By Crystal Baldwin

When I searched to purchase my first used car as a freshly licensed teenager in the late ‘90’s, I was fortunate to have an experienced mechanic and negotiator with me. Our first stop was a used car dealership that was holding a huge blowout event complete with flag garland and free large-print calculators and five salespeople per customer. I can remember the swarm of eager dealers approaching to this day. We showed up in our ten-year-old Ford LTD. One salesman approached so daringly that he might have opened the door for me had I not willingly exited the vehicle. My dad held up the flyer he received at home as he promptly asked about the promised freebie. The dealer took the flyer from his hand and then pointed to a long line. He advised us to look at cars while we waited.

I wanted something simple. The criteria I stated was, “Four doors and not a hatchback.” It went without saying that I wanted a reliable car to get me around town to my job and all my activities. We were led to a seven-year-old white Ford Tempo marked $2,000. For all appearance purposes, it seemed perfect. I could see myself driving that kind of car. While the dealer encouraged us to buy it based on price alone, my dad pushed back as if speaking straight from a consumer protection advice manual, “We aren’t putting any money down without thoroughly looking it over and having a test drive.”

That’s when he crouched down in the crowded dealer lot, nearly pushing his entire body under the car. From what he could see externally, it looked good enough for a drive, but confirmed that we wouldn’t have a clear sense of the car until it was put up on a lift. Then, I drove it. It handled okay in the lot and on the main road. But, when the dealer called from the back seat for me to take a right turn on another neighborhood road, my dad advised me to take a left onto the thruway. The car could not reach highway speed and sounded as though it might combust at any moment. “How does it feel?” my dad asked.

I called back in my loudest octave, “Like it doesn’t want to go anywhere.”

He followed, “Do you want this car?”

“No,” I said flatly.

He turned to the dealer, “We won’t be buying this car.”

When we got back to the dealership, we quickly got out and were ready to leave, but my dad still wanted his calculator. The salesman said he would go get it. When he came back, he did not bring the calculator. Instead, he brought three more salesmen that encircled us with shaming jabs aimed at my father that he was letting me down. While my heart raced with anxiety and anger, my dad remained calm. At one point, I heard my dad reply, “I can’t believe you are selling this car. It sounds like it could break at any minute. I am not letting my daughter in that thing again.” By the end of their banter, we walked away with three things:

- My dad was offered a job at the dealership—he did so well saying “No” they wanted him to work for them.

- A large-print calculator (My dad did not stop asking for it).

- An etched lesson: Purchasing a quality used car is best done with backup and calm shrewdness.

Car buying is something most of us will do only a handful of times in our lives. How can we properly prepare for the moment we come face to face with a car seller? While you may not have the benefit of having my father present, there are some things consumers can do to prepare for the big purchase. The Consumer Assistance Program’s Assistant Director Lisa Jensen recently appeared on Across the Fence to share car buying tips.

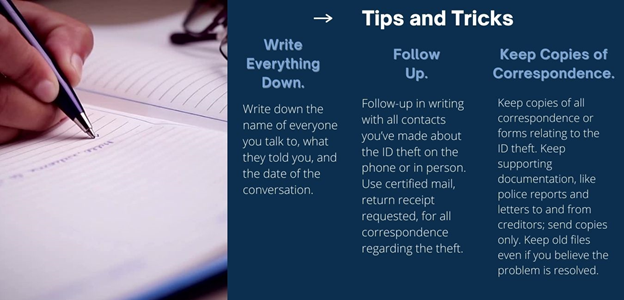

Here are some of the used car purchasing tips highlighted in the show:

- Secure financing ahead of time.

- Do thorough research on the make/model of the car; search reliability and ratings.

- Look up the Kelly Blue Book and NADA and online marketplace values

- Check out similar vehicles at multiple dealerships.

- Scrutinize the car: Test drive, get an independent pre-purchase mechanical inspection

- Look for the Buyer’s Guide and decipher warranty information; there may be none.

Buying a car can be complex, time consuming, costly, and emotionally taxing. Because buying a car is not something we do frequently, having a supportive person present who understands your financial picture and supports your interests can be beneficial. If you are in the market for a car, consider bringing a trusted companion with you to the sale, such as a friend/family member, who understands your financial picture and supports your interests.

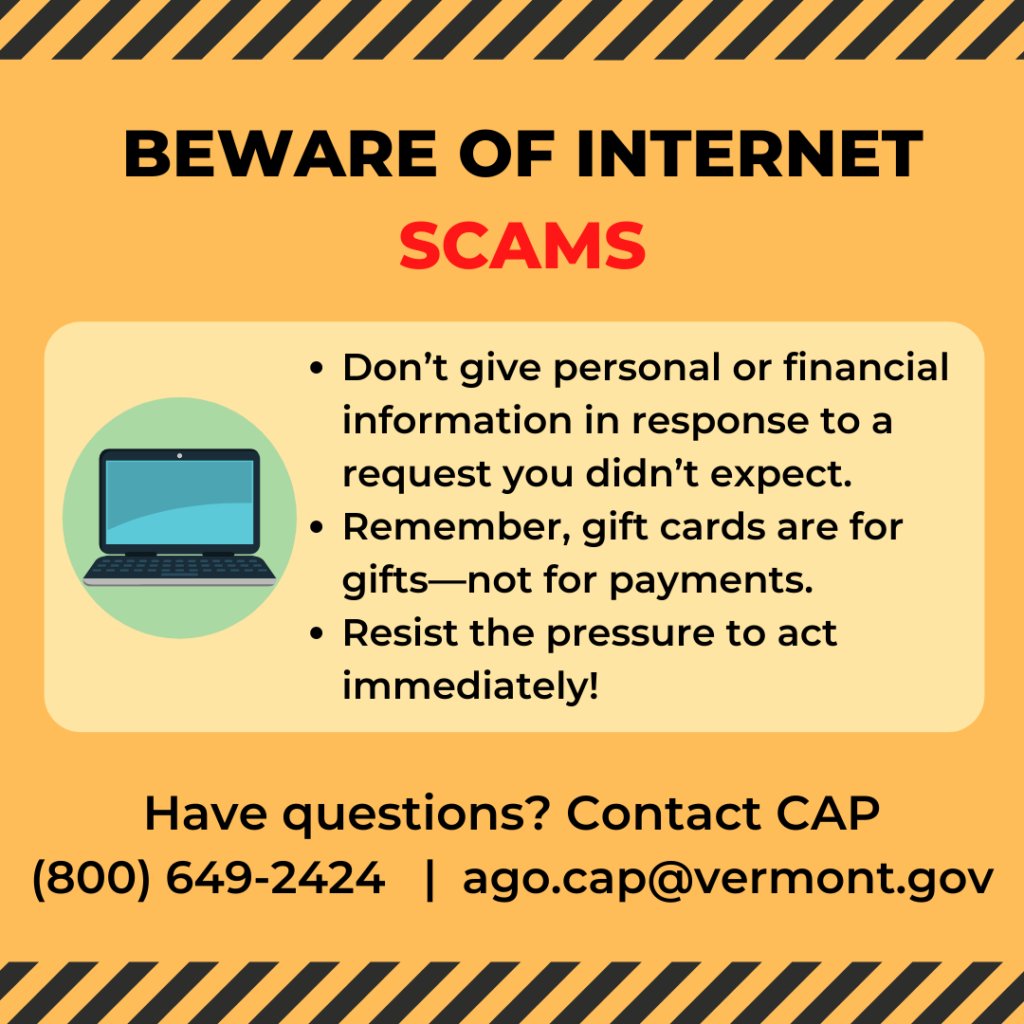

The Consumer Assistance Program (CAP) is another resource that you can call for tips before car buying. If you do experience a problem with the purchase of a dealer purchased vehicle, new or used, CAP provides a letter mediation service for Vermonters and works in partnership with the Vermont Auto Dealers Association’s mediation/arbitration program.

Did I ever get my first car? Why, yes. Yes, I did. It took another week or two, but in time, we found the perfect car for me for half the price. A metallic blue Mercury Topaz—the off-brand twin of the Ford Tempo. A test drive and thorough check-up proved the car to be a worthy fit for me. After many reliable miles, the car was repurposed for parts in the early 2000’s.