By Crystal Baldwin

It happened last year, and again this year. During Medicare Open Enrollment season, a concerned elder in my life called to ask if the person soliciting them was a scammer or an actual enrollment representative. The truth is, aside from highlighting some key identifiers of scams, it can be hard to tell. The scammers are so good at acting as if they are Medicare enrollment professionals, that it is enormously difficult to differentiate them from the real deal. The scams even spoof Medicare’s phone number, making the caller ID appear to be Medicare when it is not.

The primary difference between a telemarketer and a scammer is whether the caller is honoring the Federal Do Not Call Registry (DNC). If you ever put you number on the DNC by calling 1-888-382-1222 or by going online at donotcall.gov, you should not be receiving calls from solicitors—Even during Medicare open enrollment. You likely should not be receiving robocalls of this nature either.

What provider can call you when you are on the DNC?

Businesses with whom you have a customer relationship within the past six months, such as your Medicare provider, and other you have requested to call you. Yes, that’s it. No other unrequested calls are allowed.

More on Robocalls:

The same goes for those annoying automated/computer/robot calls. Except with these, unless you expressly opted into receiving robocalls in writing, you should not be receiving these calls either.

What if the call IS my Medicare provider, or I am interested in changing plans during open enrollment?

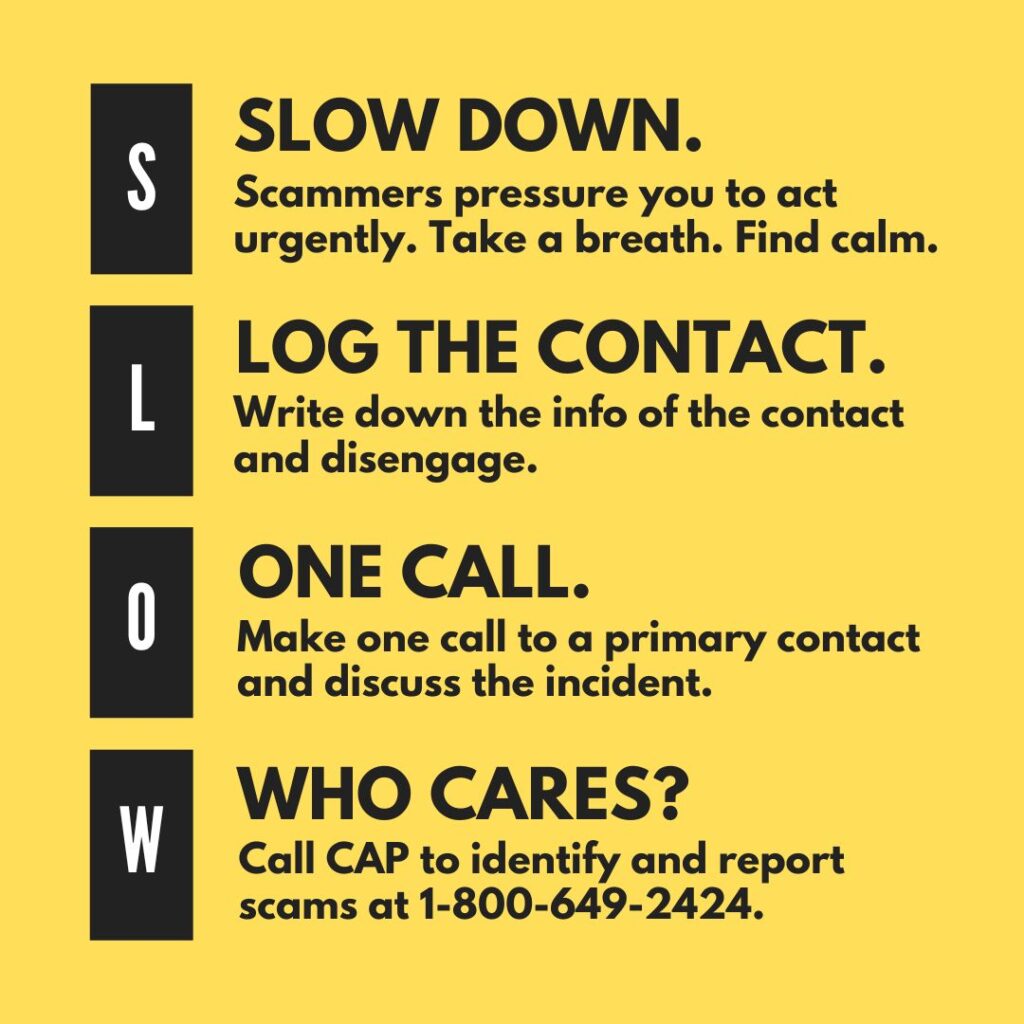

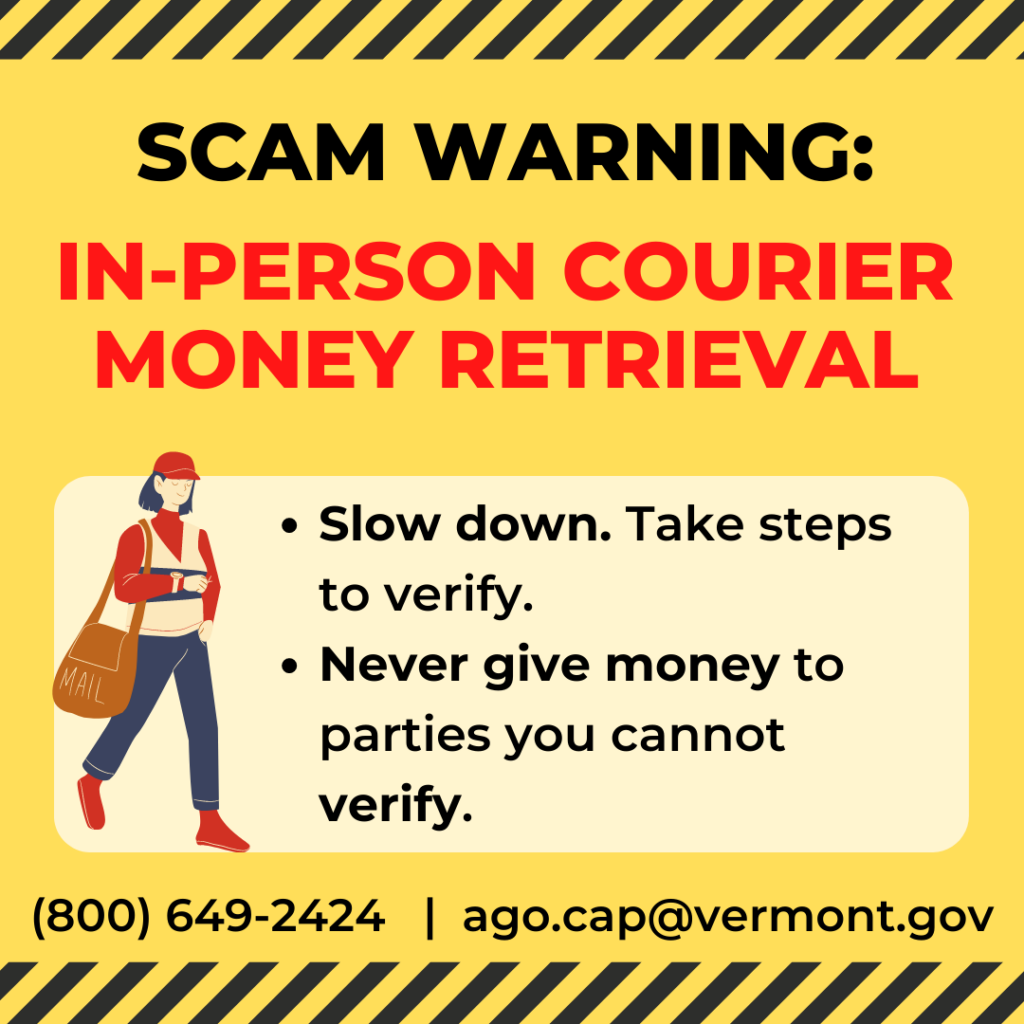

This is where it gets tricky. It is difficult to know whether your provider is calling instead of a scammer, especially because scammers copycat caller ID numbers. The only way to be sure is to take steps to verify by hanging up on the caller and calling back a number you know to be valid.

If you are looking to change enrollment during the Medicare open enrollment period, do so on your terms.

- Connect with the State Health Insurance Program (SHIP) at 1-800-642-5119 to get help navigating Medicare enrollment and to understand the complexities of Medicare plans.

- Seek out options using the Medicare.gov website.

If you are concerned about your Medicare plan or need to report known Medicare provider fraud/abuse, contact Medicare directly at 1-800-MEDICARE (1-800-633-4227).

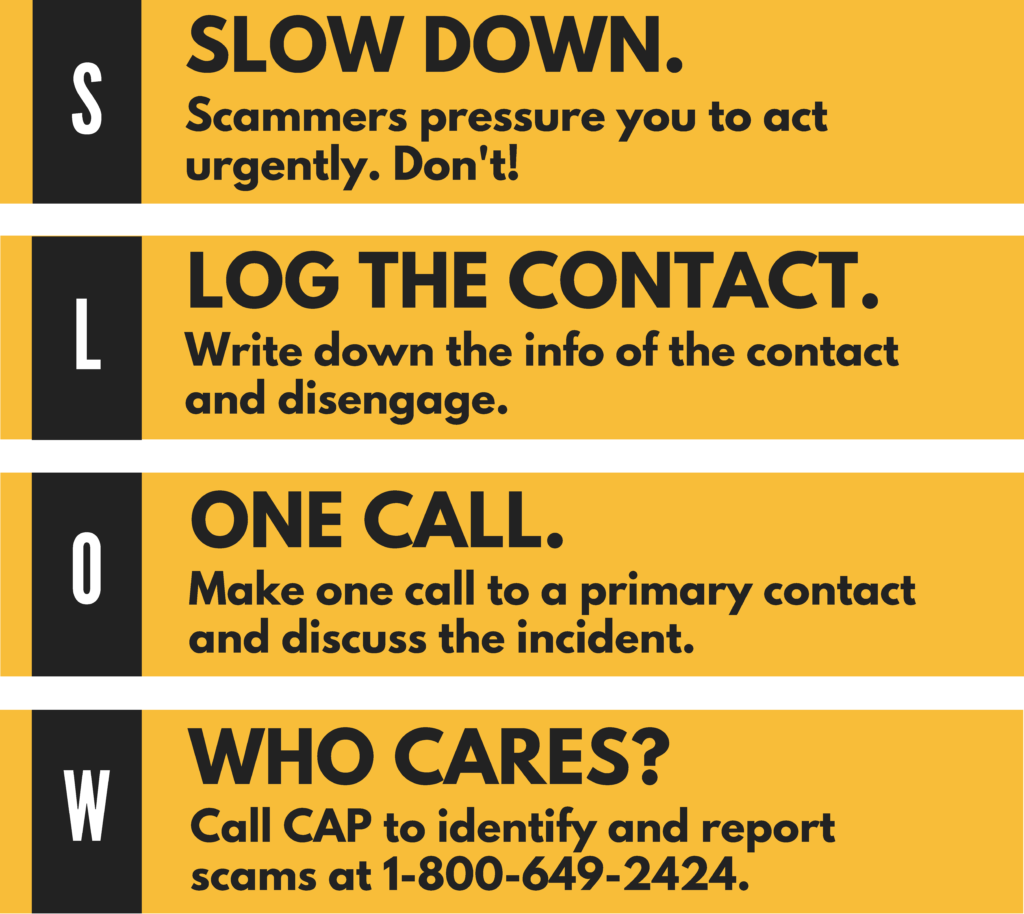

Please help the Consumer Assistance Program (CAP) stop Medicare scams by sharing this information with someone you know. If you have questions about this scam, or have provided personal information to the scammers, please contact CAP at 1-800-649-2424 or go online to ago.vermont.gov/cap.

Resources: