Most Vermonters love a good deal. So, we know how appealing it can be to search for discounted products through online listing sites. And, when the deal of the century is finally located, we know how easy it is to want to act quickly, rather than question if the deal is too good to be true. But sometimes the most important thing you can do is stop and verify an online offer before you pay.

At CAP, we typically hear about the times people get scammed online, rather than the times they found a great deal. Vermonters report scams to our office so we can assist them if there is a way to recoup their money and so that other consumers are made aware that there are scammers lurking online, looking to take your money without earning it. A couple of weeks ago, we heard from a gentleman hoping to close a deal on purchasing an excavator. He fulfilled his end of the deal by wiring more than $16,000. After receiving the funds, the scammer went dark. This Vermonter was lured into the scam through a blatant lie; from a Craigslist post, he was connected to a realistic-looking eBay site to fulfill his order. The site however, was not eBay. The money that was wired was gone within a few moments.

Last year (2016) 122 Vermont consumers reported online listing scams to our office. And, fourteen people reported monetary loss due to wire transferring funds in response to an online listing. The year before (2015) nineteen people reported loss by wire transfer.

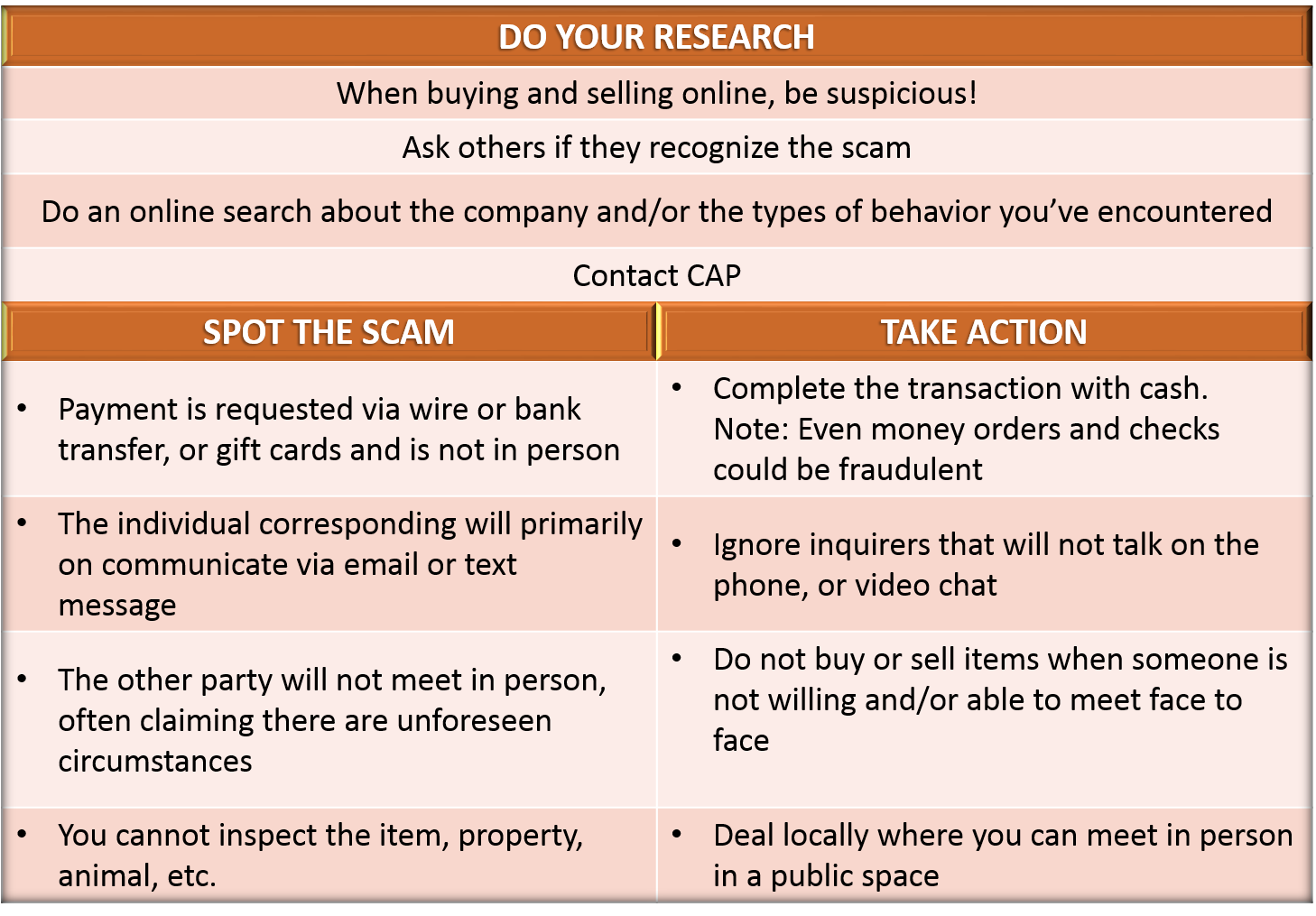

Listing scams take on many forms. Sometimes the scammer responds to a seller post, overpays with a check, and asks for the remainder to be wired back. Sometimes the post is for a fictitious rental property and the scammer is looking for the deposit and first month’s rent to be sent. Sometimes the item being sold is a used car, riding lawnmower, or construction equipment.

Scams even happen when you are looking for that perfect puppy or pet to expand your family, but the transport of the animal is held up at the airport or elsewhere. People have reported trying to buy wedding dresses, only to be bilked of their wedding budget due to scam activity. The point here is, listing scams can happen with any kind of product or service when you least expect it. The key to prevention is knowing the signs, taking an extra moment to verify an online offer before you pay, and if you are the victim of a scam report it to our office.

The Attorney General will continue to alert Vermonters about new and ongoing scams. In the meantime, here are some helpful tips to help you avoid online scams:

Contributing Writer: Crystal Baldwin