By Crystal Baldwin

Love fills us with joy, lifts us up, and makes us feel alive. As determined by a recent Stanford University study, for many, love is found online.

Technological advances and the move of our social lives and networks to online platforms has shifted the dating world to unchartered territory–online dating websites (Match, Zoosk, OurTime, Plenty of Fish, OKCupid, eHarmony), dating apps (Bumble, Tinder, Hinge), gaming platforms (Words With Friends, Sociable, Yahtzee with Buddies) and unassuming networks (Facebook, Instagram). As if the dating world were not challenging enough to navigate. Now, those looking for love must also learn how to create a true connection through tech, while avoiding scammers.

New data from the Federal Trade Commission show that more consumers than ever report falling prey to romance scammers.

Federal Trade Commission

Consumers reported losing $547 million in 2021 alone.

Reported losses to romance scammers were up nearly 80 percent compared to 2020.

At the end of last year, our office released a video and toolkit alerting Vermonters about imposter romance scams that can take place on dating platforms. Before looking for love online, check out the video and tools we created to help you to identify unscrupulous love interests and relationships of confidence.

- Watch the videos and read an open letter about a Vermonter’s engagement in a romance scam: Introducing: Romance Scam Prevention Videos

- Learn how romance scams materialize online: Stay Safe Online This Valentine’s Day

- Identifying a potential match from a mooch: Match or Mooch? Preventing Romance Scams

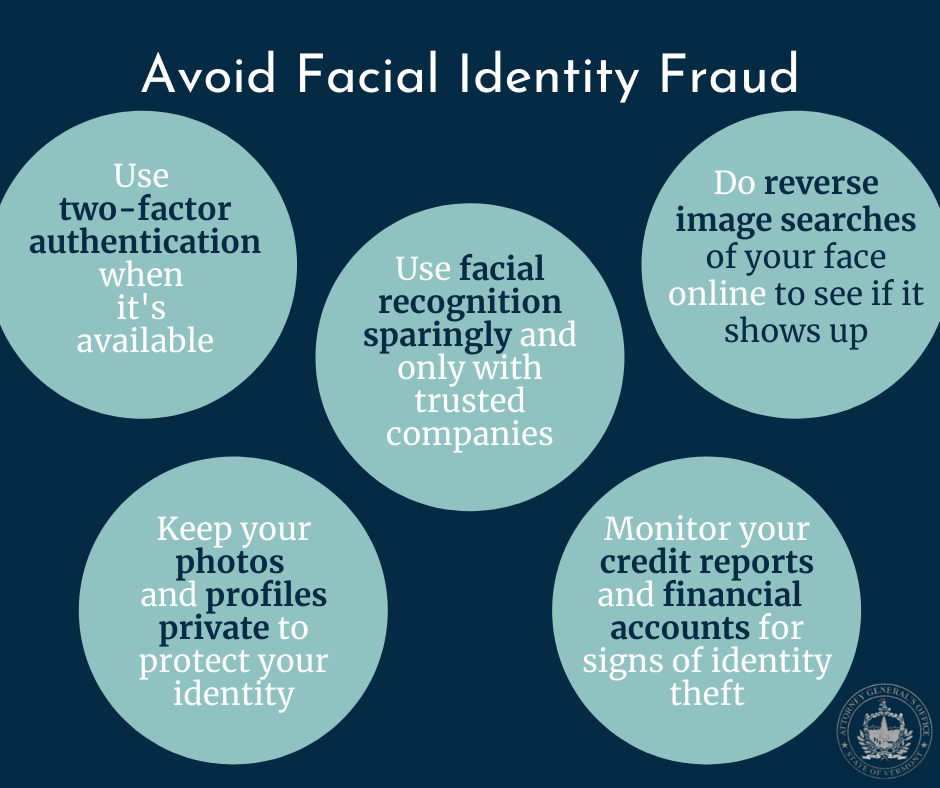

You can find love online and avoid scams. Print out our helpful verification flyer and reference it often.

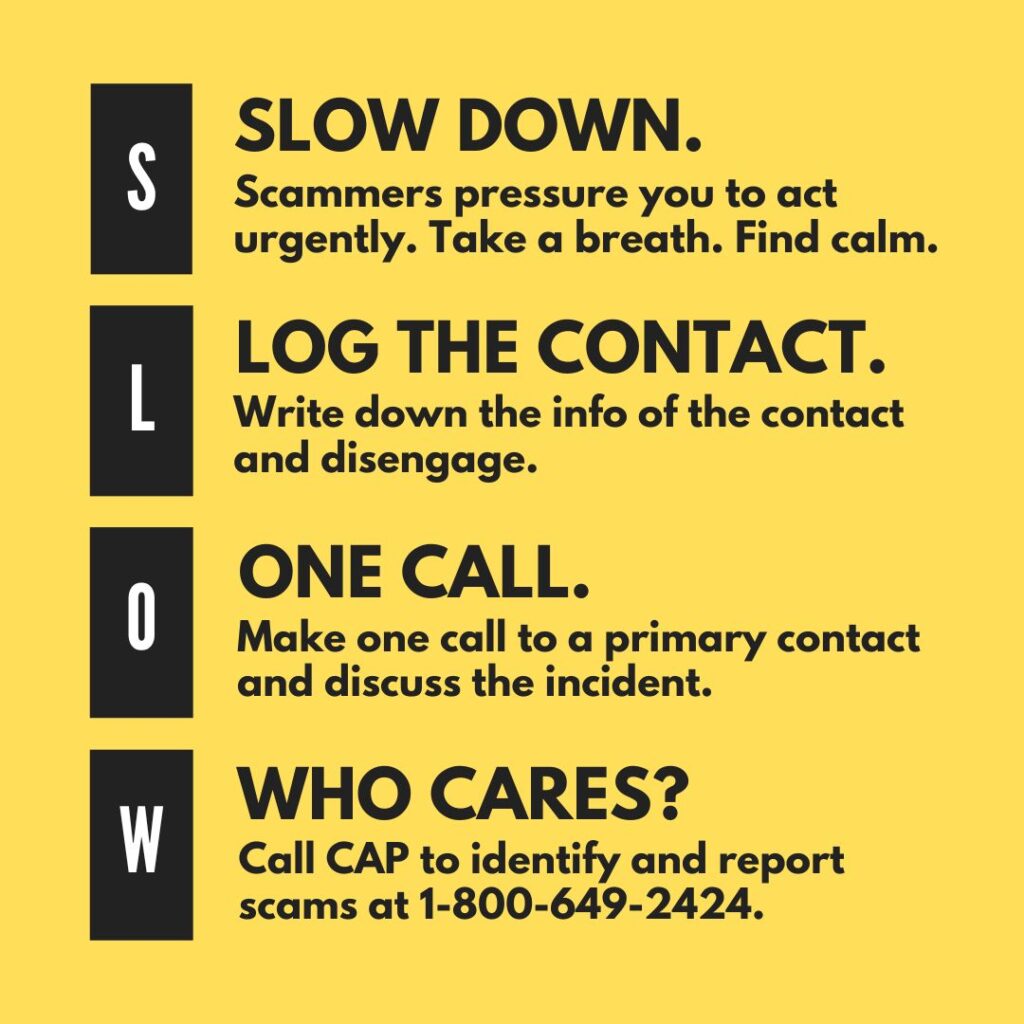

If you or someone you know has encountered a scam in Vermont, report it. Use CAP’s online scam reporting form and visit the our scam recovery webpage.

Help us stop these scams by sharing this information with those you care about.

Resources: FTC.gov, news.stanford.edu