By Cristina Leiva

A National Consumer Protection Week feature. “National Consumer Protection Week (NCPW) is a time to help people understand their consumer rights and avoid frauds and scams” (FTC).

Improving your home can be an overwhelming process to complete on your own. Turning to a contractor can help relieve the stress, but homeowners should be aware of the existence of home improvement fraud.

Home improvement fraud happens when a contractor promises to improve your home, but leaves the project incomplete or your home in an uninhabitable condition.

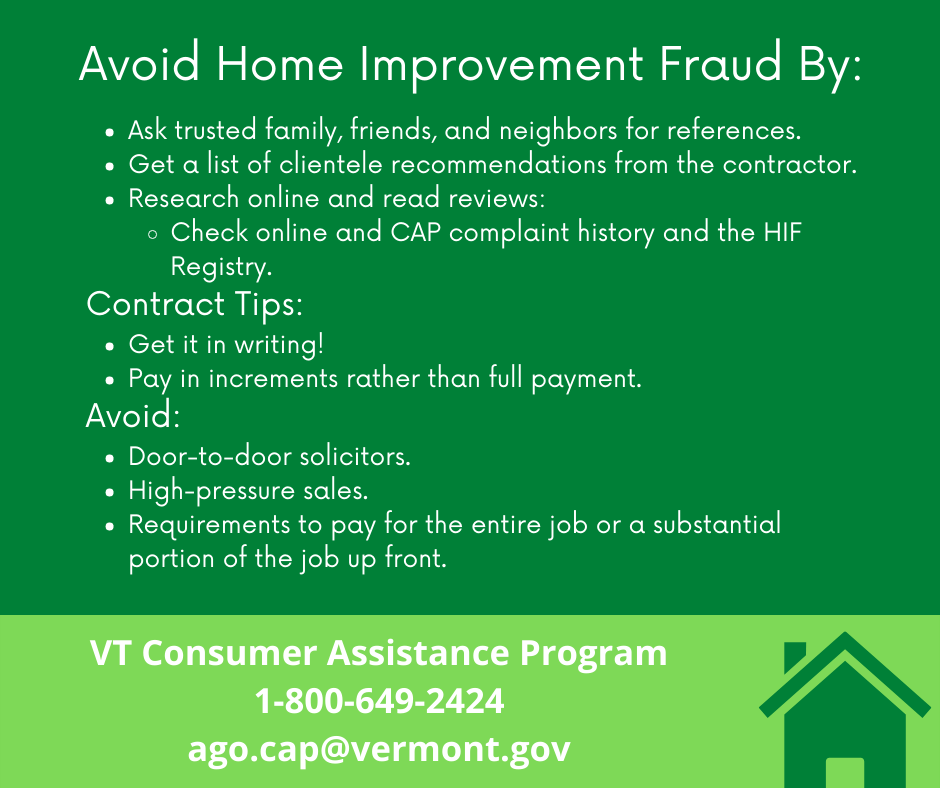

Before hiring a contractor for a home improvement project, do your research:

- Start by reviewing the Vermont Attorney General’s Home Improvement Fraud Registry where you’ll find the names of individuals who have been criminally convicted of committing home improvement fraud in Vermont.

- Check the Secretary of State’s website to verify that the residential contractor is registered, as required by Vermont law.

- Review complaint history posted on websites like BBB.org.

- Contact the Consumer Assistance Program (CAP) and ask if any complaints have been filed against the contract you are considering.

- Ask your friends, neighbors, family, and co-workers about their home improvement experiences. These individuals are more than just connections; they are resources that can provide contractor references and warnings.

Tips for avoiding home improvement fraud:

- Ask the contractor for references. Then, call the references and ask detailed questions about the work done, satisfaction, price, the time it took to complete, and how they found the contractor.

- Find your contractor through trusted family or friends or trusted websites.

- Pay in increments rather than a large sum/total payment upfront.

- Once you’ve chosen who you want to hire, determine the exact timeframe and the estimated price for the job. Compare this price to makeups for similar projects (get at least three estimates).

- Get all agreements in a written contract. Verbal statements are difficult to prove.

- Keep your down payment to a minimum.

- If possible, make your payment upon completion of the work; or at least make payments as the equivalent portion of the work is completed. That way, if the contractor walks off the job, you haven’t lost any money.

- Don’t make the final payment until you are completely satisfied with the work.

- Always request proof of insurance.

Warning signs of less than reputable contractors:

- Door-to-door solicitations.

- Claims that the contractor was passing by and noticed a problem with your home.

- Discounts for finding other customers or to use your home as a demo model.

- Offers a good price for materials left over from a previous job.

- Only accept cash payments.

- Uses high-pressure sales tactics and demands a decision on the spot.

- Asks you to pay for the entire job or a substantial portion of the job up front.

- Suggests that you borrow money from a lender the contractor knows.

- Refuses to provide proof of insurance or legitimate contact info.

Before hiring a contractor, you should know that while Vermont law does not require all home improvement contracts to be in writing, you can request a written contract outlining the terms of the agreement. If there isn’t a written contract, the contractor may disclaim liability for complications, or dispute the agreed-upon terms. When considering a contract, it’s best to read each page and verify acceptance before you sign it. Fraudulent contractors could conceal important documents underneath the agreement that could have dire consequences, including the loss of your home.

If you have a problem with a home improvement project or want to research a contractor before hiring them, contact CAP for assistance by visiting ago.vermont.gov/cap or by calling 1-800-649-2424.

ADDENDUM: As of April 1, 2023, registration of certain residential contractors is required. Learn more about the requirements from the Office of Professional Regulation of the Vermont Secretary of State.

Residential Contractor FAQs: https://sos.vermont.gov/residential-contractors/residential-contractor-faqs/

Residential Contractor Statutes, Rules & Procedures: https://sos.vermont.gov/residential-contractors/statutes-rules-resources/