April showers bring May flowers…and tax season.

Tax season is stressful enough without being worried about getting scammed. Yet threatening scammers pretending to be from the IRS make up almost half of the 5,000+ scam call reports that the Consumer Assistance Program received last year!

Attorney General T.J. Donovan and Tax Comissioner Kaj Samsom recently held a joint event to warn consumers and raise awareness about tax and identity theft scams. They informed the public that the IRS will never call you directly if you owe money.

Many Vermonters are also concerned about tax identity theft.

The first way to prevent this type of theft is to protect your Social Security number. Never give out sensitive personal information to an unknown entity. Make sure your passwords are secure and not easily guessed. If your Social Security number has been stolen, file your tax returns early so that no one else with stolen information has time to file a return on your behalf.

You can also register to monitor your information, so you know if there’s an issue such as a fraudulent tax return. You can visit: https://www.irs.gov/payments/view-your-tax-account.

If a fraudulent tax return is indeed filed—your return is rejected because it is a duplicate file, or you are instructed to do so—complete IRS Form 14039, Identity Theft Affidavit. The IRS requests that you fill out this form online then mail it according to instructions.

You may also contact the Identity Protection Specialized Unit of the IRS at 1-800-908-4490. The Attorney General’s office urges Vermonters to:

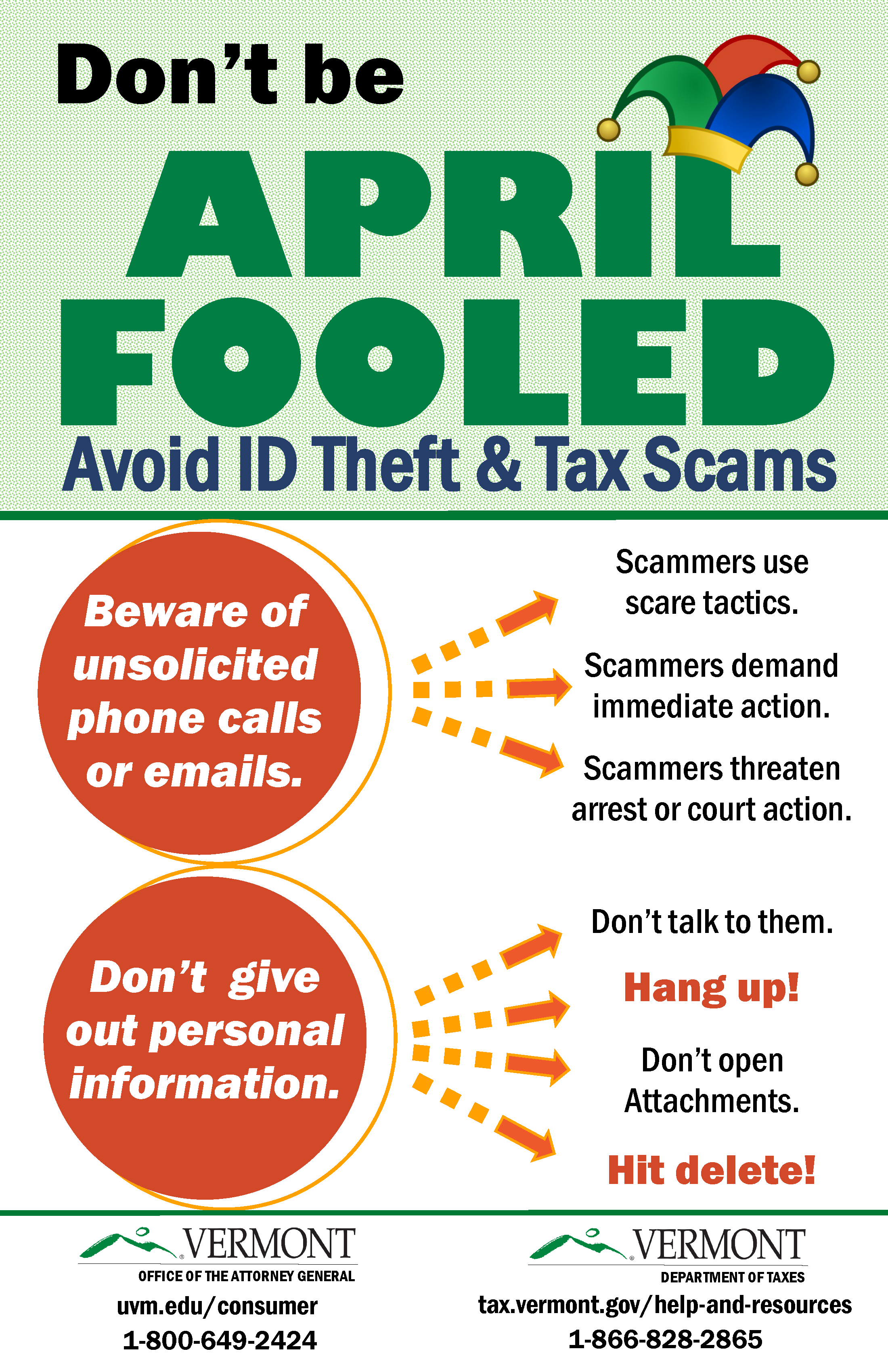

- Beware of unsolicited calls or emails

- Don’t give out personal information

- Be alert to scare tactics: Scammers demand immediate action or threaten arrest or court action. Don’t talk to them: hang up!

- Don’t open attachments: hit delete!