Auto complaints are a top complaint received by the Consumer Assistance Program every year. Cars are both an important transportation resource and, sometimes, an extension of personal identity. Outside your home, a car purchase may be one of the most expensive purchases a person may make. Consumers may be eager to buy a new car after long periods of saving. Usually buying a handful of cars in their lifetime, consumers are at a disadvantage to dealers, who sell cars every day. There is an emotional component to buying a car that consumers should also be aware of – this is true of brand-new cars, or “new to you” used vehicles that may have had previous owners.

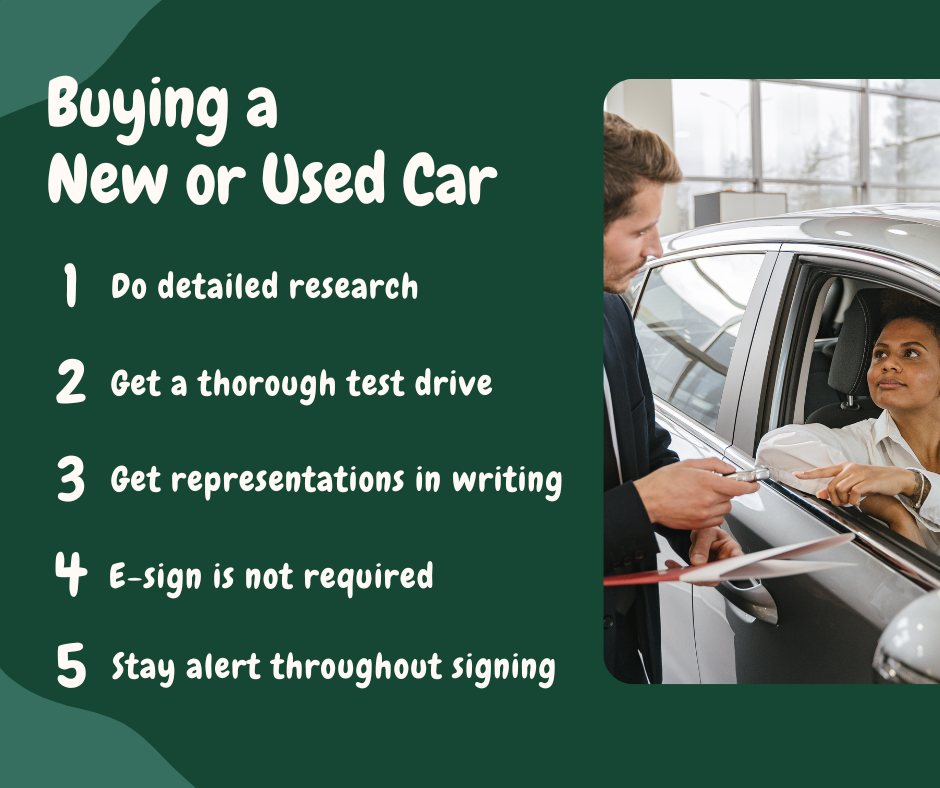

Online Research: Using the Internet as your tool, research different makes and models that have the features you are looking for. Once you have a new car in mind, look up the Manufacturer Suggested Retail Price (MSRP), which is the manufacturer’s recommendation on vehicle pricing. You can usually find this information on the manufacturer’s website. Also check pricing through online forums, such as Reddit, where many consumers post about their experiences with different cars. Don’t take everything you read from other consumers as fact. Gather information that will help you make an informed decision.

Test Drive: Once you have a clear idea of the car you want, it is time to go to the dealership. Make clear to the salesperson what you want to try without expressing your interest in buying. If you share how much you like the car, or are excited, salespeople may seek to capitalize on this knowledge when negotiating. Try to stay calm and neutral to help get the best deal.

Trust your own research over verbal representations. After selecting a car, you will move on to the paperwork, a process which can feel cumbersome for consumers. People tend to relax after selecting the car they want, which is a huge choice. Stay alert throughout the signing.

Most people do not buy cars frequently, but a salesperson sells cars every day. Because of this, they are better at selling than you are at buying. One very common strategy used in car sales is to stretch out the car deal. This can be exhausting for the consumer, making it harder to make thoughtful decisions.

You may be asked to provide an electronic signature on a tablet or computer. This can be problematic as you may not see or comprehend the document. It is easy to miss key facts when reading on the digital screen. You can ask the salesperson to print out any contract you are expected to sign and read the contract carefully. You have the right to get printed documents before you sign, as well as to choose to sign in writing.

If financing with the dealer, be careful to avoid “yo-yo deals,” where the dealer reserves the right to cancel the agreement and re-finance at a higher interest rate and payment. Sub-prime auto loans often have high interest rates and prepayment penalties for paying off the loan early. Getting pre-approved by your bank—or even having your bank pay with the auto as collateral with a bank auto loan, is also an option.

For used cars: ask for a Car Fax report or other documentation showing its driving history; check the odometer disclosure statement. A new Vermont law also requires used car dealers to provide an inspection disclosure (meaning: the dealer is required to tell you when the vehicle was last inspected, how long until inspection is due, and that you have a right to have it inspected before you purchase). This is an important new consumer protection because instead of paying for a used car, only to find out three months later that it may be deemed “un-inspectable” (or require more money for repairs before it passes inspection) ensures that you have full information and know your rights before making a purchase.

If you have experienced an issue in car buying, contact the Consumer Assistance Program.

This piece is adapted from an earlier edition, “Buying a New Car” brought to you by one of the Consumer Assistance Program’s (CAP) service-learning interns. UVM undergraduate students make significant contributions to our program and Vermont through their participation in our service-learning lab, where they learn about consumer protection while honing their professional skills.

References: