Written By:

Taylor R. Smith ‘22

Editor, Finance

Connect with Taylor on LinkedIn

“It’s hard to find a job you can retire on.” The sentiment runs deep. As I sat with writer’s block in my cramped Burlington apartment, my roommates bustled in the kitchen making lunch and small talk. Katy, a soil scientist with the Franklin County Natural Resources Conservation District, had recently been on a field assignment to meet with a farmer in snowy northern Vermont. In the hours spent passing paperwork around a kitchen table, the conversation touched on retirement. The offhand comment, from a dairy farmer aged about 60, is reflective of the fact that retirement readiness is a serious challenge – a unifying anxiety across generations of American workers.

For many, the simplest way to start investing for the future is through an employer-sponsored retirement plan. Dairy farmers in rural Vermont don’t have that luxury. The U.S. Bureau of Labor Statistics reports only 67% of workers in private industry had access to an employer retirement plan in 2020. The distribution of those retirement plans follows a predictable and troubling pattern, with high earners far more likely to have access; only 39% of part-time workers have an employer-sponsored plan.

A secure retirement can feel especially remote for people without access to a plan through their workplace. For starters, sparing a few dollars is no small feat. Between student loans, rising rents, and (not-so-transitory) inflation, times are feeling very tight indeed. If you can ration the funds, it may still be difficult to cross the starting line. In a pandemic that feels more and more like a never-ending airline delay, it’s tough to muster the mental energy to explore investment options and dive in.

For those ready to take the plunge, the investment marketplace can be scary. Many individuals aren’t inclined to trust the financial services industry, as Wall Street’s reputation continues to recover from the 2008 financial crisis. Faced with the multitude of investment options and complex-sounding terms, I’ve seen “analysis paralysis” stop potential investors in their tracks. What brokerage firm should I choose? Do I need an advisor? When it comes to fees, how high is too high? What the heck is an ETF?! As Ryan Gosling quips in The Big Short,

“It’s pretty confusing right? Does it make you feel bored? Or stupid? Well, it is supposed to. Wall Street loves to use terms to make you think only they can do what they do.”

Ryan Gosling, The Big Short

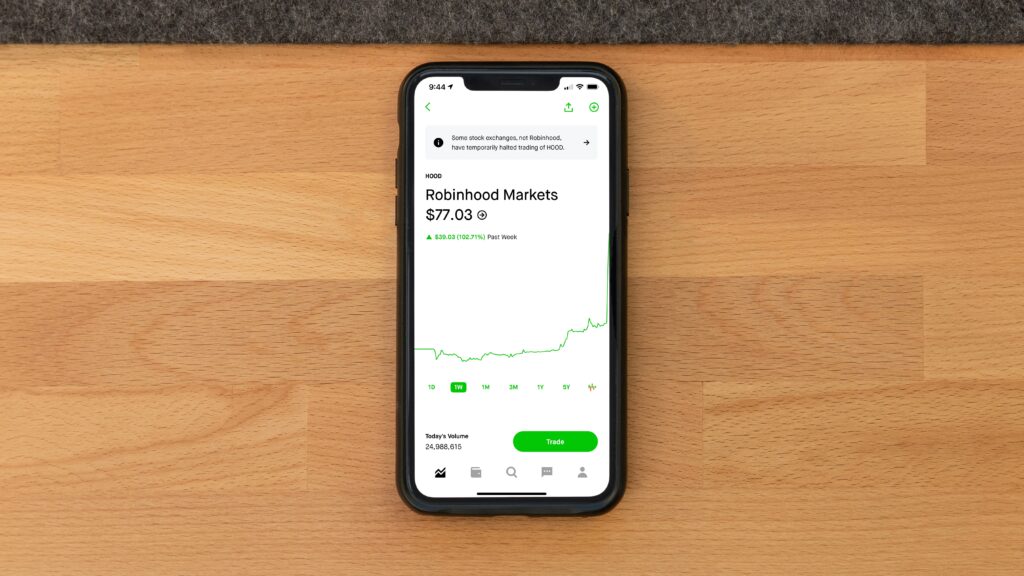

Enter Robinhood. Established in 2013, the investing app has seen its popularity explode in the past few years, with huge user growth between 2020 and 2021. Granted, Robinhood doesn’t bill itself as a retirement service, but it may be the most accessible option for new investors – at least for now. Robinhood’s website proudly states: “We’re on a mission to democratize finance for all.” That’s a mission I can get behind, but critiques aren’t hard to find. Selections from Vice and NBC News touch on a few common criticisms, from Robinhood’s gamification of investing (complete with casino style graphics and confetti) to their sale of user order flow1. Robinhood also allows advanced investment techniques typically reserved for seasoned investors and professionals.

1A substantial portion of Robinhood’s revenue is derived from their sale of order flow. When you make a trade on Robinhood, the app sells your order to a larger investment firm for final execution. Your order is sold to the highest bidder, not to the firm that will complete the trade most quickly. Robinhood gets paid a fee, the outside firm gains a slight advantage on the open market, and the user pays a price.

A core tenet of finance is the relationship between risk and return. Riskier investments demand a higher expected return to justify their potential downside. It’s an open question whether apps like Robinhood shift this relationship out of balance for the at-home retail investor. The meteoric rise of Robinhood coincides with a period of strong economic growth following the Covid-crash of March 2020. Many retail investors cashed in, and new investors flocked into the market. A recent survey by Charles Schwab suggests 15% of stock market investors got their start in 2020. But what does the future hold during a downturn? Have inexperienced users been conditioned to take outsized risks, and if so, can these habits be reined in?

Financial Technology (Fintech) companies are rising to meet the soaring demand for retail financial services. While it’s still early in the game, I’m interested to see which companies can profitably occupy a middle ground between the jargon-heavy multinational corporations of the past and the gamified trading apps led by Robinhood. We need a platform that is accessible to new investors but encourages stable portfolios geared for the long term.

The right platform could fill the needs of a large segment of American workers that have been historically passed over by the financial services industry. I’m advocating for a new service that forgoes the frequent dopamine hits of Robinhood and lacks the intimidating interface of a legacy firm. In other words, a platform that’s not too hot, and not too cold. Just right.

Acorns and Greenlight offer two intriguing models. Both startups seem to put a larger emphasis on education and financial literacy (based on my informal review of their online platforms and messaging). Acorns facilitates micro-investing into diversified portfolios by rounding up daily purchases and investing the so-called “spare change.” Acorns does not currently allow trading of individual stocks, though according to Bloomberg this feature could be added in a limited capacity down the line. Greenlight focuses on a young audience (with parental controls in place), allowing money earned from chores and allowances to be invested into stocks and ETFs. In their words, they hope to “…empower parents to raise financially-smart kids.”

These offerings from Acorns and Greenlight are promising, and more options will surely rise in the coming years. There’s little time to waste. The mathematics of compounding interest are compelling – an early start can make all the difference for an investor. I hope these services, and others, can bring more inclusion to a retirement industry that has typically catered to an affluent customer base. Our country will be more prosperous and secure if its workers are better positioned for a stable future. It’s also the right thing to do.

In the folktales, Robin Hood is the hero, stealing from the rich for the benefit of the poor. But the winners and losers aren’t so clear in the rapidly changing world of Fintech. Buyer beware, Robin Hood was also a master of disguise.

The opinions expressed in this article are my own, and do not represent the views of UVM or the Sustainable Innovation Review editorial team. This is not an endorsement of any investment product or service.