By Crystal Baldwin

My fellow Consumer Assistance Program (CAP) colleagues and I have heard hundreds of personal stories from those who have experienced loss due to scams. The effects of scams are devastating and overwhelming. We understand where you are coming from when you reflect, “This just isn’t me,” after having sent thousands of dollars. We feel your confusion when you say, “I don’t know where I went wrong.” We band together to rally your call to action to “do something,” because we too “don’t want this scam to happen to anyone else.”

In chasing the call to do something, in 2019 we applied for a grant through the Sears Consumer Protection and Education Fund to produce three scam awareness and prevention videos with a uniform message for consumers to “Know Your Relationships: Take Steps to Verify.” We were awarded this grant in the middle of the coronavirus pandemic, which slowed, but could not stall our efforts in completing this important project.

I wrote each script, calling on personal accounts of courageous Vermonters, who were willing to share their stories with one goal in mind: to help prevent scams from happening to others. We drew up character breakdowns, hoping for a diverse cast and put out a casting call for volunteers. In the end, we had two professional actresses, Ruth Wallman and Chloë Clark, donate their talent and expertise to the cause. For the remaining roles, we relied on our personal network of generous souls, including our Assistant Director’s son, Lars Jensen, and neighbor, Dave Saraceno. The remaining roles were brought to life by CAP personnel, Cameron Randlett, Charity Clark, and me. Without any formal acting experience, I was not first in line to fill the role, but when our casted actress relocated as our filming deadline encroached, I stepped up. We finally had a concrete filming date with a spectacular set, thanks to the kindness of Twincraft Skincare to offer up their space. I couldn’t let them or this project down. So, I put on my actor-in-training hat and broke a couple of legs—so to speak.

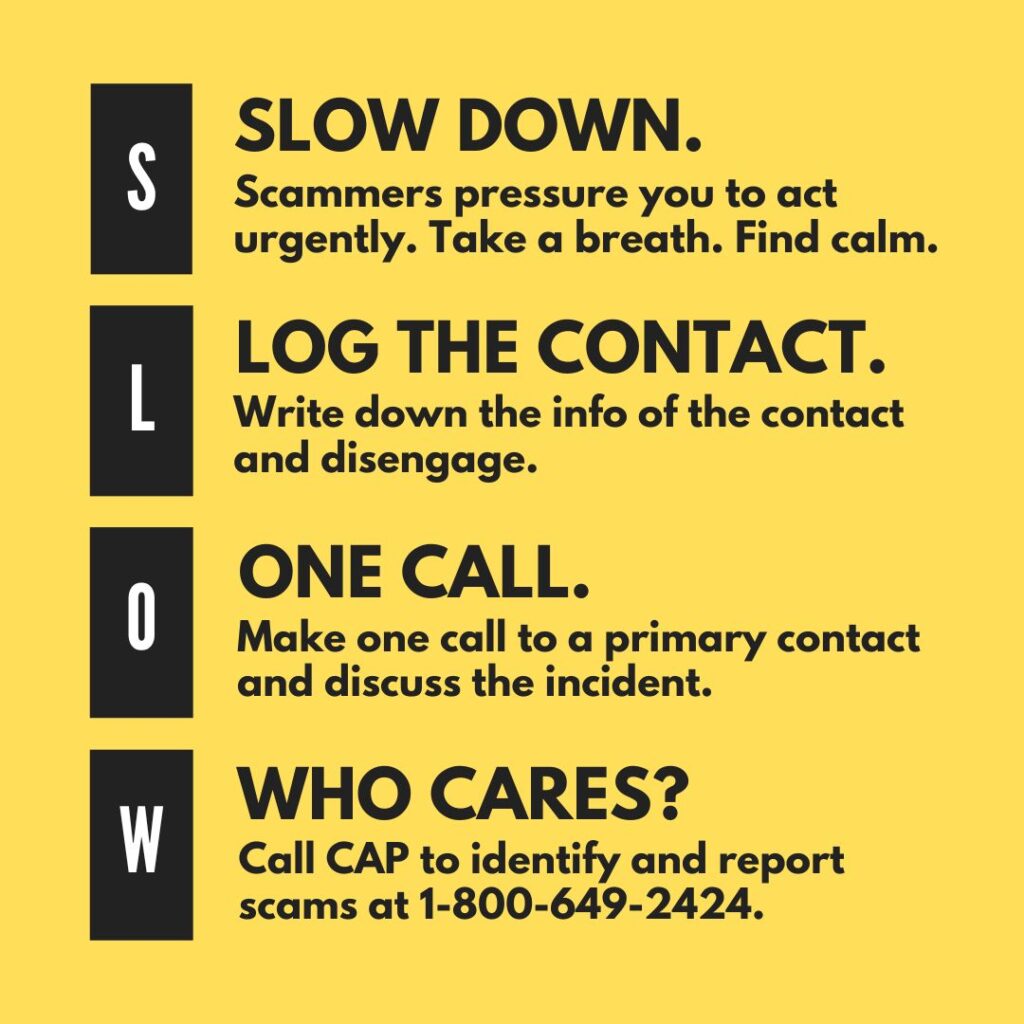

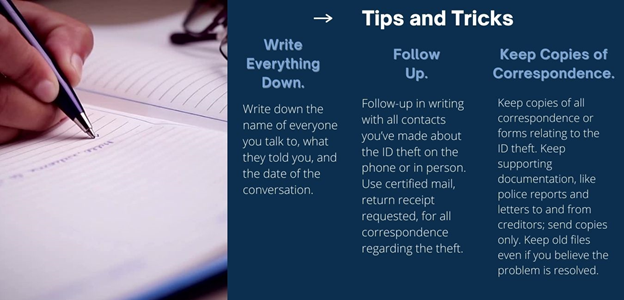

This experience, from start to release date, has reinforced my commitment to providing compassionate service to the people of our state. In completing this project, we have compiled so much more than videos and information. The videos, packaged with our online resources, equip consumers to be aware about imposter scams and apply specific mechanisms to stop scams in their tracks. I am proud of my team and the final product we present to you now.

Throughout the month of December, we will be showcasing the three produced videos, which highlight three very common scams with dollar loss: the romance imposter scam, the family emergency/imposter scam, and the business email imposter scam. It is our hope that as each video is showcased, it will be shared widely by you. As I hoped to instill throughout this work—this information is best in the hands of everybody. Please share it.