Attorney General T.J. Donovan has been spearheading criminal justice reform, most recently calling for reforms to the bail system so low-income Vermonters don’t get stuck in jail for low-level crimes. In 2016 he created the Community Justice Division to protect public safety, increase fairness, promote equal access to justice, and reduce incarceration. He was also a leading advocate for the passage of Act 61, which expanded pre-trial services and diversion. Act 61, among other provisions, created the Tamarack Program, a treatment-oriented diversion program aimed at adults with serious mental health and substance abuse issues. Since Act 61 took effect in July of 2017 the rate of referrals to diversion programs has more than doubled statewide, from 10% to 24%.

We caught up with Co-Chief of the Community Justice Division David Scherr to get more background on why criminal justice reform matters and how we’re making a difference here in Vermont.

David Scherr, Co-Chief of the Community Justice Division.

What is the reason for the creation of the Community Justice Division? Why is this issue so important to the Attorney General?

The Attorney General created the Community Justice Division to focus on the issues of criminal justice reform. The division seeks to increase public safety by promoting equal access to alternative justice programs and increasing fairness in the application of the law. The division does everything from administering the statewide Diversion and Pretrial Services Programs to creating new legislation that supports criminal justice reform efforts—including initiatives like bail reform.

These are key issues for the Attorney General. He made them a cornerstone of his platform during his candidacy, and he created this new division to enact real reform.

What work is going on nationally on criminal justice reform? How does Vermont fit into that?

There is an amazing amount of work being done nationally on criminal justice reform. States across the country, and the federal government, are making significant changes in how they approach crime, punishment, and rehabilitation. Nationwide people recognize that mass incarceration is an unjust and ineffective way of dealing with crime—particularly nonviolent crime. It is also systemically racist, incarcerating African American men at disproportionate rates.

The same problems exist in Vermont and need Vermont solutions. Vermont has the most disproportionate rate of incarcerating African American people in the nation. Our office is working hard to provide equal access to justice and strongly supports efforts to root out systemic racism in our criminal and juvenile justice systems.

What inspired you to work in criminal justice reform?

Before I arrived at the Attorney General’s Office I worked mostly as a public defender based in Burlington while working on cases all over the state. In my role as a public defender I saw firsthand the challenges, inequities, and unfairness of our criminal justice system. The people involved in the system are largely poor, with few resources—economic or social—to provide support.

Underlying causes of behavior, like addiction and mental health issues, are not adequately addressed in the standard criminal justice system. By assisting people with the issues that lead to offenses and recidivism we are protecting public safety by making it less likely that people will reoffend.

Although I enjoyed helping people one at a time my view of our system made me want to have a system-wide impact by changing policies and laws. The Attorney General’s office has given me a place to do that, and I am grateful.

What are the Attorney General’s Office’s goals regarding criminal justice in Vermont over the next 5-10 years? How are we getting there?

Our long-term goals are to increase public safety by having robust alternative justice systems—working in close cooperation with our public health system—to adequately address underlying causes of criminal justice involvement, and to reduce the incarcerated population to the people who really need to be there. The work we are doing presently around our Diversion and Pretrial Services programs, along with legislative and policy efforts like bail reform, will move us in the right direction.

Thanks to David Scherr for sharing his expertise today! You can follow up with any questions you might have at david.scherr@vermont.gov.

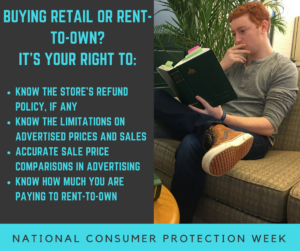

We all get them in our mailboxes and on our doorsteps – those colorful flyers advertising the “Biggest Sale Ever!” or the “Lowest Prices of the Year”. We may see signs for a big “Going out of business – Everything Must Go!” sale in the window of a local store.

We all get them in our mailboxes and on our doorsteps – those colorful flyers advertising the “Biggest Sale Ever!” or the “Lowest Prices of the Year”. We may see signs for a big “Going out of business – Everything Must Go!” sale in the window of a local store.