Written by:

Vanessa Chumbley ’22

Managing Editor

Connect with Vanessa on LinkedIn

The relationship between film and television and American culture is a popular topic which many scholars have dedicated their careers to. Indeed, it is part of the evolution of the relationship that art has always had with culture. Through pre-historic drawings, sculpture, the written word, visual art, and now films and TV, art has always been both a product of a given culture and a vehicle for influencing and changing culture. Art reflects current attitudes, beliefs, and trends, but also provides new perspectives and has the power to change the way people understand and interact with the world around them. It is difficult to understand exactly the extent to which the content we watch today is a product of cultural trends versus the cause of cultural trends, but Oscar Wilde may have been on to something when he wrote, “Life imitates art far more than Art imitates life.”

It is through art and storytelling that we have come to understand our history as a species, and they remain a vital and integral part of our understanding of the world. Today, it is largely through film and TV that we tell the stories of our time – the stories that future generations will look to in order to understand this period of time in human history. One of the most important stories of our time, if not the most important, is that of our rapidly changing environment, climate change, and the role that human beings play in these changes.

The entertainment community is beginning to understand how they can play a role in tackling the climate crisis. A recent UK report, produced by the Behavioural Insight Team in collaboration with Sky TV, provided a strong call to action for the media and entertainment industry to use their platform to promote a more sustainable future, stating:

Broadcast organisations and content creators… have a unique opportunity to make a difference for the planet. Through the programs that they produce, the characters that they create, the plot-lines that they develop, and the adverts that they broadcast, content creators have the potential to have a far-reaching impact on the knowledge, attitudes and behaviours of citizens, and to spark conversations in boardrooms and political arenas alike. They are also pivotally placed to help people sift through the maze of choices and claims, to adopt behaviours – and products – that can get us to a greener future.1

The idea of entertainment content influencing and shifting cultural norms around sustainability and climate change is compelling and credible when we consider how content has shaped culture in the past. Film and TV’s influence on things like violence and smoking among children and teens has been widely discussed, but there is also data on the positive impact content has had on topics such as acceptance of homosexuality, public health, and having a designated driver.

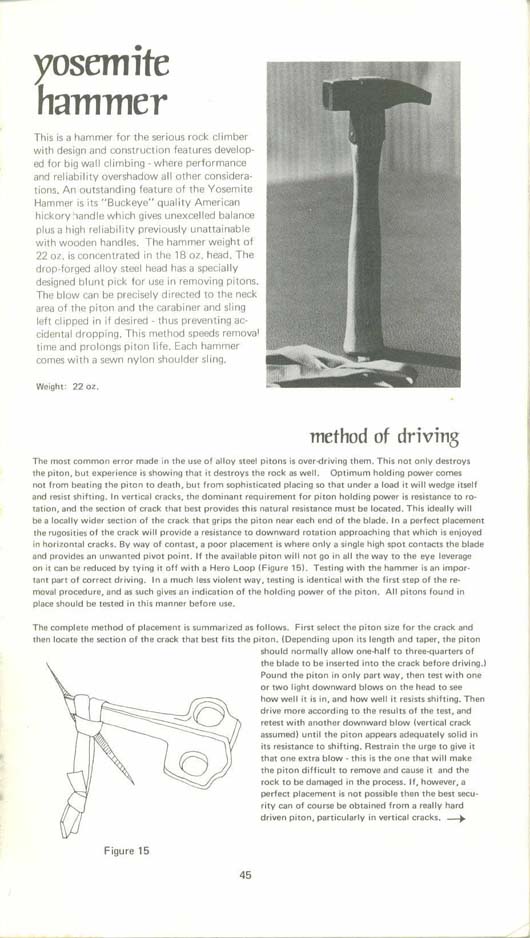

As the world’s largest Entertainment and Media (E&M) industry, Hollywood is beginning to take this call to action to heart. In April of 2022, Good Energy – a “story consultancy for the age of climate change” – released their climate storytelling playbook: “A playbook for screenwriting in the age of climate change”. This playbook applies climate and behavioral science to the writing and storytelling process, outlining best practices for climate character development, how to talk about climate change, and how to portray sustainable behaviors on screen.

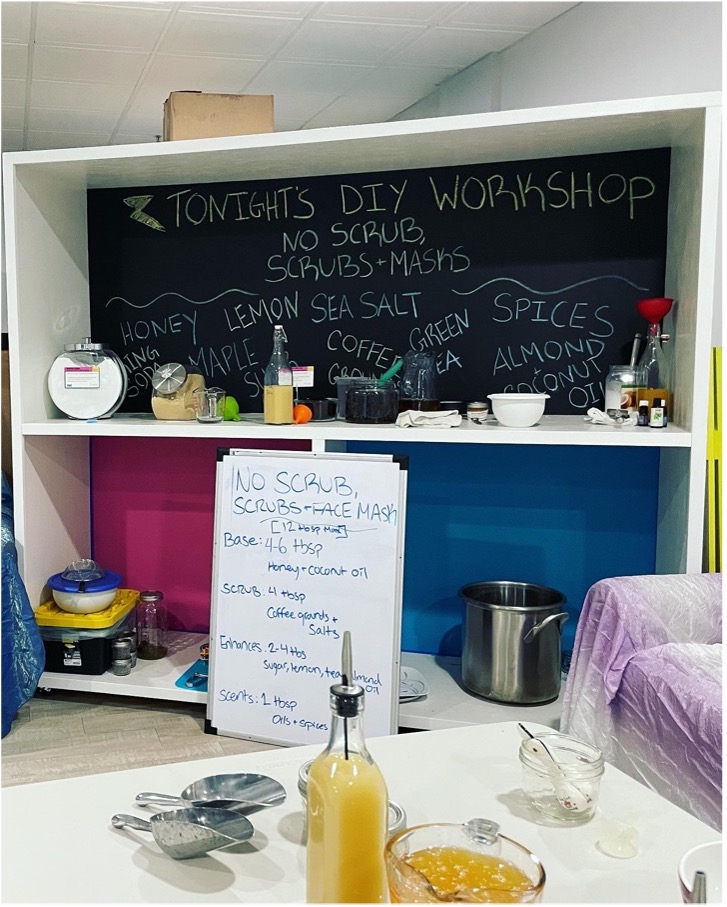

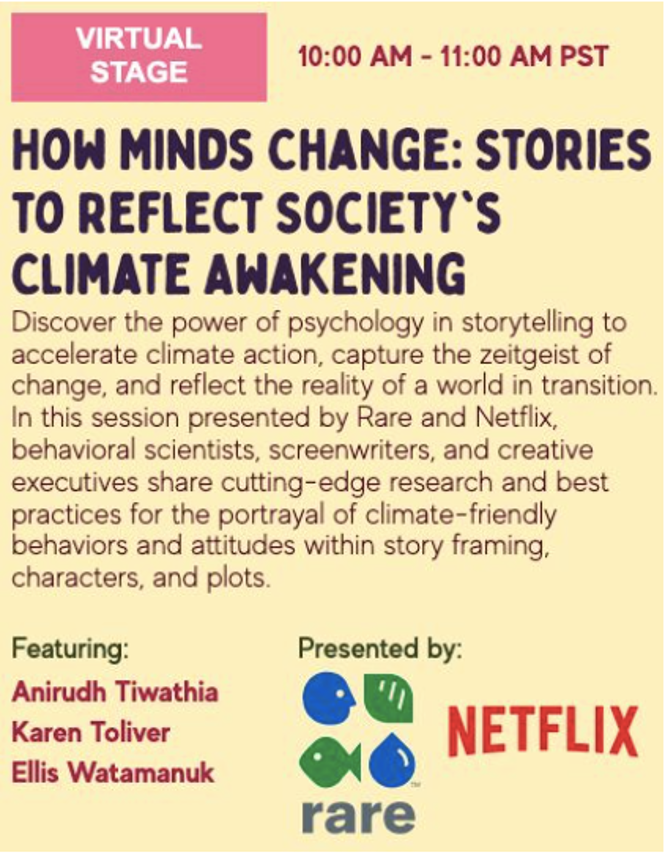

The conversation continued in June at the Hollywood Climate Summit, an annual gathering of entertainment, climate and behavioral science experts, and activists with programming aimed at how Hollywood can address the climate crisis. I attended a few of the Summit events as research for my Practicum Project with the Sustainable Production Alliance (SPA) – a consortium of the world’s leading film, TV, and streaming companies dedicated to accelerating the transformation of the entertainment business into a more sustainable industry. Working on this Practicum Project has provided introductions to many organizations working to tackle the climate crisis through content, including Green Product Placement, the Environmental Media Association, and Rare – one of the presenting organizations at the Summit.

The Summit brought together some of the industry’s most knowledgeable professionals, from the VP of Animation Film at Netflix to the founder of Good Energy to Erin Brockovich. Programming covered a variety of climate storytelling topics, including workshops on screenwriting, dispelling character tropes, unpacking climate emotions, and seminars on climate justice stories and elevating the voices of minority creators.

I was thrilled to see SI-MBA alum, Julie Keck, leading an event titled, “Kin Theory: A Community Centering Indigenous Creators”. Julie graduated from SI-MBA in 2019 and is now Co-Founder and Chief Business Development Officer of OTV Studio, an artist and IP incubator for intersectional creators that connects these artists to studios, networks, and audiences. She also works as a Consulting Producer with Nia Tero, a non-profit organization working to preserve Indigenous peoples, cultures, and land through advocacy, policymaking, and storytelling.

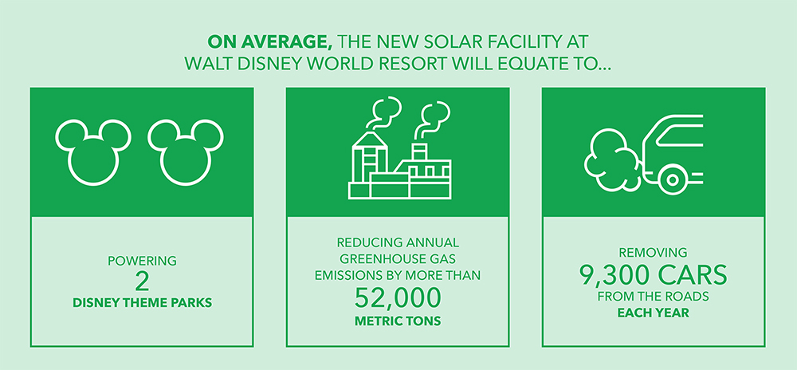

The industry is not only addressing climate change through its content, however. The major Hollywood studios and streaming companies are taking ambitious steps to reducing the carbon footprint of their business and physical production operations. For example, Sony installed solar panels on their lot, offsetting 100% of the electricity consumed by stage operations. Paramount constructed an alternative energy plant on their property, lowering energy consumption to below 1990 levels and saving 400 million tons of greenhouse gases over the past decade. Disney is piloting a digester, turning all their food and green waste into compost without needing to be transported to another facility. Studio crews take home the compost to use in their gardens, thus engaging and educating employees in the process2.

Much of the work done by my Practicum host, SPA, has centered around reducing the carbon footprint of physical production. They have produced tools including a carbon footprint calculator and a plywood tracking worksheet to be used on set. They connect filmmakers to a variety of green vendors and published the industry’s first comprehensive report on carbon emissions from physical production between 2016 and 2019. What is inspiring about SPA is that it’s an alliance comprised of the industry’s largest competitors – always battling for projects, talent, and viewers. However, they’ve come together to work collaboratively to make the industry as a whole more sustainable. Lisa Day, Manager of Environmental Sustainability at Disney, is one the point people for my Practicum project. The Hollywood Reporter Sustainability Issue shared the following quote from Lisa:

From the early, early days of starting this work, we came together and we said, ‘You know what, we can be as competitive as we want to at the box office, on our linear channels and our streaming services, but this is an area where we really need to be cooperative and not competitive,’ speaking of the industry’s collaborative effort to tackle climate change.1

The entertainment community has only just begun these important conversations on how to be a force for good when it comes to the climate crisis. Much more work and research are needed to reach the full potential of the positive impact the industry could have. I am excited and honored to make even a small contribution to this effort through my Practicum Project. While there is still a long way to go, this movement within the industry is gaining significant momentum, and I am hopeful it will lead to more action and widespread positive impact.

1Londakova, K., Reynolds, J., Farrell, A., Whitwell-Mak, J., Meyer zu Brickwedde, E., Mottershaw, A., . . . Park, T. (2021). The power of TV: Nudging viewers to decarbonise their lifestyles. Retrieved July 1, 2022, from https://www.bi.team/wp-content/uploads/2021/10/Broadcasters-Report.pdf

2Chuba, K. (2022). Thr sustainability issue. Retrieved July 1, 2022, from https://sustainability.hollywoodreporter.com/p/5