From jobs and housing, to loans and utilities, taking control of your credit is more important than ever. And, with the looming threat of identity theft, knowing how to monitor your credit is essential to protecting yourself from fraud. For National Consumer Protection Week, here is some information on your credit and collection rights under Vermont law, as well as tips and resources for monitoring your credit.

Know Your Credit File

Knowing what is in your credit report is important, not only for getting a loan, but also for protecting yourself from fraud. Identity thieves can use your personal information to take out credit cards and loans they will never pay back, and ruin your credit. You can monitor your credit a number of ways. Some of them are free, some carry costs. It’s up to you to determine the best choice for you. Here are some options:

- Free annual credit reports – As a Vermont consumer, you are entitled to TWO free credit reports from EACH of the credit bureaus every year. You can get these online, or write to the credit bureau to request your report. If you have been denied credit, you are entitled to a free credit report as well.

- Credit monitoring services – These services are generally NOT free, unless offered as a result of a data breach. When choosing a service, look for features that work for you, and research user reviews and ratings.

- Credit cards and banks – Some credit cards and banks offer credit monitoring as part of their services for your account. Searching for a new card or bank? Ask them if they offer this service, and at what (if any) cost.

Collections? Know your rights!

You have the right to be treated fairly by debt collectors. Under federal or state law, generally a debt collector CANNOT:

- Threaten you with harm or legal action they cannot actually pursue

- Call you in a harassing manner, or after 9pm at night

- Call you at work if you have asked them not to

- Tell other people about your debt (other than a spouse)

You have other rights as well. If you have having difficulty with a debt collector, we can help! Contact us at 800-649-2424 or file a complaint online.

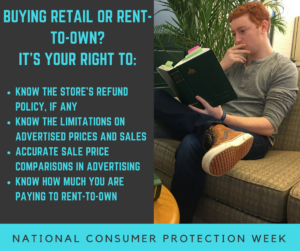

We all get them in our mailboxes and on our doorsteps – those colorful flyers advertising the “Biggest Sale Ever!” or the “Lowest Prices of the Year”. We may see signs for a big “Going out of business – Everything Must Go!” sale in the window of a local store.

We all get them in our mailboxes and on our doorsteps – those colorful flyers advertising the “Biggest Sale Ever!” or the “Lowest Prices of the Year”. We may see signs for a big “Going out of business – Everything Must Go!” sale in the window of a local store.