By Margaret Tabb and Ana Amo

A National Consumer Protection Week feature. “National Consumer Protection Week (NCPW) is a time to help people understand their consumer rights and avoid frauds and scams” (FTC).

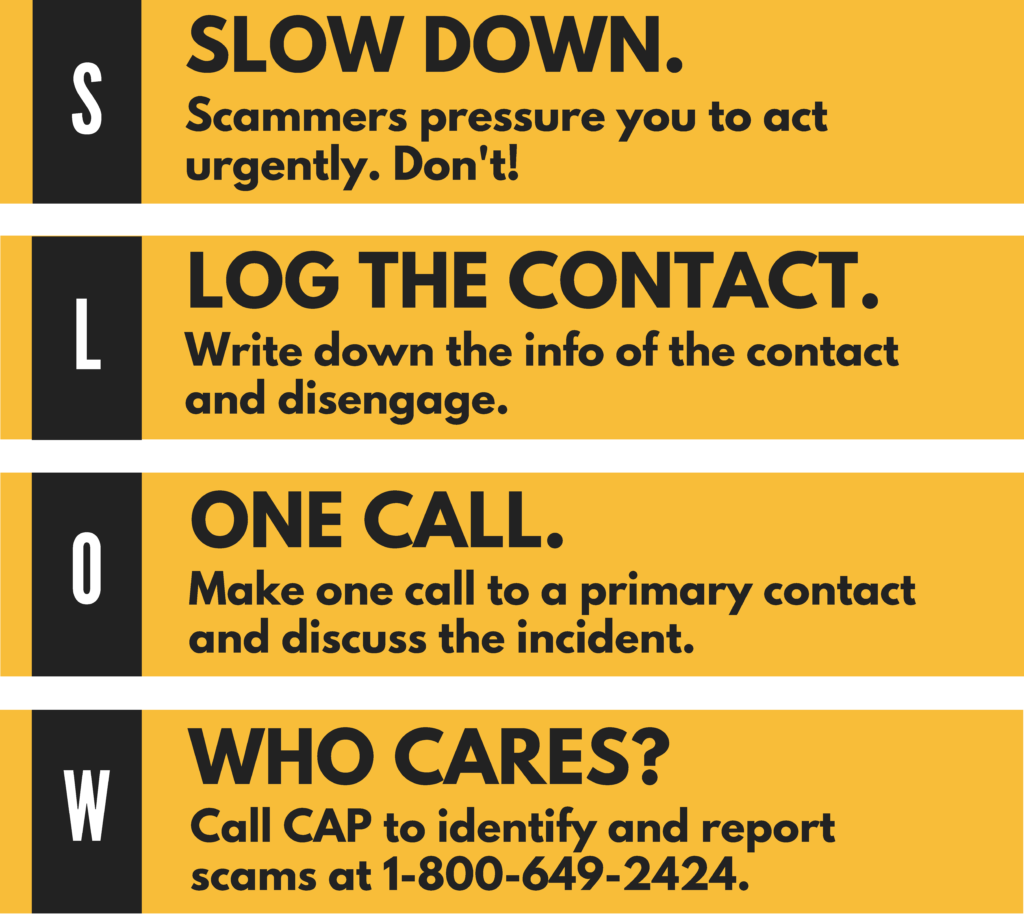

Government Impersonation scams were the top fraud reported between 2014-2021, with a total reported loss of $442.21 million according to the Federal Trade Commission (FTC). In 2020, with the popularity of the Social Security Imposter scams increasing steadily to date, the Social Security Administration Office of the Inspector General dedicated a day during National Consumer Protection Week as National SLAM the SCAM Day, to remind individuals of how to spot these pesky scam calls. The goal of Slam the Scam is to raise awareness during Consumer Protection Week on prevalent government imposter scams and invite consumers to slam down the phone on these scammers! In honor of SLAM the SCAM Day, the Consumer Assistance Program (CAP) is reminding you to SLAM the SCAM and hang up on government imposters.

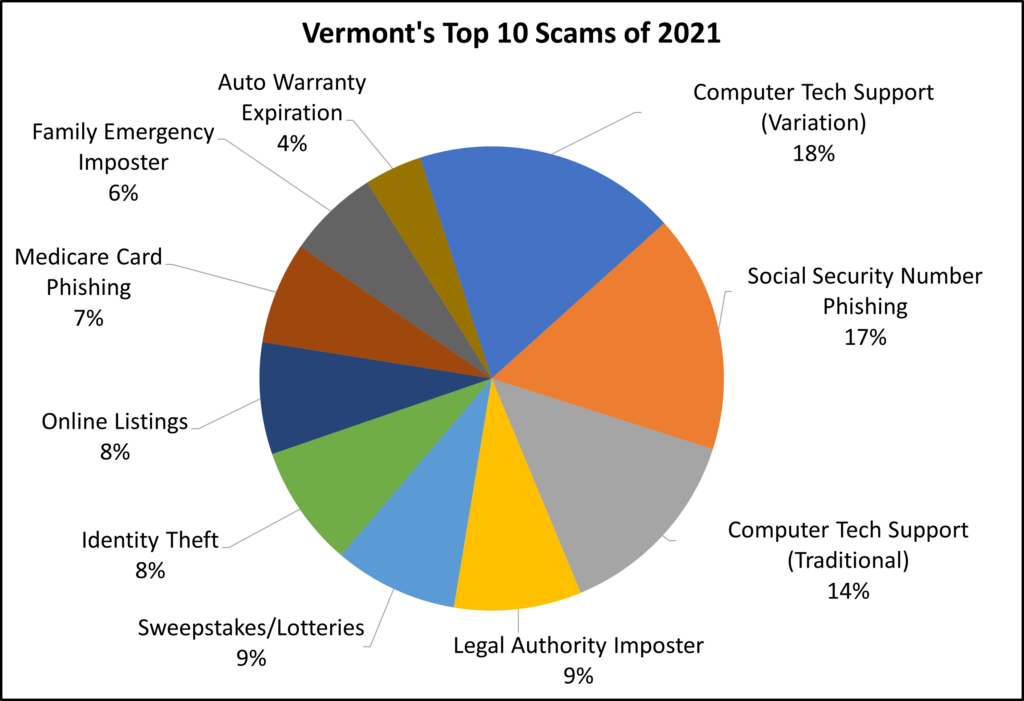

Receiving a call from someone claiming to be from the government can be alarming. These calls can be threatening in nature, claiming your personal information or identification was involved in a crime, or money is owed to a federal agency. On the other hand, sometimes these calls are more positive which offer fake opportunities for government grants, entitlements, or benefits. In 2021, the FTC reported a[TM1] total of 396,302 scam reports relating to government imposters. In Vermont, government and legal authority imposter scams clocked in at the fourth most reported scam last year. This accounts for 9% of the 5,154 scams reported to the Consumer Assistance Program (CAP) in 2021, compared to 41% of the top scams reported to CAP in 2018. While the FTC numbers can be startling, there has been an average 7.3% yearly decrease of reported loss to government imposters, meaning consumers did not provide funds. To continue the declining trend of loss to scams, we need your help. To help reduce these fraudulent attempts, CAP will break down popular government imposter scams to help 1) identify the scam, 2) review what to know about the scam, and 3) provide some tips on how to navigate government impersonation scams.

Hang Up on Government Imposters!

Social Security Number Phishing

Identify It: You may get a call, text, email, or even a direct message on a social media platform from someone claiming to be from the Social Security Administration or Magistrate’s Office. The scammer may claim your Social Security benefits are ending or will be suspended unless funds or personal information about yourself is provided. Sometimes there are even threats of arrest or legal action to be taken against you. They will ask you to pay with gift cards, wire transfers, peer-to-peer payment methods (EX: Zelle, Venmo, PayPal, CashApp, etc.), or mailing cash. We have also seen an increase in requesting cryptocurrency, as these transactions are untraceable.

What to Know: The Social Security Administration would never call you threatening to cut off benefits or suspend your Social Security number. Instead, these are scammers looking to steal your money and identity by gathering your personal information. The Social Security Administration would never contact you via text message, email, or through social media. The only time Social Security will contact you by phone is if you request a call from them. Otherwise, most if not all correspondence occurs through mail. A legitimate government agency would never request money be sent by wire transfer, gift cards, pay with cryptocurrency, or mailing cash. Ignore these fraudulent attempts, and if the call is a robocall, do not press any buttons. If you need to speak with the Social Security Administration, call your local office using the Social Security Office Locator. You may also report the scam directly to the Social Security Administration Office of the Inspector General.

Medicare/Medicaid Imposter

Identify It: Scammers will call, often from a spoofed caller ID number, and pose as Medicare or Medicaid representatives to gain your personal information and money. CAP finds these scams are most frequent during times of open enrollment. The scammers will state they need your Medicare/Medicaid card number or Social Security number to keep your coverage active and verify medical information. The calls may also claim that coverage is expiring or in need of renewal. Scammers will also ask if you received a “new Medicare card”, often referred to as a “gold card” or “red, white, and blue card”. They may claim to be offering sought-after medical supplies or test kits in exchange for your ID.

What to Know: Never provide your Medicare number or other personal information and payment to unknown callers. In general, Medicare cards do not expire. Medicaid, on the other hand, provides coverage for a year with the option to renew yearly. This is done through Vermont Health Connect or Department of Vermont Health Access through the Agency of Human Services. Unless you have called Medicare using the 800 number on the back of your card and requested a callback, Medicare will not call you. If a phone call is required, you would receive a letter from Medicare to schedule a call. Medicare representatives will never call you to verify your information, sell you products, tell you that your coverage is expiring, or to issue you a new card. In Vermont, representatives of the State Health Insurance Assistance Program (SHIP) at 1-800-642-5119 through local Area Agencies on Aging can help address Medicare questions. Other questions and concerns about Medicare coverage can be directed to Medicare at 1-800-MEDICARE.

IRS Impersonator

Identify It: The scammers will call claiming that they are from the IRS and that you owe them for back taxes. Sometimes the call will begin with a robocall asking you to press a number or to confirm your personal information. They will ask you to pay immediately, and the caller might threaten you to say that the local police will arrest you, legal action will be taken, or your tax documentation will be suspended if you don’t pay. They could even provide some legitimate information like your Social Security number to make you believe that they are related to the IRS, but they are using this call to gain money and more information from you. The scammer usually requests the payment in a specific way, such as wire transfers, access to bank accounts, gift cards, mailed cash, or cryptocurrency.

What to Know: If the IRS contacts you, it would be by mail, not by phone unless you requested a callback. They may call you only after sending you two letters by mail. The IRS will never ask you to pay debts by phone, nor demand a particular payment method. Lastly, legitimate IRS employees will never threaten you. If you didn’t receive written notification about a tax issue and receive a call claiming to be from the IRS, don’t engage. Do not press any numbers, give personal information, or provide funds. This could lead to more scam calls. In this situation, the better thing to do is hang up the phone.

Legal Authority (Police/Sheriff/Litigant/Immigration)

Identify it: The scammer will pose as a police officer, an attorney, or any person with legal authority. They will mention pending lawsuits or government debts involving you and will threaten arrest or legal action. The solution provided by the scammer is to send money, and your problem will disappear. But they will call again, saying that something went wrong, often requesting more money. Variations of this scam can involve immigration issues and the scammer using your legal status in the U.S. to threaten you with deportation and visa revocation.

What to Know: Law enforcement agents, like police officers, sheriffs, or other government employees, will not warn you ahead of time about pending warrants. If you were going to be sued, the papers would be served without notice. The government will never call and threaten you. The best thing to do is hang up the phone and call the legitimate agency’s phone number to check about possible lawsuits, immigration status, and debts. If you are concerned about your immigration application, petition, or status, contact the United States Citizenship and Immigration Services directly.

More Government Impersonation Scams

United States Postal Service (USPS)

Identify It: You may receive a call, email, or most commonly a text from a number you do not recognize, with a “tracking link” for a package or a notice a package was unable to be delivered by USPS. Scammers may also claim to be from U.S. Customs and Border Protection (CBP) regarding a package containing illicit items. In the communication, there may be a number to call or a link to view the tracking information. Once connected with the scammers, you are prompted to pay a fine to avoid arrest or legal action. You may also be prompted to provide additional personal information about yourself to ensure the package can be delivered. In terms of employment opportunities at USPS, please be aware of where the job is being posted and what the scammers are asking for. Offers are created to be enticing by alleging outlandish benefits, guaranteed jobs, or claim they will hire you on the spot.

What to Know: If you are not opted in for text communications from USPS or receive a text from a number not associated with USPS, this is a scam. Additionally, if you were not planning on receiving a package, chances are it is not legitimate. If you receive a package that you did not order, mark it “return to sender” and bring the package to your local mail carrier. If you are questioning if the claimed delivery is real, call your local USPS office to confirm if a package exists. If you are given a tracking number, you can check the legitimacy by using USPS’s Tracking page. U.S. Customs and Boarder Protection posted a press release a few months ago, warning consumers about this scam as well.

Government Funds (grants and unclaimed funds)

Identify It: These types of imposter scams focus on a variation of “free money” scams while pretending to be calling from a government agency. CAP receives the occasional notice about a scam call that claims to be from the State Treasurer, claiming there is “Unclaimed Property” for the individual to claim. Unclaimed Property is any lost or abandoned money that someone has not claimed, usually from past business dealings such as refunds and rebates, an overpayment on an account, or funds that were unclaimed in a financial account that was closed. In order to release those funds, the scammer will ask a fee to be paid, generally claiming the money is for tax purposes or interest on the funds. CAP has also received reports regarding the “Community Development Block Grant” or other government grants, where individuals have received texts and social media messages from fake profiles pretending to be a government employee. You are prompted to provide personal information and told you must pay a fee to receive your grant money.

What to Know: You would never have to pay money to claim your “Unclaimed Property” through the Office of the State Treasurer. You do not have to pay a fee to claim your Unclaimed Property. You may file for your Unclaimed Property online or by mail with the Office of the State Treasurer. To find out more about unclaimed property, go to USA.gov. The government does not contact you about available grants, you contact them. Legitimate grants require an application and are to be used for specific purposes. In addition, if you did apply for a grant, you do not need to pay money to receive the grant. You may find available federal grants at grants.gov.

How to Navigate Government Impersonation Scams:

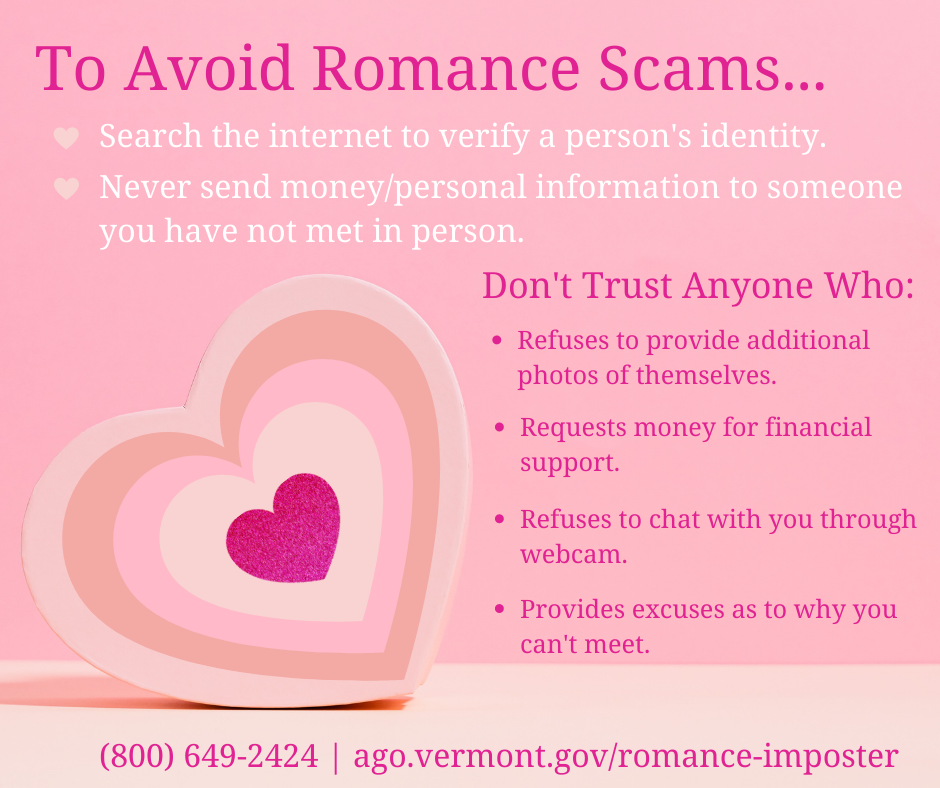

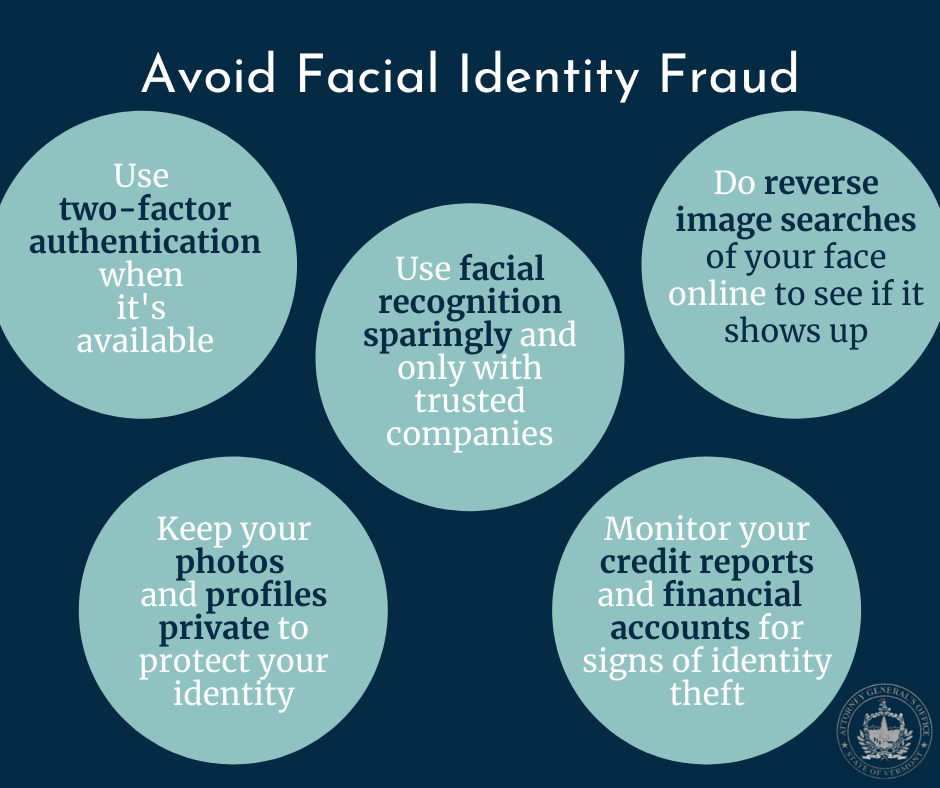

If you suspect that you are being targeted by a scam, the best thing you can do is not respond. If you receive a scam call, SLAM the SCAM by hanging up! Do not call back the number. If you get an email, text message, or social media direct message, do not engage and mark the correspondence as “Junk/Spam” or delete the message. NEVER give out any personal information, money, or allow access to your devices to someone claiming to be from the government. If you are worried the claims may be true, contact the department directly using a trusted number. If you cannot find one, call CAP to inquire about legitimate contact information. Report scam encounters to CAP. Please see below for information on how to report scams to our office.

Do not trust caller ID. Instead, vet your calls by listening to your voicemail messages. Scammers are known to “spoof” legitimate phone numbers and names of government agencies, using fake identification of government and law enforcement agencies. These scammers can use aggressive tones or create a sense of urgency to provide the information or funds they are requesting. Often, the scammers will say not to tell anyone you spoke with them and to keep your conversation a secret. Do not isolate. Tell a trusted friend, family member, or member of your community to help you navigate this situation. CAP cares and is here to talk with you about the scam call you received.

For more information about government imposter scams, please check out the FTC’s article on How to Avoid a Government Impersonator Scam.

Reporting Scams to CAP

To report scams, please visit our scam reporting form: https://ago.vermont.gov/cap/stopping-scams/. If you have difficulty accessing the form, call our office at 800-649-2424 to report the scam over the phone.

Learn more about imposter scams on our imposter scam prevention video and resource page: ago.vermont.gov/imposter-scam