Which long-term care facility is right for you or your loved one? It can be difficult to navigate this decision, but the Vermont Attorney General’s Office hopes to provide some help.

Together with the Department of Disabilities, Aging and Independent Living (DAIL), we’ve released a new consumer guide called “Comparing Nursing Homes, Assisted Living Residences, and Residential Care Homes in Vermont.” The guide lays out the primary differences between nursing homes, assisted living residences, and residential care homes in Vermont, including:

- how facility-types are defined and who is eligible to be a resident;

- restrictions on the level of care the facility can provide;

- facility staffing requirements;

- allowable discharge practices; and,

- when the State may grant a facility a “variance”—or waiver—from governing rules.

Key Differences Between Long-Term Care Facilities

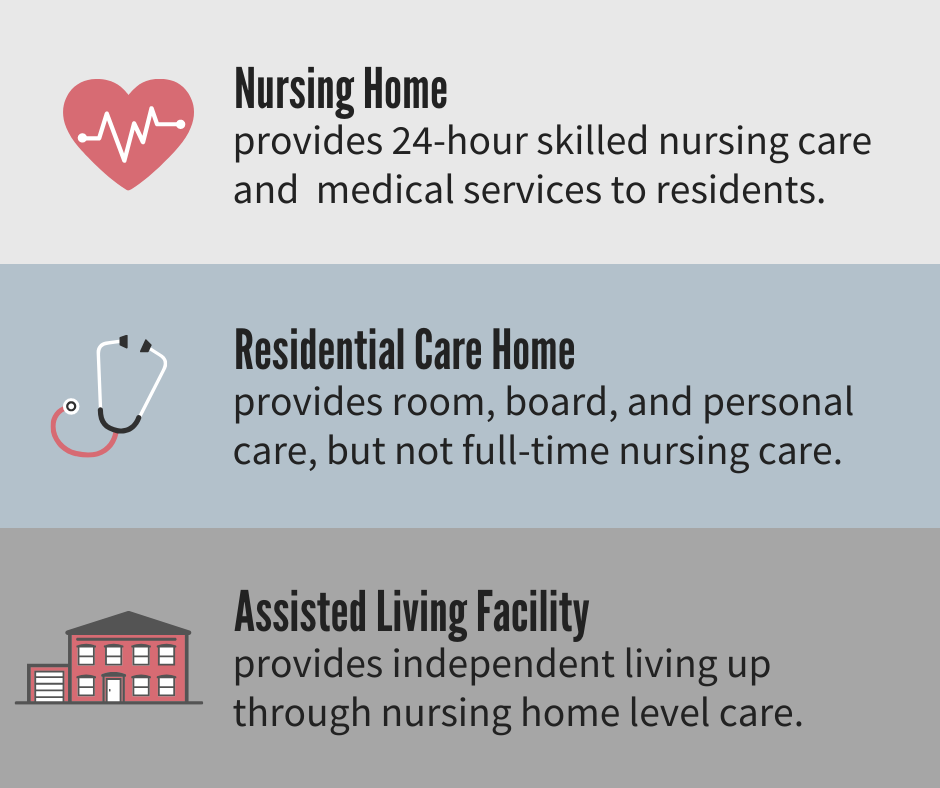

As explained in depth in the guide, there are three types of long-term care facilities in Vermont:

- Nursing Homes provide skilled nursing, rehabilitation services, and 24-hour health services.

- Assisted Living Residences combine home, health, and supportive services while promoting self-direction and resident independence.

- Residential Care Homes provide room, board, personal care, medication management, and some nursing “overview,” but are restricted in the level of care they can provide and generally do not provide full-time nursing care.

There are restrictions on who may become (and remain as) a resident at assisted living residences and residential care homes, but not nursing homes.

Need to report a concern?

This guide also provides contact information for reporting concerns about long-term care facilities.

| Adult Protective Services 1-800-564-1612 | To report abuse, neglect or exploitation of a resident in a long-term care facility. Also contact the police & the Attorney General’s Medicaid Fraud & Residential Abuse Unit. |

| Attorney General’s Medicaid Fraud & Residential Abuse Unit 1-802-828-5511 | To report (1) abuse, neglect or exploitation of a resident in a long-term care facility or (2) Medicaid fraud. |

| VT Long-Term Care Ombudsman 1-800-889-2047 | For assistance resolving complaints made by, or for, individuals receiving long-term care services. |

| Attorney General’s Consumer Assistance Program 1-800-649-2424 | To report misleading business practices by the facility. |

| DAIL Division of Licensing & Protection 1-888-700-5330 | To report long-term care rule violations, including residents harmed by facility practices. |

Need a copy of the complete guide?

The guide may be accessed online, or you may request a copy of the complete printed guide by mail by calling the Consumer Assistance Program at: 1-800-649-2424.

Contributing Writer: Madison Braz

Content Editor: Crystal Baldwin