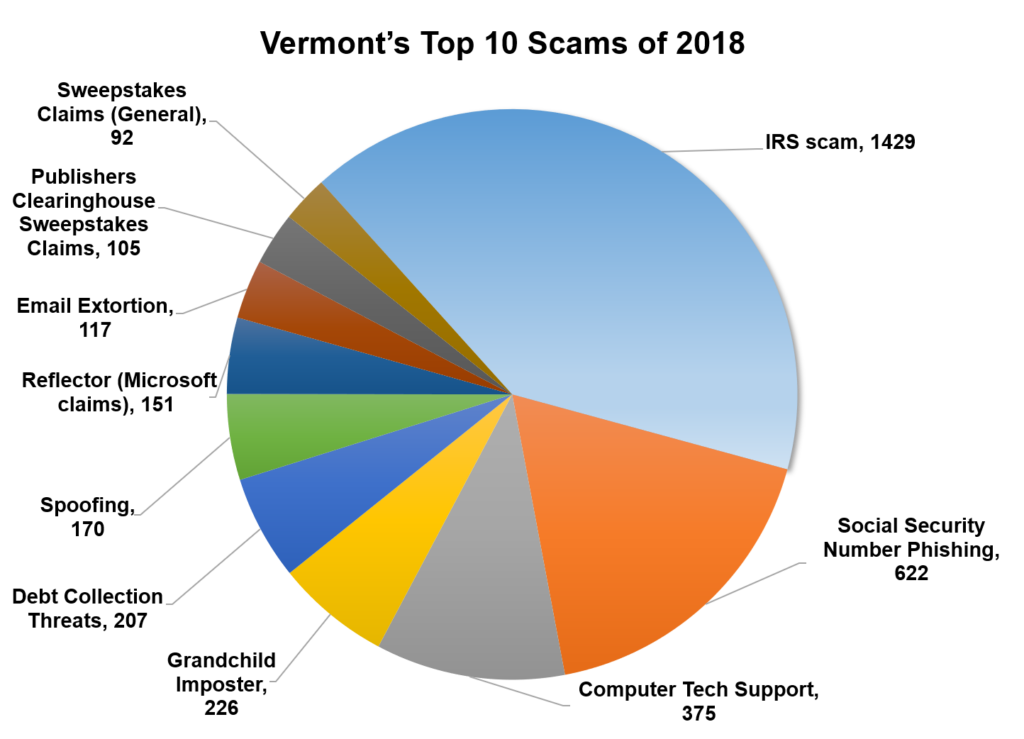

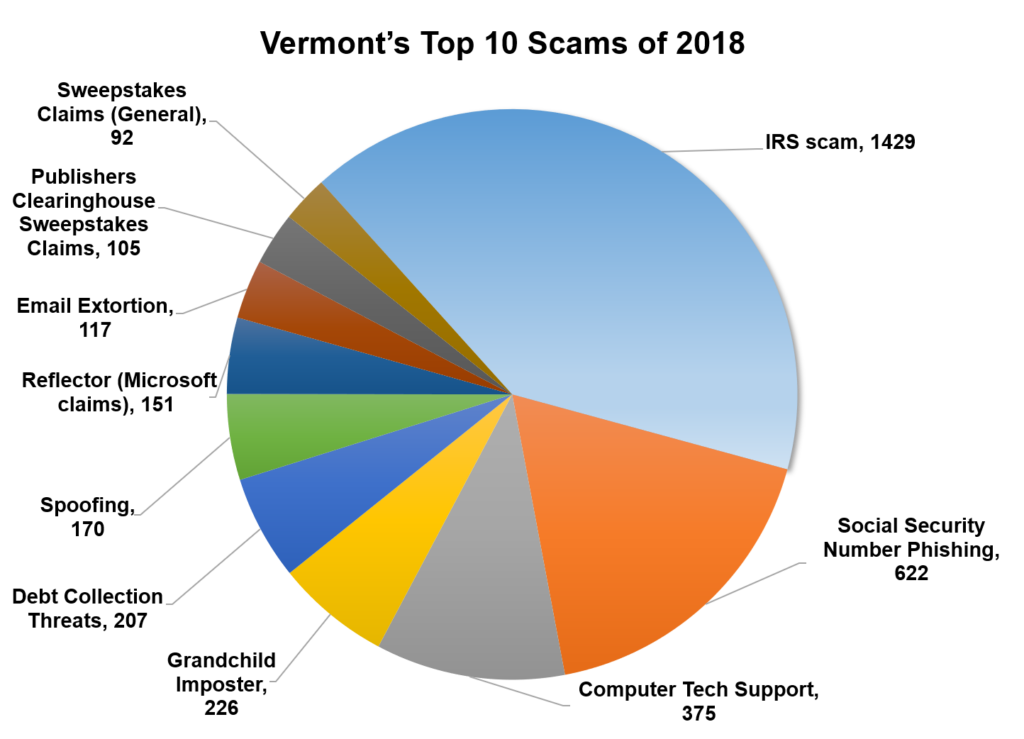

Vermonters filed 5,471 scam reports with the Attorney General’s Consumer Assistance Program (CAP) in 2018 according to the Attorney General’s list of top 10 most commonly reported scams of the year. This amounts to a 4.55% increase in scams from 2017. As new scams emerged, old scams persisted. The IRS scam, which involves scammers claiming to be government officials collecting back taxes, was the most common scam for the fifth year in a row. Vermonters filed 1,429 reports regarding the IRS scam.

Spoofing, when scammers falsify information on Caller ID to appear as though the call comes from a local number, is on the rise. One type of this call is the “reflector” scam, which involves repeated calls coming in from ones’ own number. Another new scam this year reported by more than 100 Vermonters was a threatening email containing an old password and demanding money. The number of social security number phishing scams also increased, rising sharply at the end of the year.

“Scam calls are everywhere and affect everyone,” Attorney General T.J. Donovan said. “I urge Vermonters to stay alert and know the common scams. And please continue to report scams to my office so we can work to educate and protect Vermonters.”

Scam reports total over one-third of all contacts to CAP, making them one of the most common consumer issues affecting Vermonters. To counter the overwhelming number of scams, Attorney General T.J. Donovan, in partnership with the Department of Public Safety, launched a new scam alert system in 2017 to warn Vermonters about new or widespread scams. Vermonters can report a scam or sign up for the Scam Alert system by going to ago.vermont.gov/cap or by calling CAP at 1-800-649-2424.

The top 10 scams of 2018 are:

- IRS imposter

- Social security number phishing

- Computer tech support

- Grandchild imposter

- Debt collection threats

- Spoofing

- Reflector (claim to be Microsoft)

- Email extortion

- Publishers clearinghouse sweepstakes claims

- Sweepstakes claims (general)

Information about each scam:

- IRS Imposter

The scam: A phone call claiming you owe “back taxes” or payments to the government allegedly from the IRS or “US Treasury and Legal Affairs.” They may threaten you with arrest or investigation.

How to ID the scam: The IRS will never call you at home to threaten legal action.

What to do: Don’t respond to these callers. If you think you may actually owe back taxes, hang up and contact the IRS directly at 1-800-829-1040.

- Social Security Number Phishing

The scam: An attempt to obtain your social security number by posing as the Social Security Administration or a business. They may try to get access to your social security number by telling you it has been compromised or stolen.

How to ID the scam: If social security (or any official agency) wanted to contact you, they would not call to ask for your personal information, especially your social security number, over the phone.

What to do: Be wary responding to unsolicited contacts and never provide personal information to unknown contacts.

- Computer Tech Support

The scam: A phone call or pop-up message on your computer claiming to be from Microsoft/Windows or another well-known tech company. They will say that there’s a virus or other problem with your computer and try to persuade you to give them remote access to resolve the issue.

How to ID the scam: Legitimate customer service information usually won’t display as a pop-up. Companies like Microsoft, Apple and Google do not call you to notify you of malware on your computer.

What to do: Never provide remote access to your computer to a stranger or click links from an unknown sender in an e-mail or pop-up message. If you get a call from “tech support,” hang up. Also, be careful when searching for tech support numbers online. Some users have been scammed by calling illegitimate company numbers.

- Grandchild Imposter

The scam: Scammers pose as grandchildren and claim to be in serious trouble, such as in prison or at the hospital. They urgently request money in the form of wired funds or prepaid gift cards.

How to ID the scam: Call your grandchild or family members on known phone numbers to ensure your grandchild is safe.

What to do: Never wire or otherwise send funds unless you can verify the emergency.

- Debt Collection Threats

The scam: Scammers pose as a debt collector or government official and say legal action will be taken against you if you don’t pay them what you owe.

How to ID the scam: If you did owe a debt collector or official agency money, they are not allowed to threaten you with arrest over the phone.

What to do: Hang up the phone, and if they call again let it go to voicemail. If you think you do actually owe money to a debt collector or other agency, make sure you call and check using a trusted number.

- Spoofed Calls

The scam: Spoofed calls come from a number that appears local to Vermont – or even your town. But in reality, the scammer is often calling from overseas, and “spoofing” the number to make it show up on caller ID as a neighbor so you’ll be inclined to answer.

How to ID the scam: The call comes from a number you don’t recognize and/or happens repeatedly at all hours. It may be your own number.

What to do: Ignore the call. Don’t call the number back – chances are the person you are calling has nothing to do with the scam.

- Reflector (claim to be Microsoft)

The scam: Similar to other spoofed calls, these scammers will call you on what appears to be your own number. Upon picking up, the scammer tells you that your Microsoft software or your computer IP address has been compromised. They will ask you to pay them immediately over the phone to protect your computer data.

How to ID the scam: Nobody from Microsoft would call you to say that your data has been breached or your IP address compromised. They especially wouldn’t ask you to pay immediately using Google Play gift cards or your credit card.

What to do: Never give personal or financial information to an unverified person or service that contacts you.

- Email Extortion Scams

The scam: You may receive a threatening email from a person you don’t know saying that they have an old password of yours or some other personal information. They use that against you in order to scare you into paying them.

How to ID the scam: Legitimate actors would never threaten you, even if they had access to your old information.

What to do: Never click on links that are in the email because they may give the scammer remote access to your computer or download viruses. Don’t reply to the email or interact with it in any way and delete it from your inbox. If they refer to a valid password, go to your account directly and change your password.

- Publisher’s Clearinghouse Sweepstakes Claims

The scam: A call, email or letter claiming that a consumer has won big from Publisher’s Clearinghouse and needs to pay a fee to collect winnings. Sometimes this will include a realistic-looking check.

How to ID the scam: If you actually win a major prize from Publisher’s Clearinghouse, they will contact you in person. For smaller prizes (less than $10,000), winners are notified by overnight delivery services (FedEx, UPS), certified mail, or email in the case on online giveaways. They never make phone calls.

What to do: Never pay an upfront fee to receive winnings. If you win something, they will pay you – not the other way around.

- Sweepstakes Claims (general)

The scam: A phone call or mailing claiming that you won money or a prize but have to make a payment in order to receive it. Sometimes the outreach includes a realistic fake check. The check bounces and no “winnings” are ever dispersed.

How to ID the scam: If it is a well-known organization, try contacting them to verify the information. If it is an unknown organization, chances are the winnings are fake. An unsolicited check in the mail from an unknown sender is usually a scam.

What to do: Never pay upfront to receive winnings. If you win something, they will pay you – not the other way around. No actual contest or sweepstakes would you make you pay first to receive money.

Contributing Writer: Sarah Anders

Content Editor: Crystal Baldwin

That’s why access to heat is so important. The Vermont Attorney General’s office is charged with seeing that companies remain in compliance with Consumer Protection Rule 111: Regulation of Propane. Our Consumer Assistance Program (CAP) receives propane complaints each year. Since 2011, there has been an overall decline in propane complaints which is good news.

That’s why access to heat is so important. The Vermont Attorney General’s office is charged with seeing that companies remain in compliance with Consumer Protection Rule 111: Regulation of Propane. Our Consumer Assistance Program (CAP) receives propane complaints each year. Since 2011, there has been an overall decline in propane complaints which is good news.

As a little girl, I fondly remember watching my dad open scores of charitable solicitations, some containing gifts of greeting cards or address labels, others with a simple request to help their cause. This giving season, I am now the one who opens the mail with thoughtful poise and consideration, “Which causes should I support this year?” In this time of giving, many of you may be asking the same question. To help you decide, I’ve outlined the steps that I take before giving:

As a little girl, I fondly remember watching my dad open scores of charitable solicitations, some containing gifts of greeting cards or address labels, others with a simple request to help their cause. This giving season, I am now the one who opens the mail with thoughtful poise and consideration, “Which causes should I support this year?” In this time of giving, many of you may be asking the same question. To help you decide, I’ve outlined the steps that I take before giving: