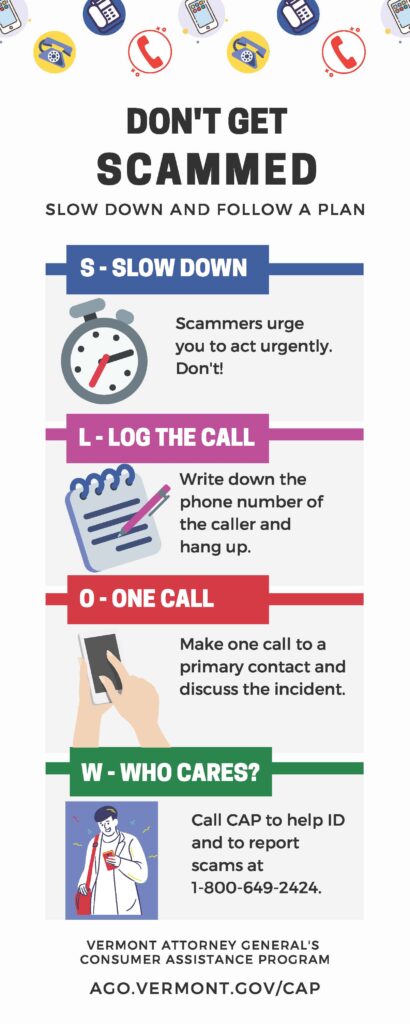

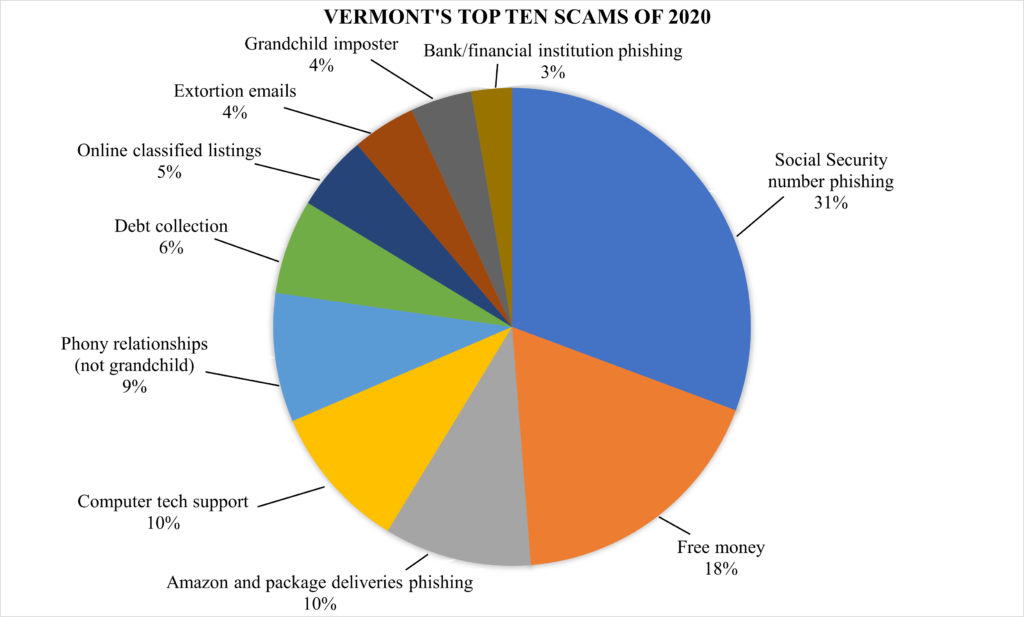

Vermonters filed 5,021 scam reports with the Attorney General’s Consumer Assistance Program (CAP) in 2020. The Social Security number phishing scam, which typically involves calls claiming that your Social Security number has been compromised, suspended, or linked to criminal activity, remained the most commonly scam for the second year in a row with 1,160 reports filed. Claiming the number two spot on the list of top ten scams in 2020 were “free money” scams. Six-hundred-eighty-three Vermonters reported receiving “free money” scam calls where they were told that they had won a prize or money and needed to pay fees or taxes upfront to collect. With scam attempts remaining high, Attorney General T.J. Donovan urges Vermonters to Take it Slow: scammers will pressure you to act fast, demanding personal information and payment, while threatening extreme consequences if you do not comply. Don’t let them pressure you!

“If you get a suspicious call, remember to slow down, hang up the phone, and take notes on the interaction,” warned Attorney General Donovan. “If you still need help identifying if something is a scam, call us at CAP at 800-649-2424.”

Unfortunately, many scam encounters result in monetary loss in Vermont. In 2020, 249 Vermonters lost approximately $1.5 million, in total, to scammers. The most common scams associated with monetary loss were imposter scams (scammers posing as friends, family members, or romantic interests) and online classified listing scams (scams perpetrated on sites such as Craigslist or Facebook Marketplace). Scammers ask their victims to send money using a variety of methods, including gift card transactions, peer-to-peer payments apps like Venmo or CashApp, wire transfers, and cash or checks in the mail.

Vermonters can report a scam or sign up for the Scam Alert system by going to ago.vermont.gov/cap or by calling the Consumer Assistance Program at 1-800-649-2424.

The top 10 scams of 2020 are:

- Social Security number phishing

- Free money

- Amazon and package deliveries phishing

- Computer tech support

- Phony relationships (not grandchild)

- Debt collection

- Online classified listings

- Extortion emails

- Grandchild imposter

- Bank/financial institution phishing

The scam: You receive a phone call (usually a robocall) stating that there has been criminal or fraudulent activity involving your Social Security number. The scammer may also claim to be a government agency or law enforcement, threatening arrest or serious consequences. The scam often begins as a robocall.

How to spot the scam: If Social Security (or any official agency) wanted to contact you, they would not call to ask for your personal information, especially your Social Security number, over the phone. These agencies mail communications and would never threaten you for information or payment over the phone.

What to do: Be wary when responding to unsolicited contacts and never provide personal information to unknown contactors, especially over the phone.

The scam: You receive a phone call, email, or mailing that claims you have won money or a prize—but there’s a catch: you have to pay money up front for taxes or fees. Sometimes the outreach includes a realistic-looking fake check. The check bounces and no “winnings” are ever dispersed. Often, they claim to be Publishers Clearing House. Scammers may also claim to offer government grants or stimulus money, getting touch via social media.

How to spot the scam: If you actually win a major prize from Publishers Clearing House, they will contact you in person. For smaller prizes (less than $10,000), winners are notified by overnight delivery services (FedEx, UPS), certified mail, or email in the case on online giveaways. They never make phone calls. An unsolicited check in the mail from an unknown sender is usually a scam.

What to do: If it sounds too good be true, then it’s not true. Never pay an upfront fee to receive winnings or a grant. If you win something, they will pay you – not the other way around. No actual contest or sweepstakes would you make you pay first to receive money.

- Amazon and package deliveries phishing

The scam: An automated phone call or email claiming that your credit card has been charged by Amazon or that you have an outstanding balance on your account. The scammer instructs people to call them to get a refund or resolve the charge, at which point they request your card number and attempt to gain remote access to your computer. You might also receive a text message or email claiming that you have a package, but they need to verify your information.

How to spot the scam: Amazon will not call you unless you request that they do so. If you have legitimate concerns about your Amazon account, or other accounts, contact the company directly through a trusted contact, such as through the customer portal within your account.

What to do: Hang up the phone and do not call back. Furthermore, you should not allow remote access to your computer to unknown parties. If you are concerned about charges made to your credit card, contact your credit card company directly. If you receive a text regarding a package delivery, don’t click any links or reply.

The scam: A phone call or pop-up message on your computer claiming to be from Microsoft, Apple, or another well-known tech company. They will say there is a virus or other problem with your computer and try to persuade you to give them remote access to resolve the issue. They may also ask for immediate payment for their services.

How to spot the scam: Legitimate customer service information usually won’t display as a pop-up. Companies like Microsoft, Apple, and Google do not call you to notify you of malware on your computer.

What to do: Never provide remote access to your computer to a stranger or click links from an unknown sender in an e-mail or pop-up message. If you get a call from “tech support,” hang up. Also, be careful when searching for tech support numbers online. Some users have been scammed by calling illegitimate numbers for legitimate companies.

The scam: There is a wide variety of phony relationship scams. Sometimes, the scammer pretends to be someone you know, like a love interest, friend, relative, or even a religious leader. They typically reach out to you online or on the phone, claiming to need money.

How to spot the scam: They ask you to send money immediately, often in the form of wire transfers or gift cards. If you met the person online, but they refuse to video-chat or talk on the phone.

What to do: If they claim to be someone you know, call the person using a verified phone number. If you receive a suspicious email, be sure to double-check the email address. If you’re feeling suspicious, get the real story and talk to someone you trust. Cut off communication with the scammer. If you receive an email from a friend or coworker asking for money, do not send money. Be sure to call that person directly—it’s most likely a scam.

- Debt collection

The scam: Scammers pose as debt collectors or law enforcement and say legal action will be taken against you if you don’t pay them what you owe. Some may claim to be familiar businesses or the government, such as utility companies or the IRS.

How to spot the scam: If you did owe a debt, collectors are not allowed to threaten you with arrest over the phone. You can request verification of the debt, which has to be sent to you in writing. If you ask them to stop calling you, they are generally required to stop.

What to do: Hang up the phone, and if they call again, let the call go to voicemail. If you think you do actually owe money to a debt collector or other agency, make sure you call using a trusted number.

The scam: Sometimes the scammer responds to a seller’s post, overpays with a check, and asks for the remainder to be wired back. Sometimes the post is for a fictitious rental property and the scammer is looking for the deposit and first month’s rent to be sent immediately. Scams even happen when you are looking for that perfect puppy or pet to expand your family, but the transport of the animal is supposedly held up at the airport or elsewhere.

How to spot the scam: If you feel suspicious, stop the sale or purchase. The scammer may ask you to wire them money, send a bank transfer, or pay using gift cards. They may not want to talk on the phone or meet in person. Remember, you should not provide a rental deposit before signing the lease or contract in-person.

What to do: Complete your transactions in cash and preferably in-person. If they refuse to meet in-person or talk on the phone, ignore them and end communication.

The scam: You receive an email that threatens exposure of compromising home video and pictures, unless you pay, usually in Bitcoin. The email claims you have been hacked and may reference a current or former password you may have used. The sender claims that they have access to your computer and webcam and threatens to release embarrassing photos and video unless you send them money.

How to spot the scam: The scammer is using scare tactics to make you act fast. Don’t take the bait! The email message will often include threats and hurtful language.

What to do: Do not reply to the email or click on any links or attachments included on the message. Do not send money. If you find that your current password is listed in the email, change your passwords from another computer and run virus scans. Delete the email or add it to your spam/junk folder.

The scam: Scammers pose as grandchildren and claim to be in serious trouble, such as in prison or at the hospital. They urgently request money in the form of wired funds or prepaid gift cards. They may also claim that their voice sounds unfamiliar due to injury. After the initial call, they may claim you will be hearing from an attorney or officer.

How to spot the scam: Call your grandchild or family members on known phone numbers to ensure your grandchild is safe.

What to do: Never wire or otherwise send funds unless you can verify the emergency. Take it slow and contact someone you trust.

- Bank/financial institution phishing

The scam: You receive an email or phone call claiming to be from a bank. Emails might claim that your account is in danger or has been suspended, or that your card is on hold due to suspicion activity. The email also includes links to phony websites. Phone calls may claim that there has been fraudulent activity involving your account, and the scammers demand personal information about you and your account.

How to spot the scam: Scammers mask their actual identity by changing the sender name to the name of the financial institution. Look at the email address before opening the email. You will often find an account not affiliated with your bank. Similarly, scammers can spoof phone numbers of financial institutions. If you answer a call that appears to be from your bank and they ask for your personal and/or account information, hang up and call your bank directly on a number you trust to verify their attempt to contact you.

What to do: Do not reply to the email or click on any links or attachments included on the message. If you receive a call, hang up the phone. To correspond directly with your bank or financial institution, use verified contact information, such as information listed on your statement.

Contributing Writer: Madison Braz

Content Editor: Crystal Baldwin