By Crystal Baldwin

The Consumer Assistance Program’s (CAP) top consumer complaints of 2021 ranks health/medical concerns fourth among the primary problems reported by Vermont consumers, with issues including billing and charge disputes. While the Consumer Assistance Program provides informal mediation on medical billing disputes involving providers, there are several resources available to consumers to resolve medical billing disputes, particularly if a regulated business, such as an insurance provider is involved. In the medical billing realm, consumers have earned more protections just this January through the Federal No Surprises Act, aka the “No Surprises Act” or the “No Surprise Billing Act.”

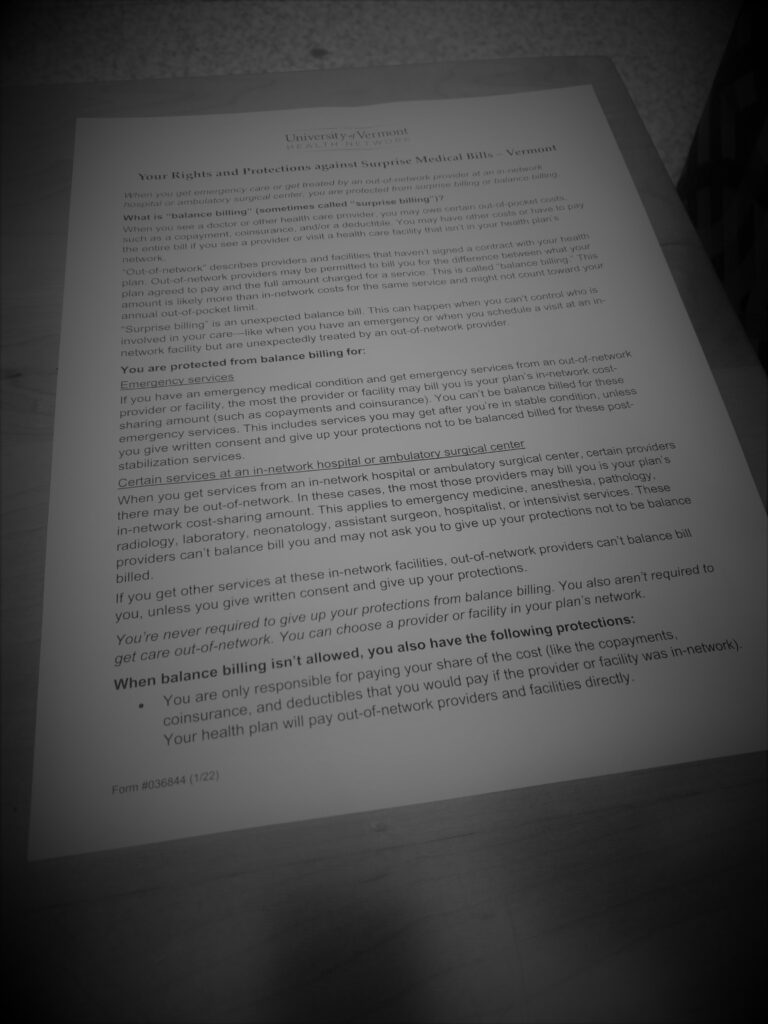

The No Surprises Act prevents surprise medical bills and has changed how unanticipated out-of-network bills can be assessed. The intention of the act is to remove the surprise that accompanies receiving large unanticipated bills after receiving health care services. There is a lot to know and there are already a number of resources to help you understand the act and your rights more thoroughly, including information on Centers for Medicare & Medicaid Services and the U.S. Department of Health & Human Services websites.

The No Surprises Act gives some medical billing control back to the consumer.

Key information you should know about this new law:

Who does it cover?

People covered under group and individual health plans.

What does the law provide?

Protection from receiving surprise medical bills for most:

- Emergency services

- Non-emergency services from out-of-network providers at in-network facilities

- Services from out-of-network air ambulance service providers

It…

- Bans surprise billing in private insurance for most emergency care and some instances of non-emergency care.

- Requires that uninsured and self-pay patients receive key information, including overviews of anticipated costs and details about their rights.

- Bans surprise bills for emergency care and requires that cost-sharing for these services–like co-pays—always be based on in-network rates, even when care is received without prior authorization.

- Bans surprise bills from certain out-of-network providers if you go to an in-network hospital for a procedure; cost sharing for certain additional services during your visit will generally be based on in-network rates.

- Requires providers and facilities to share with patients easy-to understand notices that explain the applicable billing protections and who patients should contact if they have concerns that a provider or facility has violated the new surprise billing protections.

- Requires most providers to give a “good faith estimate” of costs before providing non-emergency care for people who do not have health insurance or pay for care on their own.

- Protects against “Balance Billing” abuse. Balance billing is when a provider bills for the difference between the provider’s charge and the allowed amount.

- Prohibits a preferred provider from balance billing.

- Prevents air ambulance services from imposing cost-sharing greater than the in-network cost.

When might the law not apply?

While there are many protections in place, a patient may agree to balance billing for certain non-emergency situations, however this must be disclosed in writing and utilize a specific “Surprise Billing Protection Form.” By signing the form, patients agree to give up their federal consumer protections, agreeing to pay more for out-of-network care.

This notice and consent waiver for balance billing is NOT permitted for:

- Emergency services

- Unforeseen urgent medical needs arising when non-emergent care is furnished

- Items/care related to emergency services

- Diagnostic services including radiology and lab services

- Out-of-network provider services when in-network providers cannot provide necessary such service

Surprise bills may continue to be issued by the following facilities:

- Birthing centers

- Clinics

- Hospice

- Addiction treatment facilities

- Nursing homes

- Urgent care centers (by circumstance)

What if you receive a surprise bill?

There is an independent dispute resolution process for payment disputes between plans and providers as well as new dispute resolution opportunities for uninsured and self-pay individuals.

For remaining questions about the law, visit: cms.gov/nosurprises

What about medical billing disputes not covered under the law?

For those bills that still are not covered, there are some important resources still available to consumers:

| Dispute Resolution Resource | Issue |

| Centers for Medicare & Medicaid Services | Medicare billing disputes |

| ERISA | Private-sector/work place health benefit insurance plan disputes |

| Insurance Division of the Vermont Department of Financial Regulation | Health insurance billing dispute |

| Patient Financial Assistance Program of the provider, such as the program available at UVMMC | Challenges paying valid medical bills |

| State Health Insurance Program (SHIP): | Help understanding health insurance, including Medicare and Medicaid |

| Vermont Health Care Advocate (HCA) HelpLine: 1-800-917-7787 | Assistance obtaining free and lower-cost health coverage. Advice and support in solving medical billing problems, including Medicaid. Assistance deciphering health plan coverage. |

As described in CAP’s blog a few years back, Navigating Health Care Can Be Tough, click the blog for even more helpful resources. Contact CAP for assistance resolving provider billing disputes.