By Crystal Baldwin

There are only two kinds of food a newborn baby can eat: breastmilk and simulated breastmilk, otherwise known as baby formula. Formula has since the eighteen hundreds been a helpful nutritional supplement—establishing itself as a necessity to grow our infants, helping to overcome milk/food allergies or the obstacles that present in breastfeeding, and providing an alternative for families.

At six weeks, my baby developed a milk protein allergy. Still too young to eat solids, my family began investing in the protein dense, nutrient rich smoothie that is formula to make sure she was fed.

Sure, sometimes when I went to the store the preferred brand of her soy-based formula was out of stock. Determined, I sought alternatives to purchasing in-store, so that my baby could have the food she liked. I could buy in bulk from wholesale stores, or direct from the manufacturer online. I opted to have the containers of formula delivered to my doorstep. Upon each delivery arrival, I felt a pang of extreme gratitude in knowing that my baby would eat. I wish I could extend this feeling to every parent navigating the baby formula shortage.

The Biden administration has highlighted the concern of the baby formula shortage with a plan to alleviate the struggle, which was predominately initiated by a voluntary recall at the largest U.S. formula manufacturer, Abbott Nutrition, three months ago.

The federal government has been:

- Working with other infant formula manufacturers to increase production, expediting the safe import of infant formula from abroad.

- Calling on both online and store retailers to establish purchasing limits to prevent the possibility of hoarding.

- Simplifying product offerings to increase the speed and scale of production, to stabilize the overall volume of formula available on the market.

The federal government is now:

- Invoking the Defense Protection Act, diverting needed ingredients to infant formula manufacturers before sending the supplies to other consumer goods.

- Launching Operation Fly Formula, utilizing Department of Defense commercial aircraft to transport overseas U.S. approved infant formula to deliver it to the store shelves faster.

- The FDA is working with the largest U.S. formula producer to reopen Abbott’s Sturgis, Michigan facility.

“On a personal note: I have firsthand experience with the formula shortage. Luckily, we’ve always been able to find alternative sources, but it’s been difficult (and scary at times).”

A Vermont Infant Parent

Vermont parents are resilient and savvy–they have been finding solutions to this problem for months. The parents that have been navigating this well know best, but perhaps I can help simplify some of the information that has been circulating. The following, in addition to the VT Department of Health’s help page released last week, might provide some level of clarity.

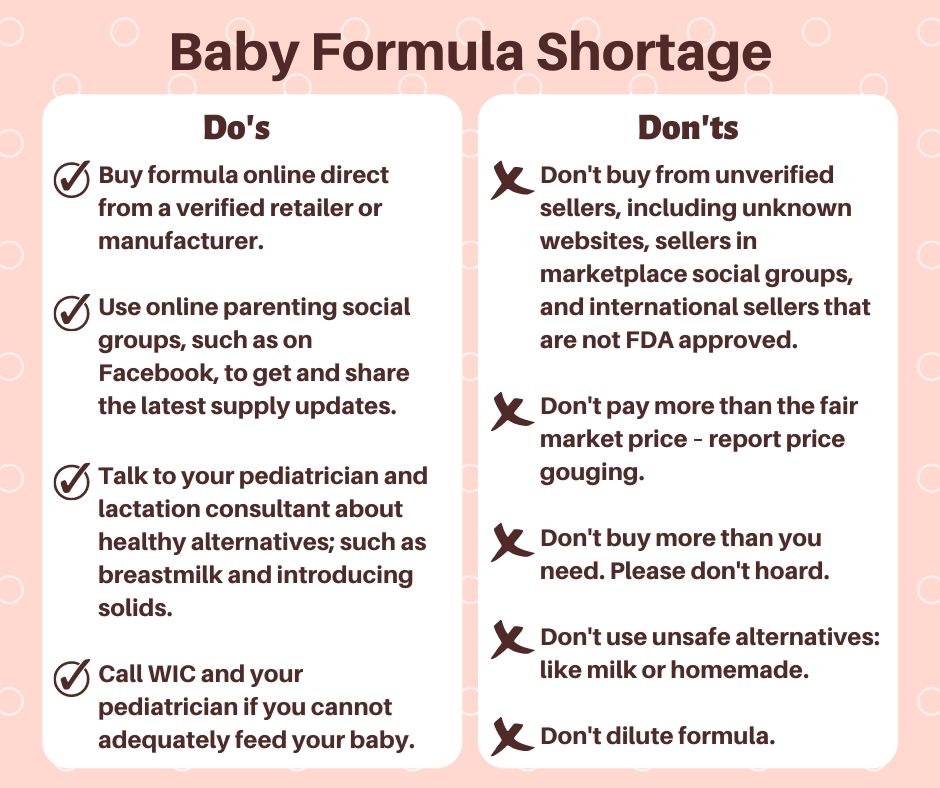

Caregiver Formula Shortage Do’s and Don’ts

Do

- Buy formula online direct from a verified retailer or manufacturer.

- The New York Times is regularly updating a list of online available baby formula stock, organized by formula type.

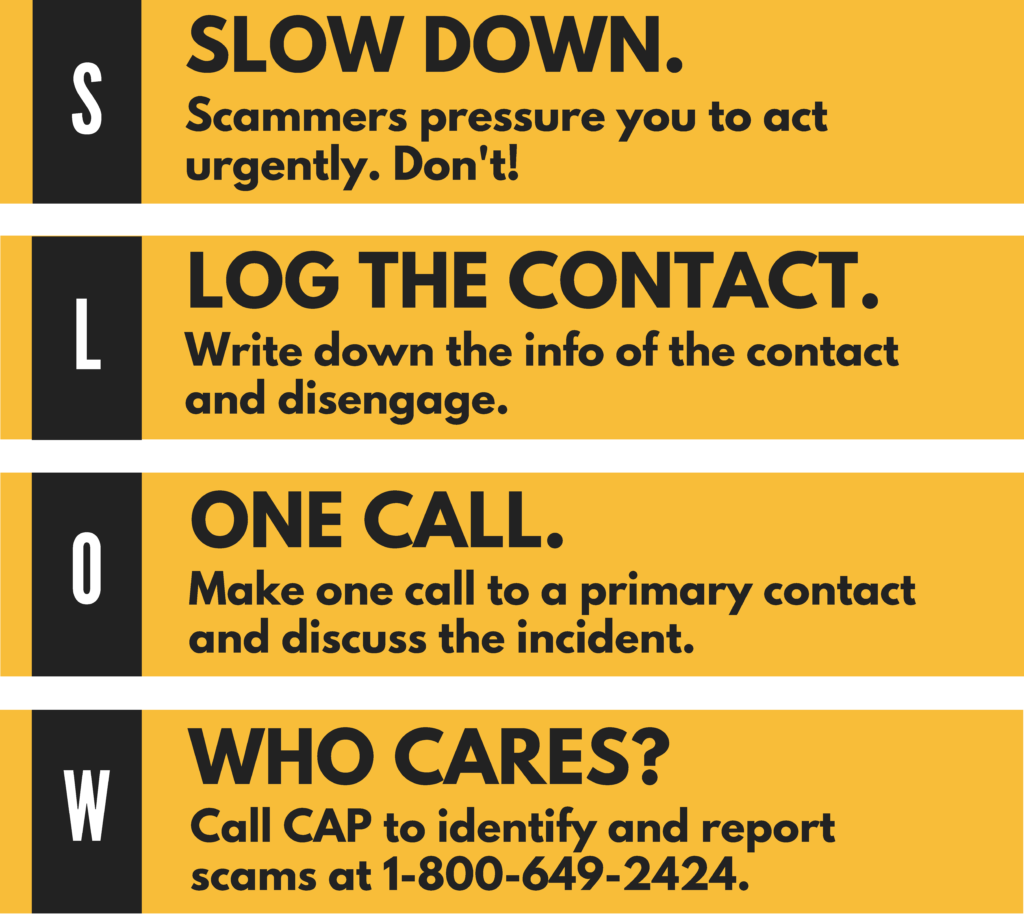

- Other ways to verify online formula sellers: Check BBB.org complaints and reviews, check the business registrations in the state of incorporation, perform an internet search of the company name and “scam” or “complaints” to find if others have reported problems. Double-check the website address before completing the order. Scammers will create mock websites, looking very similar to known sites.

- Abbott Nutrition has a hotline number for families that need specialty formula. For information and orders, call 1-800-881-0876.

- Use online parenting social groups, such as on Facebook, to get and share the latest updates.

- The two groups where I have noticed activity of parents sharing retail store formula stock updates are Parents & Caregivers of Burlington, VT and Beyond, and Helping Others .

- Talk to your pediatrician and lactation consultant (or similar Women, Infants and Children support services (WIC)) about healthy alternatives, such as breastfeeding, temporary use of an alternative formula, and introducing solids—where appropriate.

- Your pediatrician is your connection to infant safety. Stay connected regarding infant wellbeing. Lactation consultants are covered under most health insurance providers. They are nurses that provide dietary advice, supplement recommendations, and direct teaching and support for nursing mothers.

- Call Women, Infants and Children (WIC) and your pediatrician if you cannot adequately feed your baby.

If this shortage has caused undue hardship and you cannot feed your baby, especially due to the lack of supply, please reach out for help.

Don’t

- Don’t buy from unverified sellers, including unknown websites, sellers in online marketplace social groups, and international sellers that are not FDA approved.

- Scammers lurk at every disadvantage. Not engaging in disreputable activities and keeping scammers away will help everyone in the long run.

- Don’t pay more than the fair market price – report price gouging to the Attorney General’s Office.

- When you pay more than the fair market price for a product, the price spikes, making products unaffordable for moderate and low-income Vermonters. Price gouging in a market emergency has repeatedly been proven as unfair and deceptive. If you notice steep increases in the price of formula in Vermont, report the store name and location, and as much identifying information about the product as you can provide, including the formula type, size, dollar amount, and the typical price, as well as a picture, if able to the Consumer Assistance Program of the Vermont Attorney General’s Office (CAP).

- Don’t buy more than you need. Please don’t hoard.

- This may prove difficult, particularly when feeding your baby is at stake. But the economics here are undeniable, if you buy more than you need now while there is a shortage, someone else will go without. It will be difficult, but please stick to the purchasing restrictions outlined by the retailers, as required by the federal government. Calendar your plan to make another formula purchase again before your supply is gone so that you don’t run out.

- Don’t use unsafe alternatives: like homemade baby formula, juice, cow’s milk, goat’s milk, plant-based milk, or watered down/diluted baby formula with water.

- Baby formula is made to simulate breastmilk with a specialized combination of vitamins and nutrients and its production is FDA monitored. While cow’s milk and other dairy alternatives are yummy for older children and adults, infant bodies can’t adequately digest food alternatives, including excess water, which provokes harm.

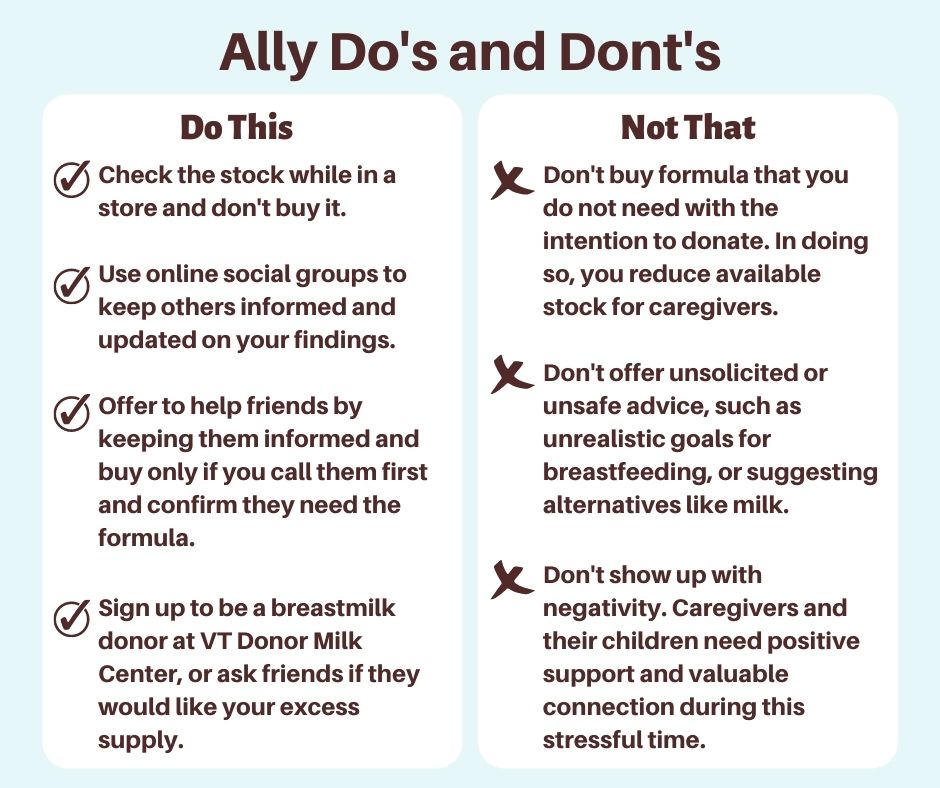

This is indeed a stressful time. Those of us on the sidelines are eager to support caregivers and help where we can. While our first inclination may be to buy formula and donate it, this action creates a greater supply problem as it leaves less formula on the shelves for caregivers to purchase when they need it. Instead, if you notice available formula stock, call up an infant caregiver directly and ask them if they would like you to pick it up for them. Another thing you can do for your community is to crowdsource formula supply by taking note of the formula available in your local stores and sharing it with caregiver support groups online. When you notice scams or price gouging in an emergency, report it to CAP at 1-800-649-2424.

References and Trusted Resources:

VT Department of Health: Infant Formula Shortage – Find Help page

White House – Biden Administration Statements – May 22, 2022 Fact Sheet 1, May 22, 2022 Fact Sheet 2, May 18, 2022 Fact Sheet, May 12, 2022 Fact Sheet