Updated 5/13/20

This page is being updated regularly with resources for agricultural businesses owners operating through the current health crisis.

Vermont Policy Updates

(4/24/20) Governor Scott releases new policy to open today for nurseries, greenhouses, and garden centers, effective Monday April 27th, 2020. See Addendum 11. This announcement, effective April 27th, 2020, allows for in-person customer purchase of seeds, annuals, vegetable seedlings, perennials, herbs, shrubs, trees, and other landscaping and gardening materials from an outdoor retail operation in adherence to the guidelines outlined in Addendum 11.

(4/24/20) Vermont Farmers Markets will be allowed to reopen under the new Farmers Market Guidance released by Vermont Agency of Agriculture, Food and Markets (VAAFM)

(4/22/20) Pandemic Unemployment Assistance (PUA). The Vermont Department of Labor is now set-up to accept unemployment claims for “self employed” business owners under PUA. PUA website for Self Employed and online application page

Micro Loan and Grant Programs: Rural VT Farmers Market Grant ($500), American Farmland Trust Grants ($1k max); VT Farm Fund (up to $10k Emergency Loans), FACT Mini-Grant ($500 for livestock and poultry)

US Small Business Administration Emergency Programs

5/4/20 : As of today (5/4) EIDL application webpage opened up today! New PPP applications are being processed. Prepare your PPP applications directly with your local bank/lender.

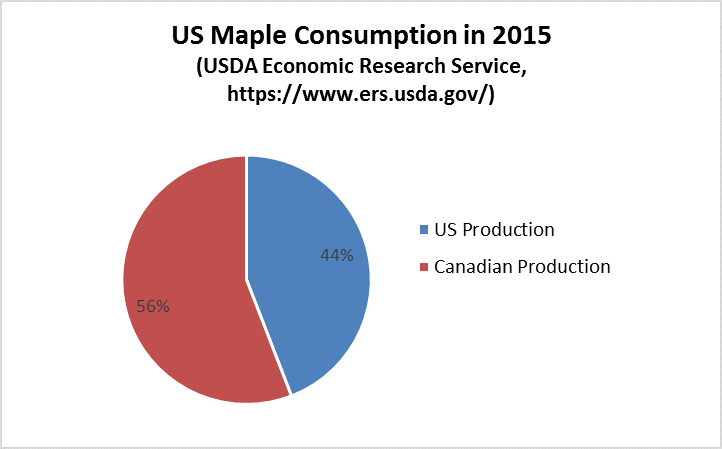

SBA Paycheck Protection Program (PPP) webpage: Updated fact sheets and applications are posted below. Contact your local bank or lender for information on how to submit an application. Farms, Forest and Maple businesses are eligible for PPP.

PPP for Self Employed (sole proprietor) seeking benefit for themselves. See this article on how to calculate your previous year Schedule F “Net Earnings” from prior year.

(4/15/20) Updated Eligibility Guidelines for PPP, See page 6 for how business owners with no employees will calculate amounts. Where is says “Schedule C Line 31”, farm owners will use “Schedule F Line 34” Click Link Below

What is an Economic Injury Disaster Loan (EIDL) Emergency Advance? 4/22/20 “Farms” will be eligible for the EIDL program in the second relief package. We expect the SBA online application eligibility section to reflect that chance once the program re-opens.

A borrower applying for EIDL can request an advance on the loan of up to $10,000 from the Small Business Administration (SBA). See the SBA EIDL Website. Applications are made online with the SBA directly. EIDL “advance” amounts are based on $1,000 per employee, thus a business with 10 or more employees can apply for the $10k max. The actual EIDL Loan can be for up to $2M and has an interest rate of 3.75%

SBA Economic Injury Disaster Application

Small Business Owners Guide US CARES Act: See document download below (includes Paycheck Protection Program and Economic Injury Disaster Loan/Grants) Note: As of 4/24/20, We have confirmation that farm businesses are eligible for the PPP SBA programs. “Farms” (ie. 100% farm production) are also eligible for Economic Injury Disaster Loans (EIDL). Food processors, value-added, maple syrup producers, nursery and aquaculture are eligble for EIDL. Both these programs feauture “forgivable” portions for certain uses and do not require 100% repayment. See the CARES Act Summary below.

VT Agency of Agriculture Covid-19 Response Page: Submission form to submit your emerging business issues, newsletter sign up and resource links.

VT Agency of Commerce and Community Development Covid Updates: Covid Newsletter Sign Up, Emergency Declaration Guidance, Economic Injury Disaster Loans, Submit data on your business losses to inform agencies where support is needed

VT Emergency Management: This site contains the Essential Persons List (subject to change) and it’s relation to Emergency Child Care