This post was written by Ben Hastings ’18

All dog lovers know the feeling. When you come home from a long day and receive a warm greeting from your four-legged friend – it’s almost as if the stresses of the day melt away with a few wags of the tail and a walk around the block.

Fortunately for us at The Sustainable Innovation MBA, we don’t have to wait until we get home to experience this joy. Meet Willy Wonka, a 3-year-old chocolate lab who has bounded into Kalkin 110 as our 31st classmate during Professor Erik Monsen’s “Crafting the Entrepreneurial Business Model” class.

Fortunately for us at The Sustainable Innovation MBA, we don’t have to wait until we get home to experience this joy. Meet Willy Wonka, a 3-year-old chocolate lab who has bounded into Kalkin 110 as our 31st classmate during Professor Erik Monsen’s “Crafting the Entrepreneurial Business Model” class.

Throughout the course of the class, our learning teams have come up with various entrepreneurial ventures. One of the most important processes in determining if the venture is viable is mapping out what the value proposition of the company is.

Prior to creating value proposition maps for our entrepreneurial ventures, Dr. Monsen suggested we first practice on Willy Wonka. He was a prime subject for this class exercise. In creating a value proposition map, one needs to ask 3 questions of the business — or in this case, a lovable pooch.

Question: What are the services that he provides (or in this case, what does he do)?

Answer: Enjoys sports (fetch, obstacle courses, etc.), lover of all things outdoors, likes people, loves to eat (hopefully, he doesn’t love to eat people — Editor)

Question: How is Willy a pain reliever?

Answer: Encourages exercise, provides comfort, absorbs negative emotion and reduces stress, acts as a home security system

Question: How is Willy a gain creator?

Answer: Makes exercise fun, provides opportunities to cuddle, delivers a sense of achievement when he learns tricks

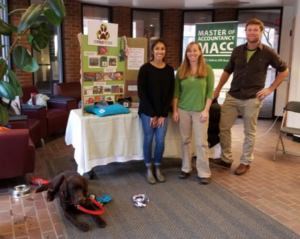

Willy Wonka doesn’t just demonstrate his value around the house. His “dad” is a professor of entrepreneurship, so naturally he has a few different jobs. As a certified therapy dog, Willy Wonka can be seen around campus during exam season providing stress relief to students. When he’s off-campus, you may be able to spot him at your local library, where children read to him. He loves a great story, but it’s hard to know exactly what his favorite genre is. He was even a tester for last year’s cohort’s recycled dog toy company, RePawposed.

Willy Wonka doesn’t just demonstrate his value around the house. His “dad” is a professor of entrepreneurship, so naturally he has a few different jobs. As a certified therapy dog, Willy Wonka can be seen around campus during exam season providing stress relief to students. When he’s off-campus, you may be able to spot him at your local library, where children read to him. He loves a great story, but it’s hard to know exactly what his favorite genre is. He was even a tester for last year’s cohort’s recycled dog toy company, RePawposed.

I know what you’re thinking: his resume is getting much longer than yours. I think I speak for the rest of the cohort when I say we are all striving to achieve Willy Wonka levels of success.

It’s a fantastic opportunity for those seeking to pivot mid-career. Prior to The Sustainable Innovation MBA, I worked in agriculture and non-profits and I had reached a point where opportunities for learning and advancement had flattened out. As a working parent of two young girls, the thought of being in graduate school for years on was overwhelming. The one-year curriculum is perfect for those looking to re-launch their careers quickly.

It’s a fantastic opportunity for those seeking to pivot mid-career. Prior to The Sustainable Innovation MBA, I worked in agriculture and non-profits and I had reached a point where opportunities for learning and advancement had flattened out. As a working parent of two young girls, the thought of being in graduate school for years on was overwhelming. The one-year curriculum is perfect for those looking to re-launch their careers quickly. Mr. Arnott describes his background as somewhat atypical among public company CEOs in that he had lots of operations experience, but relatively little formal leadership training, when he started as CEO. His style is therefore largely self-taught, but I was not surprised that his sentiments echoed what The Sustainable Innovation MBA has taught us so far.

Mr. Arnott describes his background as somewhat atypical among public company CEOs in that he had lots of operations experience, but relatively little formal leadership training, when he started as CEO. His style is therefore largely self-taught, but I was not surprised that his sentiments echoed what The Sustainable Innovation MBA has taught us so far.