UVM Extension has released a report that documents conservation adoption and economic viability on Certified Small Farm Operations. Conservation and Farm Viability on Vermont Small Farms (FBRR035) is available online. This report summarizes responses from over 170 Vermont farms to a 2019 survey. UVM Agricultural Business explores the current situations that business owners face and the major issues moving forward.

UVM Maple Development Webinar Series Starts in August

University of Vermont maple specialists will host a series of online webinars focused on business decision making and forestry practices. Learn about the best practices to integrate business management and sugarbush management for a thriving maple enterprise that targets profits and forest health.

Session information and registration is now available for sessions on August 5th, August 19th, September 2nd and September 16th. Watch our website for an updated schedule advertising webinar topics for October- December. Register now on the Upcoming Events page at www.maplemanager.org or download the program schedule here: UVM Maple Webinar Schedule

Topics will include: sugarbush leases, rental rates, business planning, tapping practices to optimize yield, tapping red maples, business entity set-up, sap-only enterprises and more. Presenters will include: Abby van den Berg (Research Associate Professor), Mark Isselhardt (Maple Specialist), Mark Cannella (Extension Associate Professor), Chris Lindgren (Forest Business Coordinator), attorneys, foresters and industry specialists.

Northern New England Dairy Webinars from UNH, UMaine, and UVM

By Tony Kitsos

On May 5th and 7th I had the opportunity to represent Vermont as part of the Northern New England Dairy Discussion webinars hosted by the University of New Hampshire’s Elaina Enzien. Extension dairy specialists Peter Erickson, Mike Sciabarrasi, Carl Majewski and Seth Wilner (New Hampshire), Gary Anderson and Rick Kersbergen (Maine) and I offered participants some sound dairy management strategies to help deal with the recent low milk prices and new pricing models. We focused on “right sizing” animal numbers, switching from 3x to 2x milking frequency, ration adjustment and using milk to feed animals on the farm as means to achieve cooperative reduction goals.

Also on the webinars were Catherine DeRonde from Agrimark, and Leon Berthiaume from DFA /St Albans to discuss the two-tier milk pricing model and what producers in each cooperative can expect for the remainder of the summer. Milk market volatility is now being driven by supply and distribution chain challenges brought on by the COVID-19 pandemic, with both cooperatives forced to take measures to reduce the flow of milk coming in to their plants.

The series proved to be timely and very popular, with over 140 participants registering for the two-day session. A link to presentation materials and the video recording of the webinars can be found HERE at the UNH website. We plan to continue the series throughout the summer, with the next session being held on Tuesday, June 16th. Find more information and register HERE.

UVM Extension Agricultural Business To Host Weekly Web Forum

For the remainder of April UVM Extension Agricultural Business will host a 30-minute web forum every Thursday at 12:30pm to keep pace with emerging COVID-19 issues faced by farm and forest businesses. Each session will include an update on market situations for our farming sectors and information on hot topics, as well as time for questions and discussion.

Weekly Focus Topics:

- April 16th: SBA Emergency Loan Programs

- April 23rd: Cash Flow Triage for Small Business

- April 30th: Digital Entrepreneurship and Online Marketing

Please register in advance for this web meeting.

Contact Mark.Cannella@uvm.edu to register.

Watch for updates about this series on our blog.

UVM Extension Agricultural Business Educators are available for consultation

If your farm, forest or maple business is under pressure to plan for COVID-19 disruption, our educators are available for business coaching and can assist with locating resources. We can help with critical business decision-making, assessing changes to markets, financial planning and other issues facing your enterprises.

Contact one of our educators by email or leaving a voicemail to make an appointment:

- Beth Holtzman (Early Stage/Homestead Farms): Beth.Holtzman@uvm.edu 802-476-2003 x204.

- Betsy Miller (Farm Business): 802-447-7582 x252 Betsy.Miller@uvm.edu *available for Friday appointments only

- Chris Lindgren (Forest and Maple Business): 802-773-3349 x274 Christopher.Lindgren@uvm.edu

- Mark Cannella (Farm and Maple Business): 802-476-2003 x207 Mark.Cannella@uvm.edu

- Mary Peabody (Farm Labor Issues): 802-598-4878 (call or text) Mary.Peabody@uvm.edu

- Tony Kitsos (Farm Business): 802-524-6501 x440 Tony.Kitsos@uvm.edu

- Zac Smith (Farm Business and Ag Business Marketing): 802-524-6501 x446 Zachary.M.Smith@uvm.edu

Covid-19 Updates for Ag Businesses

Updated 5/13/20

This page is being updated regularly with resources for agricultural businesses owners operating through the current health crisis.

Vermont Policy Updates

(4/24/20) Governor Scott releases new policy to open today for nurseries, greenhouses, and garden centers, effective Monday April 27th, 2020. See Addendum 11. This announcement, effective April 27th, 2020, allows for in-person customer purchase of seeds, annuals, vegetable seedlings, perennials, herbs, shrubs, trees, and other landscaping and gardening materials from an outdoor retail operation in adherence to the guidelines outlined in Addendum 11.

(4/24/20) Vermont Farmers Markets will be allowed to reopen under the new Farmers Market Guidance released by Vermont Agency of Agriculture, Food and Markets (VAAFM)

(4/22/20) Pandemic Unemployment Assistance (PUA). The Vermont Department of Labor is now set-up to accept unemployment claims for “self employed” business owners under PUA. PUA website for Self Employed and online application page

Micro Loan and Grant Programs: Rural VT Farmers Market Grant ($500), American Farmland Trust Grants ($1k max); VT Farm Fund (up to $10k Emergency Loans), FACT Mini-Grant ($500 for livestock and poultry)

US Small Business Administration Emergency Programs

5/4/20 : As of today (5/4) EIDL application webpage opened up today! New PPP applications are being processed. Prepare your PPP applications directly with your local bank/lender.

SBA Paycheck Protection Program (PPP) webpage: Updated fact sheets and applications are posted below. Contact your local bank or lender for information on how to submit an application. Farms, Forest and Maple businesses are eligible for PPP.

PPP for Self Employed (sole proprietor) seeking benefit for themselves. See this article on how to calculate your previous year Schedule F “Net Earnings” from prior year.

(4/15/20) Updated Eligibility Guidelines for PPP, See page 6 for how business owners with no employees will calculate amounts. Where is says “Schedule C Line 31”, farm owners will use “Schedule F Line 34” Click Link Below

What is an Economic Injury Disaster Loan (EIDL) Emergency Advance? 4/22/20 “Farms” will be eligible for the EIDL program in the second relief package. We expect the SBA online application eligibility section to reflect that chance once the program re-opens.

A borrower applying for EIDL can request an advance on the loan of up to $10,000 from the Small Business Administration (SBA). See the SBA EIDL Website. Applications are made online with the SBA directly. EIDL “advance” amounts are based on $1,000 per employee, thus a business with 10 or more employees can apply for the $10k max. The actual EIDL Loan can be for up to $2M and has an interest rate of 3.75%

SBA Economic Injury Disaster Application

Small Business Owners Guide US CARES Act: See document download below (includes Paycheck Protection Program and Economic Injury Disaster Loan/Grants) Note: As of 4/24/20, We have confirmation that farm businesses are eligible for the PPP SBA programs. “Farms” (ie. 100% farm production) are also eligible for Economic Injury Disaster Loans (EIDL). Food processors, value-added, maple syrup producers, nursery and aquaculture are eligble for EIDL. Both these programs feauture “forgivable” portions for certain uses and do not require 100% repayment. See the CARES Act Summary below.

VT Agency of Agriculture Covid-19 Response Page: Submission form to submit your emerging business issues, newsletter sign up and resource links.

VT Agency of Commerce and Community Development Covid Updates: Covid Newsletter Sign Up, Emergency Declaration Guidance, Economic Injury Disaster Loans, Submit data on your business losses to inform agencies where support is needed

VT Emergency Management: This site contains the Essential Persons List (subject to change) and it’s relation to Emergency Child Care

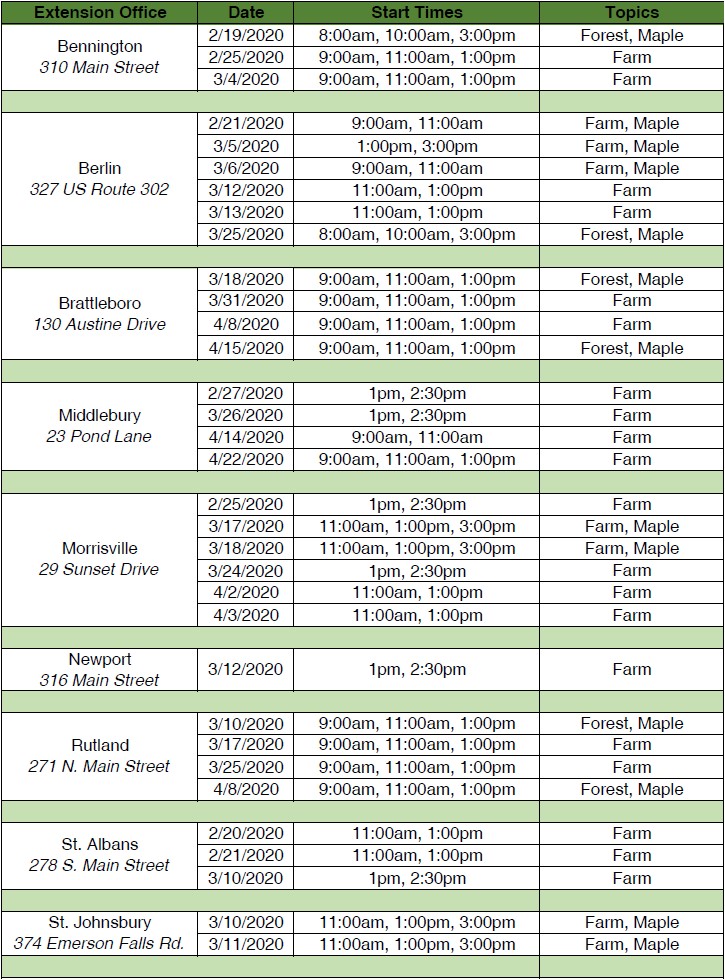

Farm, Forest and Maple Business Clinics

UVM Extension Business Specialists Mark Cannella, Tony Kitsos, Chris Lindgren, Betsy Miller and Zac Smith are available to work one-on-one with farm, forest and maple businesses on their finances. Reserve a 1½ hour appointment to prepare documents that will help manage the business. Use the time to develop a balance sheet, update financial statements, review a business plan, consider changes to the business and more. Bring your financial statements, recent records and questions!

➥ 1½ hour, private meetings

➥ Nearly 100 appointments available from February – April 2020

➥ Held at UVM Extension Offices in 9 locations (Online or phone meetings are also available)

➥ FREE!

Business Clinics Information Sheet (PDF)

Contact Christi Sherlock at Christi.Sherlock@uvm.edu or 802.476.2003 to register for one of the appointments listed below.

To ensure adequate preparation, reservations must be made by the Thursday of the week before your appointment. If you require a disability-related accommodation to participate, please call at least three weeks in advance of your scheduled session.

Useful Farm Tax resources…or are they?

by Betsy Miller, Farm Management Educator

I work with many types of farms and farmers in business planning. I don’t keep track of the percentage, but I would say a majority of the folks I work with hire a professional to prepare their tax returns. However, I am a firm believer that a basic understanding of the rules is helpful even to those who hire a professional.

When I sat down to write this I planned to share a few links of resources that would be helpful to farmers who either prepare their own returns or just want a better understanding. What I found was a little disturbing. Many of the sites that I used to find helpful are now out of date. We all expect things to change from one year to the next, but there were some big changes in 2018 and many of the farm tax resources out there do not reflect or even mention those changes.

I urge any of you who use the internet to find tax resources to check the dates on what you are reading. Make sure you are getting current information.

The one link that I will recommend is the IRS Pub 225 Farmers Tax Guide.

Sugarbush Rental Rates

The number of maple taps in Vermont has doubled in the last 10 years. Many producers are expanding and securing a lease on a maple sugarbush can be a viable alternative to purchasing the land.

Maple stand quality, accessibility, access to power and other factors will impact the rental price. Cash rental rates are common for maple forests. A typical rate in recent years has been about $1.00 per tap. In competitive maple regions in Vermont rental rates are $1.50 or more per tap. In regions with less demand or less desirable forest parcels $0.50-$0.99 is observed.

Setting flexible terms is an option for parties that want to share profits or risk between tenants and landowners. A flexible cash rate can be written so that the annual rate adjusts for the market price of syrup. Rental rates could also be adjusted for a variable crop yield.

UVM Extension is working on rental resources and maple lease templates this fall. New resources will be presented at Vermont Maple Conferences in January and made available online. Register now for the 2020 Vermont Maple Conferences in Middlebury (January 11th), Brattleboro (January 18th), and Hyde Park (January 28th).

Any Given Timber Harvest

by Chris Lindgren, Forest Business Educator

There must be as many ways to harvest timber as there are loggers, likely more. Every approach may not be “best,” but most are acceptable. Each logger has a different set of equipment and a different crew with a variety of experience and skills, forest landowners have varying visions and objectives, and forest managers approach forest systems and forest operations based on their sensibilities. Each of these variables factor into a logger’s approach.

Whatever the circumstances, all parties desire a positive economic outcome. At all stages of production those who add value want to be fairly compensated for their work. The win-win result hopefully applies to both the cash value of materials harvested and the impacts on the residual stand, as well. Clearly, this is not always how it works out.

When I first began business planning work with logging contractors, one of the first workshops I attended was with Steve Bick of Northeast Forests LLC. I “got” to play a game Steve called penny logging. This game was like production and assembly exercises I had encountered at various lean trainings over the years. The objective: given certain constraints, arrange assets and production to achieve the smoothest, most economic output. Over the years I have become keenly aware of the constraints (terrain, soil, weather, ownership, regulation) on any given timber harvest. The harvest in the video above is an example of loggers using the constraints to their advantage, creating an exciting and elegant material flow. Enjoy!