By Crystal Baldwin and Sara Spencer

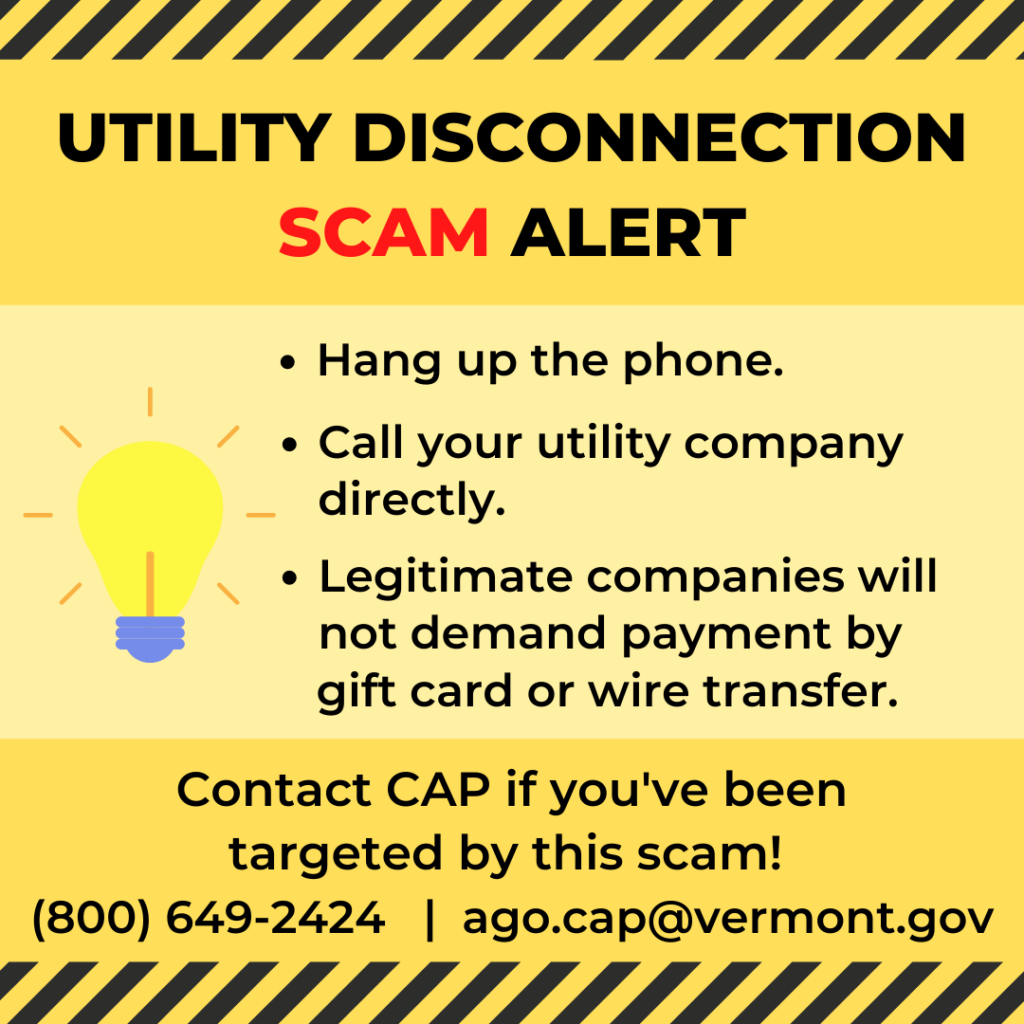

“Your electricity will be shut off, if you don’t pay.”

Imagine receiving this message in the middle of your work day while relying on electricity to serve your customers. Or, maybe the message comes into your home while every single person is using an electronic device for work or school. The message can be quite alarming, and can cause a person to react on the spot to resolve the perceived problem. Resist the urge to respond—hang up the phone instead.

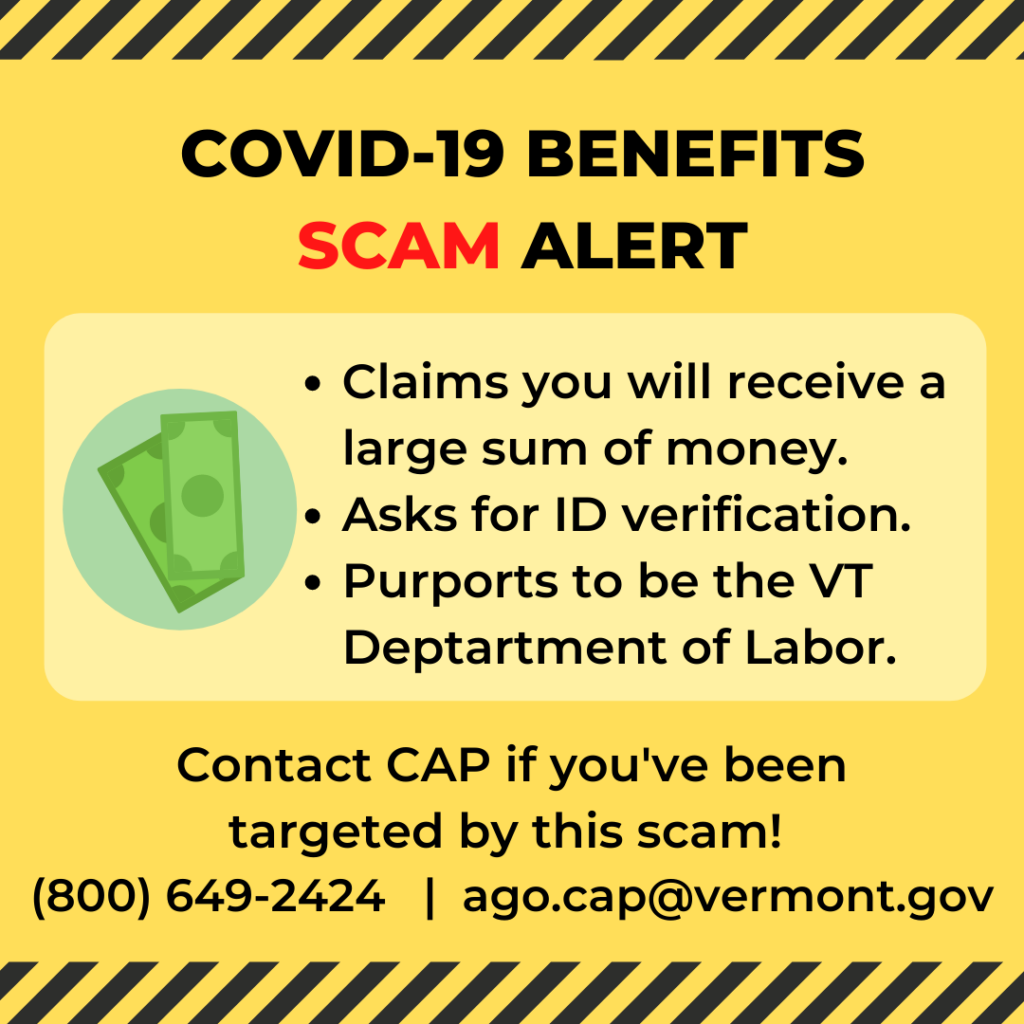

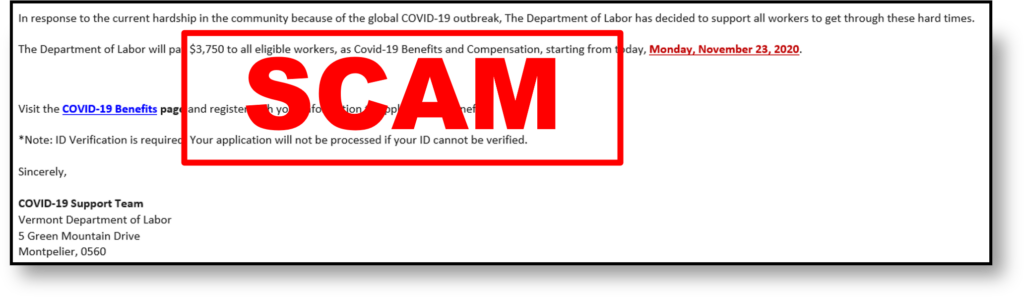

These calls are from scammers claiming to be your utility provider. They demand payment by gift card, wire transfer, credit/debit cards, peer-to-peer payment, and sometimes even cash. If you don’t pay right away, they threaten that your electricity will be turned off.

If you are contacted by one of these scams:

- Hang up! Do not engage with the scammer and do not call them back.

- Do not provide any personal information

- If you are concerned about disconnection, call your utility provider.

Help us stop these scams by sharing this information with those you care about. Get notified about the latest scams: Sign up for VT Scam Alert System alerts.

Call the Consumer Assistance Program at 800-649-2424 if you have questions, concerns, or need help determining if you have been a victim of a scam.

When you receive one of these jarring calls, here is what you can do:

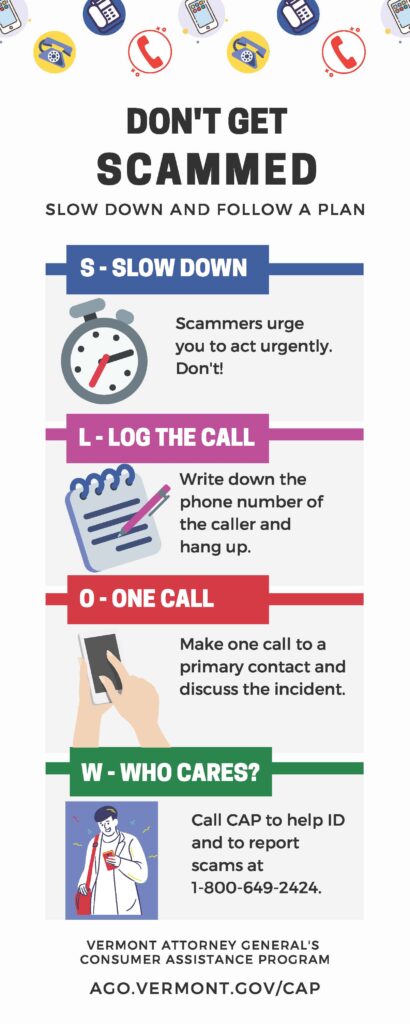

Take steps to verify by remembering SLOW:

S – Slow down. The scammers urge you to act urgently. Don’t.

L – Log the call. For your assurance, write down the phone number of the caller and hang up.

O – One call. Make a verification call to the business, using a number you know and trust.

W – Who cares? Call another person in your life who cares about you. Know that you can call CAP at 1-800-649-2424. We care and can help identify scams.

Before this scam happens to you, you can take steps now to create a scam action plan. Keep the SLOW reminder near your phone. Act now to prevent future loss.