By Crystal Baldwin

A heartfelt thank you to Jeanette Voss and Martha “Mickey” Pullen for sharing your stories in a recent Seven Days article, Cyber Scams Are Leaving Older Vermonters Destitute, Frustrated and Saddled with Tax Debt. Your stories help us understand that scams are malicious criminal operations that succeed through thievery. You have helped others to see that responding to a scam is deeply human and natural. Scams are crimes. Scams are never the fault of the people they harm.

Findings by the Federal Trade Commission as well as AARP support that we humans are most likely to respond to scams when our emotions (positive and negative) are elevated—from anger to love, we have recently experienced two or more stressful life events, are living in isolation, and have increased exposure to scam encounters.

It could look like this: A new mom on maternity leave who lost her beloved father receives a call about an unpaid IRS tax debt. When scammers use carefully scripted dialog, the notion of unpaid taxes seems plausible. One may question whether claimed dependents had been properly updated, or if a burial tax was overlooked.

This new mom receiving an unwanted call from the IRS was me. During the call, I felt panic rise as I readied myself to engage. My sleep deprivation and my baby saved me. Upon receipt of the call, I was rushing out the door with my crying child. I decided I was too tired and overwhelmed to engage in a meaningful conversation. Exasperated, I said, “I just can’t right now,” and hung up. Once I was seated in my car, I expressed a long exhale. In that moment, I started laughing as I said aloud, “That was a scam!” My baby was not amused.

When involved in a scam our brains are likely to experience an “amygdala hijack” —a term defined by Emotional Intelligence expert Daniel Goleman. This hijack is a natural response to emotional stimuli. When it is triggered, our response bypasses the orderly and fact-checking part of our brain. Scammers trigger this hijack by using manipulative psychological tactics. In the recent experience I shared above, my emotions helped me out of a tough situation. But I have experienced scams before where my emotion-based actions led me to monetary loss.

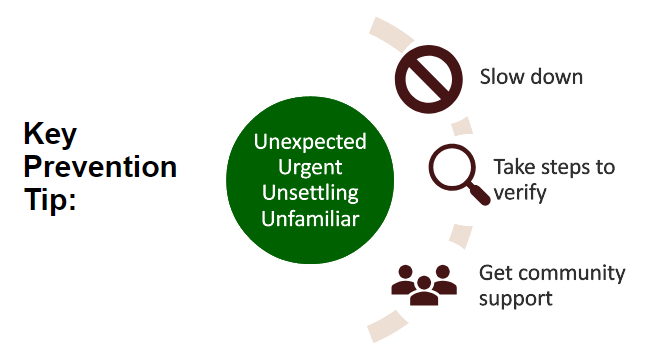

Scams frequently occur in isolation. Because of this, one of our best prevention strategies is to stay connected with our communities. That way, whenever you encounter something that is unexpected, urgent, unsettling, or unknown, you can engage a trusted contact, or community organization. This trusted support serves as your sounding board. They will help you to ask questions and expose the scam. Regularly engaging your trusted contact, such as when thinking about buying from a new website or making a high-dollar purchase, helps you to form scam avoidance habits. As burdensome as it may seem to activate a prevention strategy involving others, think of it like locking your door. It is a safety measure that will hopefully stop a thief from stealing from you.

If you have responded to a scam, know that you are not alone. Please report all scams to the FBI’s IC3.gov so that they can aggregate data to identify scam activity.

Steps when funds or personal information have been jeopardized:

STEP 1:

Immediately contact the Financial Institution’s Fraud Department.

STEP 2:

Immediately report to the FBI’s Internet Crime Complaint Center: ic3.gov or call 1-800-CALL-FBI

If personal information may have been stolen or compromised: IdentityTheft.gov provides step-by-step recovery guidance or call 1-877-438-4338

STEP 3:

Consider engaging a trusted contact who will support you through the process.

STEP 4:

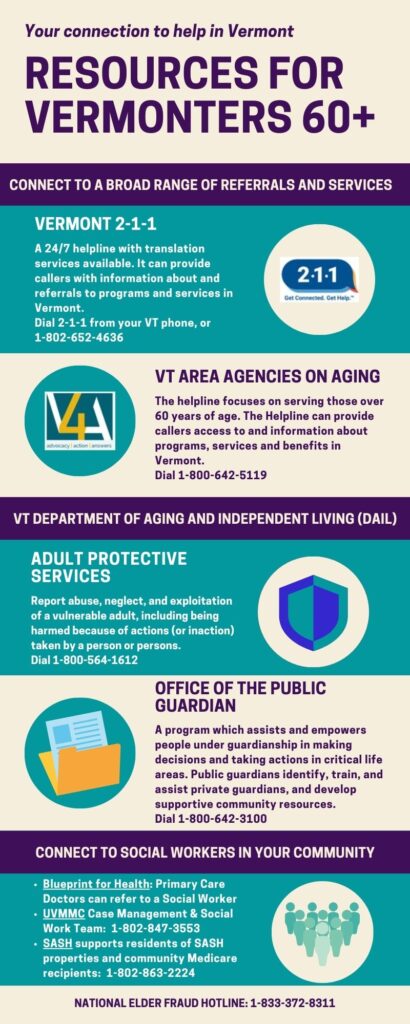

Engage Vermont supports when you need additional help:

VT Attorney General’s Consumer Assistance Program:

ago.Vermont.gov/cap

VT Department of Financial Regulation:

dfr.Vermont.gov

Local law enforcement inquiry

United Ways of Vermont 2-1-1 Information and Referral Hotline

Stay safe and be well, Vermont.