Credit can be a confusing concept. CAP wants to make it simple for you! This post is a guide to credit, credit bureaus, credit reports and more.

What is credit?

Your “credit” refers to your ability to borrow money and how much you can borrow. Your “credit score” is determined by your credit history, and suggests how likely you are to repay your loans.

What is a credit bureau?

As noted in our September 2017 blog post, credit bureaus receive regular reports about your credit history from banks, financial institutions, landlords, utilities, and even employers. The credit bureaus then put all of this information about your use of credit together into a single file — your “credit report.”

What is a credit report?

A credit report provides you with a detailed overview of your credit history prepared by the credit bureau. A credit report includes sensitive information, such as your Social Security number and history of employment. It will also indicate whether or not your accounts are in good standing and when they were opened.

How can I get my free credit report?

The Fair Credit Reporting Act (FCRA) requires each of the nationwide credit reporting companies — Equifax, Experian, and TransUnion — to provide consumers with a free copy of their credit report once every 12 months.

To access your free credit report, you can…

- Visit annualcreditreport.com or call 1-877-322-8228.

- Complete the Annual Credit Report Request Form and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

- Contact the three nationwide credit reporting companies individually:

Equifax: 1-800-685-1111 equifax.com

Experian: 1-888-397-3742 experian.com

TransUnion: 1-888-909-8872 transunion.com

Did you notice something suspicious on your credit report?

Under the Fair Credit Reporting Act, both the credit reporting company and the information provider are responsible for correcting inaccurate or incomplete information in your report.

To dispute an error on your credit report, follow these steps provided by the Consumer Financial Protection Bureau.

What is a credit freeze?

This free tool lets you restrict access to your credit report, which makes it more difficult for identity thieves to open new accounts in your name. A credit freeze does not affect your credit score, it just protects your credit. Under a freeze, you can still access your free annual credit report, and it does not affect your ability to apply for a job, rent an apartment, or buy insurance. However, if you are opening a new account, you will need to lift the freeze temporarily. Lifting the freeze is free.

Want to learn more about credit freezes? Check out this helpful FAQ page produced by the Federal Trade Commission.

What is a credit fraud alert?

A credit fraud alert is a free tool that makes it more difficult for identity theft and/or fraud to occur. According to the FTC, when you have a fraud alert in place, a business must verify your identity before it issues credit. Once you place the alert, it will be active for one year.

To place a credit fraud alert, contact one credit bureau and ask to place the alert. That credit bureau will then contact the other two bureaus.

Are you suspicious that identity theft has occurred?

If you see items on your credit report that might signal fraud, you can file an identity theft report with the Federal Trade Commission. Reporting identity theft to your local police is another important step in this process.

Signs of fraud on a credit report may include unfamiliar accounts and charges. The FTC provides a helpful list of other identity theft warning signs, including:

- Inexplicable withdrawals from your bank account

- Merchants refuse your checks

- The IRS warns you that more than one tax return was filed in your name

- You receive an official notice concerning a data breach that may have affected you

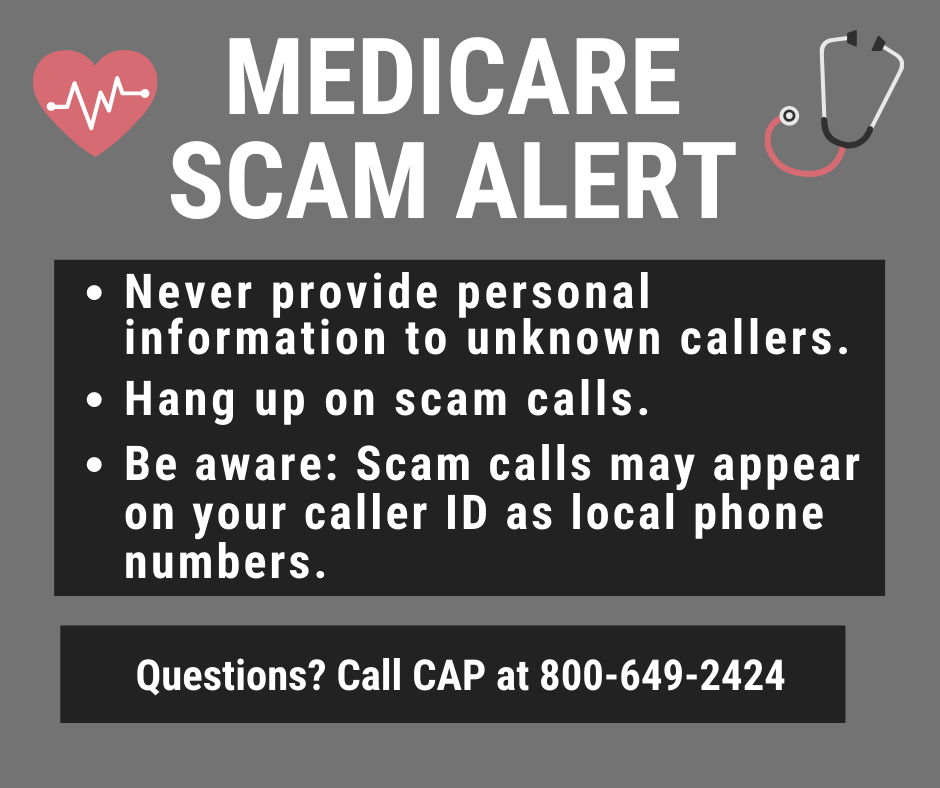

Questions about checking your credit and/or identity theft? Call the Consumer Assistance Program! (800) 649-2424

Contributing Writer: Madison Braz

Content Editor: Crystal Baldwin