By Crystal Baldwin

Anyone who has overheard the conversation of online streaming video game players on opposite sides of the globe knows that real and true friendships can form online between parties that have never met before. As shared in the following open letter, this is how scam prevention advocate Pat McCarty’s online relationship began just two years ago.

From Pat McCarty:

Until it happens to you, it’s impossible to understand; a man or woman freely sending money to someone they’ve never met in person. But I’m here to tell you, even the most cynical, worldly, educated, and discerning person can, and does, get scammed!

There are hundreds of different scams out there, I got caught up ‘catfished’ into a ‘Romance Scam’ that crippled me financially, undermined my self-confidence, and ended up breaking my heart. I was a 58-year-old, recent divorcée after a 30 year marriage, living on my own for the first time in my life. I’m a college graduate, fairly bright, cynic, who doesn’t suffer fools gladly. But, I’m also a Christian woman, who tries to help those in need, and THAT is what my scammer preyed upon—my compassion for others.

I was not out looking for a mate, date, or companion on some dating site. I was playing Words With Friends online, which I often did. And that is where this scammer targeted me. The conversation was very generic at first, but slowly, over weeks, developed into an online friendship. From there, it took a turn into a private chat room, and then he had me right where he wanted me! It’s a long twisting story, but ended with me selling all my gold jewelry, sending every spare cent I had to him, as these scammers are polished and sophisticated, they have a plausible story for EVERYTHING! At the point I actually sold my car, my only transportation, to “help” him. I knew I’d ‘jumped the shark,’ and started doing some digging myself!

What I found was heartbreaking, infuriating, and devastating.

That was 2 years ago. After some time, good therapy, and scam-specific education, I no longer see myself as a victim, but as a SURVIVOR! My life is mine again, my finances are healthy again, and I’ve taken back my power by volunteering at a Fraud Watch call-in center, advising others how to get out of scams like mine and so much more. With literally hundreds of scams out there, and new ones popping up daily, I’m so honored to help others get out of their scams and find THEIR power again. And, if I’ve learned anything, it’s that literally ANYONE can be scammed! I hear stories every day of those who thought it would NEVER happen to them. Knowledge is power. Learn all the red flags and warnings….BEFORE it happens to you!

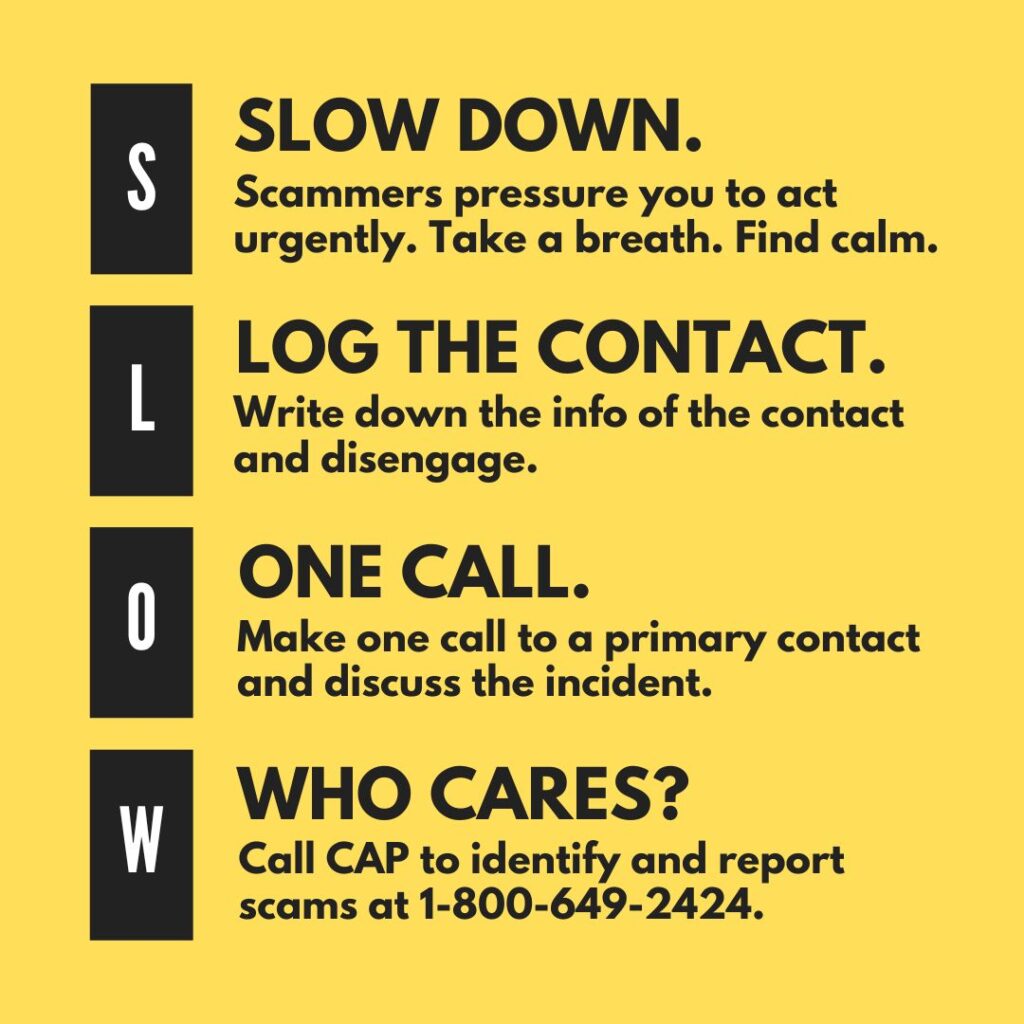

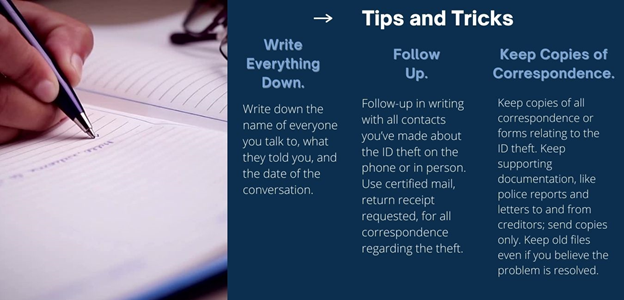

As Pat relays, enlisting in a scam-specific education to learn more about scams in order to stop them, is the best defense against scams. Today, our office announced the release of the Avoiding the Romance Scam prevention video (embedded throughout this post in varying lengths), an effort produced here in Vermont, based on true accounts of scams experienced by our neighbors like Pat. Help protect yourself and others by taking time to watch the video. Review the information on our website and encourage those you care about to learn more about scams and prevention strategies to stop them.

Learn more at ago.vermont.gov/cap/romance-imposter

Read more blogs about romance scams.

Report Scams:

If you or someone you know has encountered a scam in Vermont, report it. Use CAP’s online scam reporting form.

Help us stop these scams by sharing this information with those you care about.