I recently co-authored a summary of the economics of on-farm biodiesel with Netaka White from the Vermont Sustainable Jobs Fund. This report collects the economic and logistic learning from the past seven years of the Vermont Bioenergy Initiative (VBI). The VBI has supported a wide range of sustainable fuel related efforts in Vermont. Along with agronomic research by Heather Darby’s Northwest Crops and Soils team funding has supported efforts to streamline on-farm processing and production systems, improve safety, expand storage capacity and ultimately to expand adoption of sustainable fueling practices.

We showcase five Vermont on-farm biodiesel operations that use a variety of equipment to reach their different biodiesel and feed production goals. We use data from these farms, collected over several years, to run a detailed economic analysis of a hypothetical 100,000-gallon per year on-farm biodiesel facility. A second hypothetical case based on a 13,000-gallon per year facility is also reviewed. Finally, we explain in ten steps how to estimate breakeven and profitability in both cases. The information and steps are applicable to any farmer interested in fuel and feed self-sufficiency or generating additional farm income. The analysis was done using the Oilseed Cost and Profit Calculator I developed under this program.

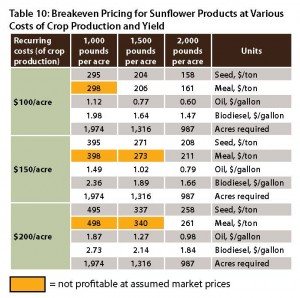

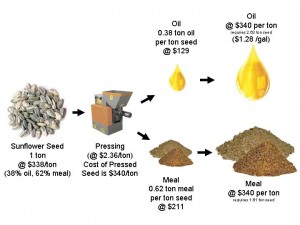

In the two examples above, one a 100,000 gallon per year commercial enterprise, and the other a 13,000 gallon per year operation, both used representative sunflower production data from five Vermont farms. Over a range of crop production costs between $100 and $200 per acre, and yields between 1,000 and 2,000 pounds per acre, at current market prices the combined worth of the meal and the oil, or the meal plus the biodiesel are shown to be profitable.

Both scales of operation can also see a payback on their investment within a reasonably short time frame when selling meal and biodiesel or selling meal and using biodiesel to reduce enterprise expenses; 100,000 gallon per year payback is 6.4 years & 13,000 gallon per year payback is 9.4 years. This is based on current, relatively low fuel costs. Should diesel prices reach $5 a gallon, simple payback could occur in less than 12 months for the 100,000 gallon per year case and less than 3 years for the 13,000 gallon per year case.