possible and do not make any permanent changes to your business until you get approval from your insurance company.

- Beware of dubious contractors that may appear with promises to restore damages immediately in exchange for immediate payment. Never pay in full upfront for a commercial project. Make sure you have a contract. Before working with a contractor, always check the Attorney General’s Home Improvement Fraud Registry and residential contractor registration status with the Office of Professional Regulation in the Vermont Secretary of State’s office.

- Contact the Consumer Assistance Program by phone at (800) 649-2424 or by email at ago.smallbusiness@vermont.gov for questions relating to hiring a commercial contractor.

Legal Assistance:

Small businesses may also need the advice or services of an attorney. Below are legal resources available to small businesses during this time.

- Vermont Bar Association (VBA) offers low-cost consultations. A lawyer will provide a 30-minute consultation for $25 to help answer questions. You can reach the Lawyer Referral Service at (800) 639-7036 Monday-Friday 8am – 4pm. Please visit vtbar.org for updates.

- Small Business Legal Assistance Project offers support and outreach on legal topics impacting diverse and disadvantaged businesses and business owners in Vermont.

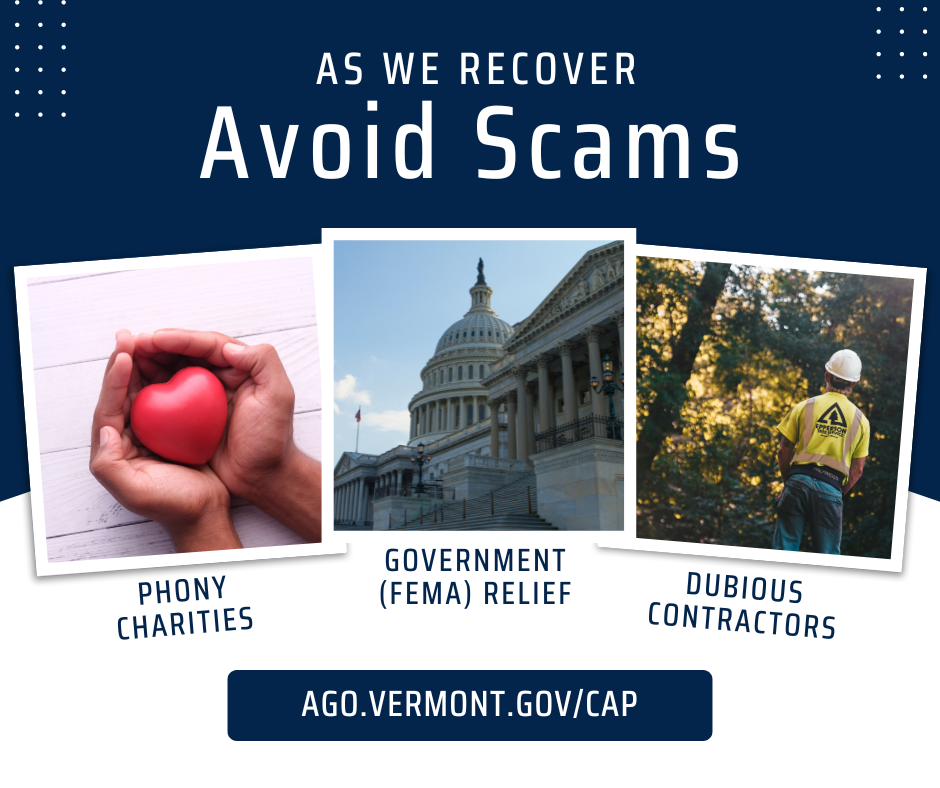

Beware of Disaster Relief Scams:

The Consumer Assistance Program is warning Vermonters and small businesses to beware of disaster-relief scams and price gouging. Scammers may impersonate FEMA or the State of Vermont. To learn more about these scams, please review CAP’s Avoid Scams and Fraud During Flood Recovery blog post.

How to Contact the Small Business Advocate:

If you have any questions on the above related material, please contact Emily McDonnell, Small Business Advocate at ago.smallbusiness@vermont.gov or call CAP at (800) 649-2424.

Many Vermonters are going through a traumatic period. If you or someone you know is having a hard time with the emotional impact of this crisis, you can call or text the National Disaster Stress Hotline, (800) 985-5990, or 9-8-8. You are not alone.