By Crystal Baldwin

Recently, three Vermonters reported losing just under $1 million in total to cryptocurrency scams. Entire retirement accounts were drained, and because of early withdrawal penalties, thousands of dollars are due to the IRS. Some owe family members for funds borrowed on the chance that cryptocurrency would substantially increase their investment.

As a peer-to-peer spending source, every type of scam could at any point use cryptocurrency as the preferred form of payment, over gift cards, wire transfers, and cash, for example. According to the Federal Trade Commission, cryptocurrency scams have been increasing since 2017 and “skyrocketed” at the end of 2020 (ftc.gov).

So, what is cryptocurrency?

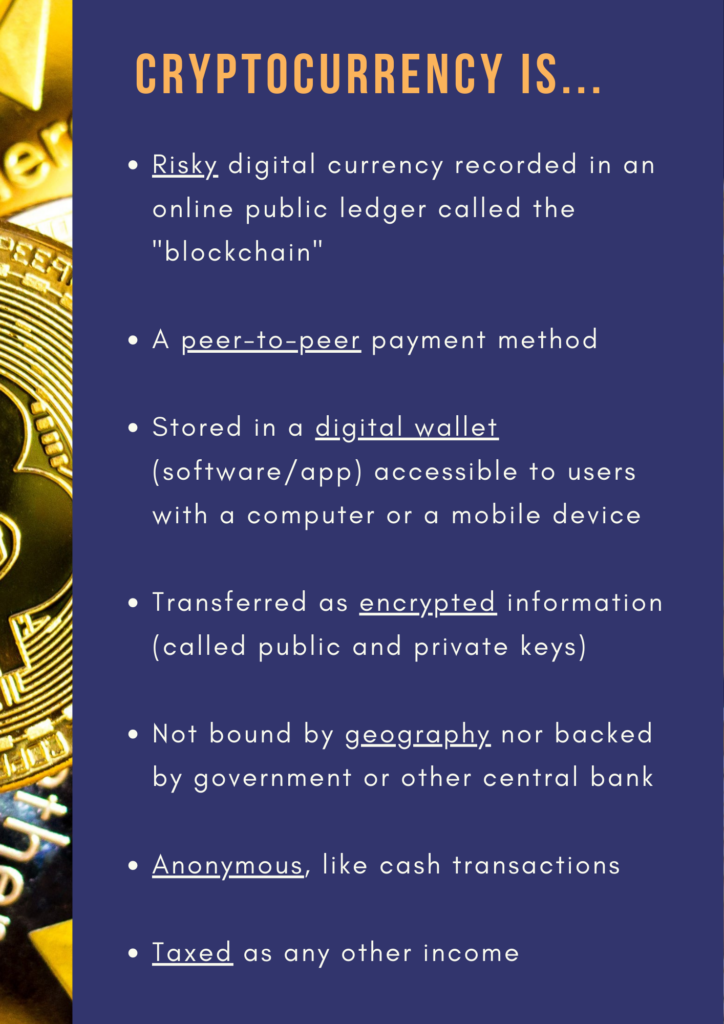

In very basic terms, it’s virtual money that uses its own currency, or monetary system. When we usually think of currency, it’s affiliated with a specific country, has an exchange rate and is produced as banknotes and coins known as fiat currency. The money in a U.S. bank account will note an amount in U.S. dollars, for example. Cryptocurrency is usually unaffiliated with a particular country, maintaining its own exchange rate. As such, cryptocurrency is not backed by any government or other central bank (ncsl.org) like we are used to with US banks which are FDIC insured—insurance that protects your money from bank failure.

How is cryptocurrency used?

To spend using cryptocurrency, a user needs a digital wallet accessible through software or an app and some funds to deposit to convert into cryptocurrency, such as Bitcoin. There are many different cryptocurrencies, affiliated applications/websites. Not all cryptocurrencies are the same and, unfortunately, some are entirely fake.

When transferring, your funds are assigned a unique password that is required to move funds. As such, the transfer of funds happens instantly, with little federal oversight or regulation, making cryptocurrency the currency of choice for fraudsters.

Cryptocurrency is the preferred payment method of scammers.

Any type of scam can manifest with crypto being the scammer’s preferred mode of transfer. Scammers like cryptocurrency, because, unlike with traditional bank transfers and transfers done by a money transmitter (like Western Union and Money Gram), there is no third-party banking institution involved in the transfer. The transfer itself is peer-to-peer and performed with a unique encryption code (in simple terms, think of the best password you have ever set eyes on). This means, if you have money in bitcoin and the receiving party receives your encryption code, now the receiving party has your money. All cryptocurrency transactions that are completed on the blockchain are irreversible and funds cannot be recovered.

The exchange of funds happens instantaneously, virtually and globally, making the jurisdiction of the monetary exchange difficult to determine. Even if the receiver says they are in the U.S., you will not be able to verify this claim.

Is Cryptocurrency an investment or a scam—an investment scam, or something else?

According to the Securities and Exchange Commission (SEC), cryptocurrency is a “highly speculative investment” and the “Bitcoin futures market should be pursued only by mutual funds with appropriate strategies that support this type of investment” (sec.gov). A speculative investment is one with a high degree of risk with hopeful long term gains.

There are a number of fake and a number of honestly operating cryptocurrency investment firms. There remains little regulation in the field. The SEC indicates, “While these digital assets and the technology behind them may present a new and efficient means for carrying out financial transactions, they also bring increased risk of fraud and manipulation because the markets for these assets are less regulated than traditional capital markets” (sec.gov). The Financial Industry Regulatory Authority (FINRA) echoes that “The markets for cryptocurrencies remain highly volatile and risky.” To learn more about cryptocurrency markets and products, review the helpful resources on the FINRA website.

More to consider:

As an entirely digital currency, all access points are digital. Individual accounts can be hacked and cryptocurrencies themselves are not foolproof. When a cryptocurrency’s system is breached, millions of dollars are lost, as demonstrated in breaches; Bithumb lost $30 million, Coinrail lost $37.2 million, BitGrail lost $195 million, and Coincheck lost $534 million (investopedia.com).

A person that opts to use cryptocurrency must ensure their account is protected and secure against the most determined hacker. Even still, there are ways that scammers can obtain direct access to your digital accounts. Through a convincing tech support scam, they claim there is a problem with your account that must be solved, and you sign them in, allowing them access to everything. Another easy route is with a simple click of the mouse, the computer can be infected with viruses, opening the virtual door for your computer and accounts on it to be susceptible to scams.

Without proper security, ensuring your systems will not be breached, one simple hack can risk your entire cryptocurrency account. With this in mind, digital currency may not be the right choice for someone who sets easy passwords, performs few antivirus checks, or is a carefree web user.

Report Scams:

If you or someone you know have encountered a scam in Vermont, report it. Use CAP’s online scam reporting form.

Help us stop these scams by sharing this information with those you care about.

References: Finra.org, sec.gov, investopedia.com, ncsl.org, investor.gov. fdic.gov, ftc.gov